Region:Middle East

Author(s):Dev

Product Code:KRAD3437

Pages:94

Published On:November 2025

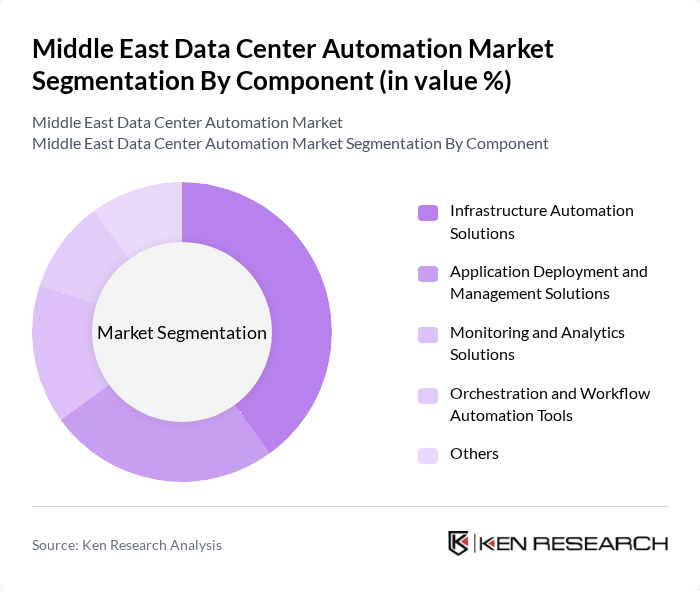

By Component:The components of the market include Infrastructure Automation Solutions, Application Deployment and Management Solutions, Monitoring and Analytics Solutions, Orchestration and Workflow Automation Tools, and Others. Among these, Infrastructure Automation Solutions are leading due to the increasing need for efficient resource management and operational efficiency in data centers. Organizations are focusing on automating their infrastructure to reduce manual intervention, enhance scalability, and improve overall performance. This trend is reinforced by the rising adoption of cloud services and the need for real-time monitoring and analytics to support digital transformation initiatives .

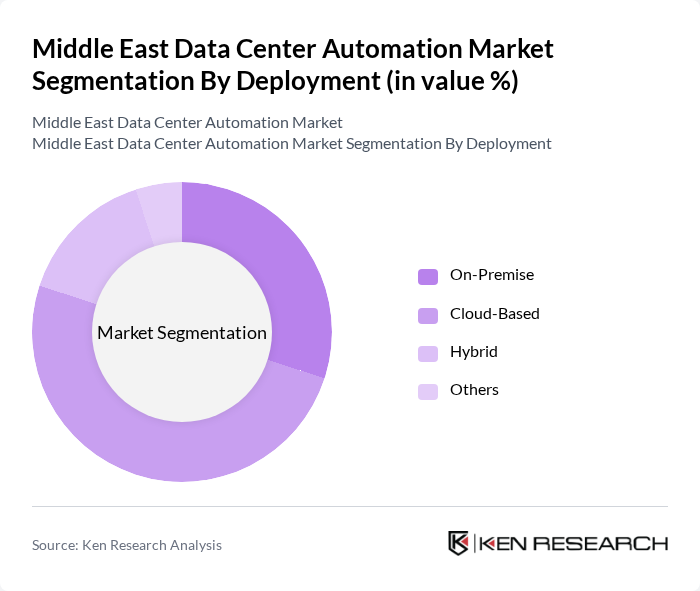

By Deployment:The deployment types in the market include On-Premise, Cloud-Based, Hybrid, and Others. The Cloud-Based deployment is currently dominating the market as organizations increasingly migrate to cloud environments for flexibility, scalability, and cost-effectiveness. The shift towards cloud solutions is driven by the need for remote access, disaster recovery, and enhanced collaboration among teams. Hybrid deployments are also gaining traction as organizations seek to balance regulatory requirements and data sovereignty with the benefits of cloud scalability .

The Middle East Data Center Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, Dell Technologies Inc., Siemens AG, Intel Corporation, IBM Corporation, Cisco Systems, Inc., Schneider Electric SE, Hewlett Packard Enterprise (HPE), VMware, Inc., Nutanix, Inc., Red Hat, Inc., Oracle Corporation, Fujitsu Limited, Atos SE, Huawei Technologies Co., Ltd., Equinix, Inc., Digital Realty Trust, Inc., Khazna Data Centers, Gulf Data Hub, Agility Data Centers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East data center automation market appears promising, driven by technological advancements and increasing investments in digital infrastructure. As organizations continue to embrace hybrid cloud solutions and automation tools, the demand for efficient, scalable data centers will rise. Additionally, the focus on energy efficiency and compliance with data privacy regulations will shape the market landscape, encouraging innovation and strategic partnerships among key players in the industry.

| Segment | Sub-Segments |

|---|---|

| By Component | Infrastructure Automation Solutions Application Deployment and Management Solutions Monitoring and Analytics Solutions Orchestration and Workflow Automation Tools Others |

| By Deployment | On-Premise Cloud-Based Hybrid Others |

| By Enterprise Size | Large Enterprises Small and Medium-sized Enterprises (SMEs) Others |

| By End-Use | Banking, Financial Services, and Insurance (BFSI) Information Technology (IT) and Telecommunications Healthcare Retail Government Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Services | Consulting Services Implementation Services Support and Maintenance Services Training and Education Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Data Center Automation | 120 | IT Managers, Data Center Administrators |

| Cloud Service Provider Automation | 85 | Cloud Architects, Operations Directors |

| Telecommunications Data Center Solutions | 70 | Network Engineers, Technical Managers |

| Healthcare Data Management Systems | 65 | Healthcare IT Specialists, Compliance Officers |

| Financial Services Data Center Operations | 80 | Risk Management Officers, IT Security Managers |

The Middle East Data Center Automation Market is valued at approximately USD 425 million, driven by the increasing demand for efficient data management solutions, cloud computing, and enhanced operational efficiency in data centers across the region.