Region:Europe

Author(s):Geetanshi

Product Code:KRAB1379

Pages:95

Published On:October 2025

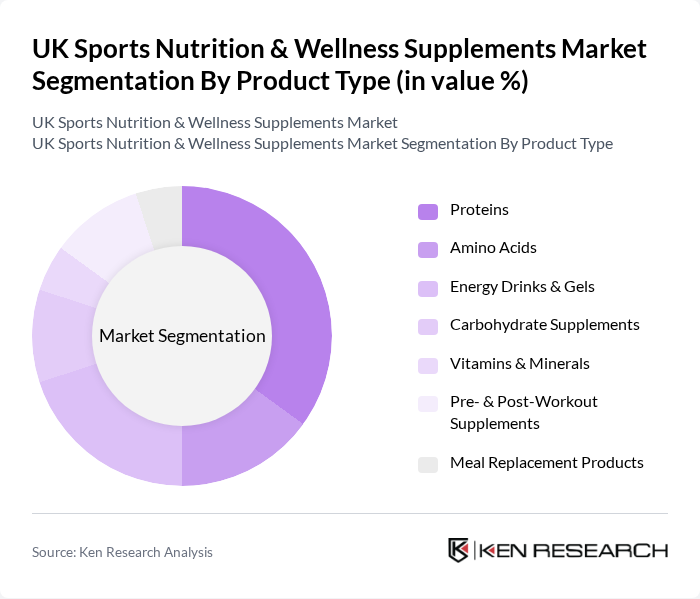

By Product Type:The product type segmentation includes various categories such as proteins, amino acids, energy drinks & gels, carbohydrate supplements, vitamins & minerals, pre- & post-workout supplements, and meal replacement products. Among these, proteins remain the leading subsegment, driven by their essential role in muscle recovery and growth, particularly among athletes and fitness enthusiasts. The increasing trend of protein supplementation in diets has led to a surge in demand for protein-based products, making them a dominant force in the market. The sports foods segment, which includes ready-to-drink products and energy bars, is experiencing the fastest growth, reflecting consumer preference for convenience and on-the-go nutrition. Innovations in plant-based proteins and clean-label formulations are also gaining traction, catering to evolving consumer preferences for sustainability and health.

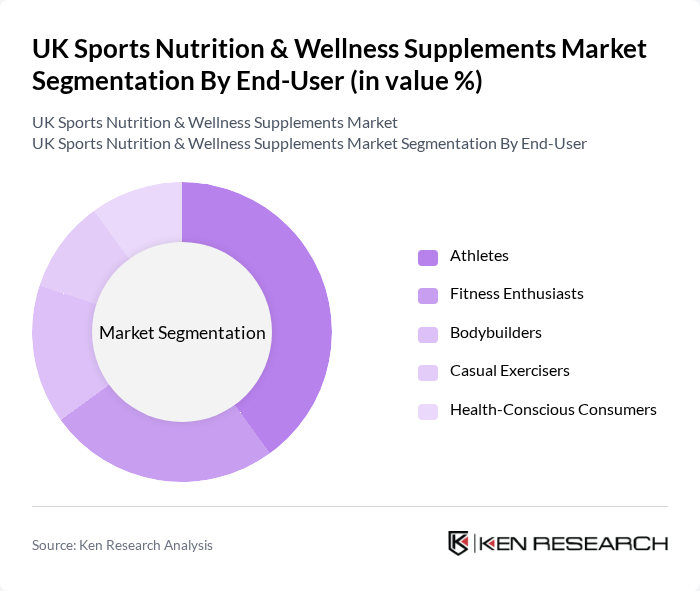

By End-User:The end-user segmentation encompasses athletes, fitness enthusiasts, bodybuilders, casual exercisers, and health-conscious consumers. Athletes represent the largest segment, as they require specialized nutrition to enhance performance and recovery. The growing awareness of the importance of nutrition in sports performance has led to an increase in the consumption of sports supplements among this group, solidifying their position as the dominant end-user category. Fitness enthusiasts and casual exercisers are also significant contributors to market growth, driven by broader participation in gyms and recreational sports.

The UK Sports Nutrition & Wellness Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Myprotein, Optimum Nutrition, Grenade, Science in Sport (SiS), Bulk, MaxiNutrition, PhD Nutrition, Reflex Nutrition, USN, Applied Nutrition, Prozis, Kinetica Sports, CNP Professional, Warrior Supplements, Nutrisport contribute to innovation, geographic expansion, and service delivery in this space.

The UK sports nutrition and wellness supplements market is poised for continued evolution, driven by emerging trends such as the increasing demand for plant-based products and personalized nutrition solutions. As consumers become more discerning, brands that prioritize transparency and sustainability are likely to gain a competitive edge. Additionally, the integration of technology in product development and marketing strategies will enhance consumer engagement, paving the way for innovative offerings that cater to diverse health needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Proteins Amino Acids Energy Drinks & Gels Carbohydrate Supplements Vitamins & Minerals Pre- & Post-Workout Supplements Meal Replacement Products |

| By End-User | Athletes Fitness Enthusiasts Bodybuilders Casual Exercisers Health-Conscious Consumers |

| By Distribution Channel | Online Retail Offline Retail Direct Sales |

| By Product Form | Powders Bars Liquids Capsules/Tablets Ready-To-Drink |

| By Ingredient Source | Plant Based Animal Based |

| By Function | Energizing Products Rehydration Pre-Workout Recovery Weight Management |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Sports Supplements | 120 | Active Individuals, Fitness Enthusiasts |

| Retail Insights on Wellness Products | 85 | Store Managers, Product Buyers |

| Trends in Online Supplement Purchases | 95 | E-commerce Managers, Digital Marketing Specialists |

| Impact of Nutrition on Athletic Performance | 75 | Sports Coaches, Athletic Trainers |

| Regulatory Perspectives on Supplement Safety | 55 | Health Policy Experts, Regulatory Affairs Managers |

The UK Sports Nutrition & Wellness Supplements Market is valued at approximately USD 1.4 billion, reflecting a significant growth trend driven by increasing health consciousness and fitness activities among consumers.