Region:Europe

Author(s):Shubham

Product Code:KRAB3233

Pages:92

Published On:October 2025

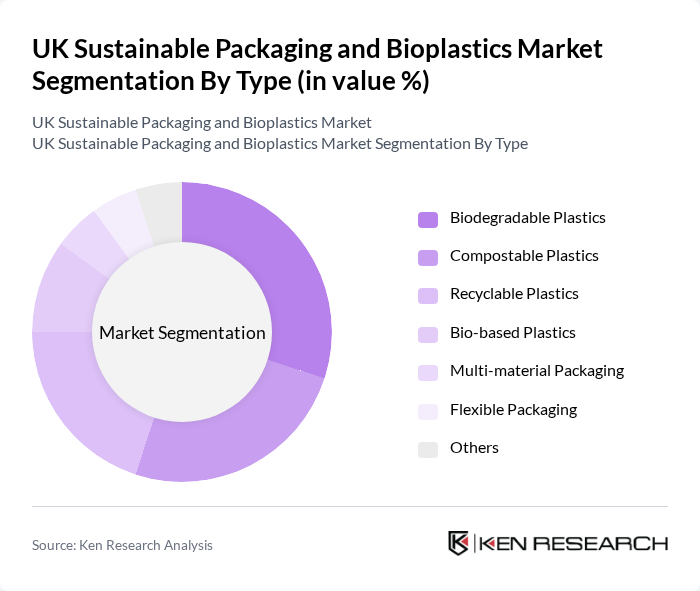

By Type:The market is segmented into various types, including Biodegradable Plastics, Compostable Plastics, Recyclable Plastics, Bio-based Plastics, Multi-material Packaging, Flexible Packaging, and Others. Among these, Biodegradable Plastics and Compostable Plastics are gaining traction due to their environmental benefits and consumer preference for sustainable options. The demand for Recyclable Plastics is also significant, driven by increasing recycling initiatives and consumer awareness.

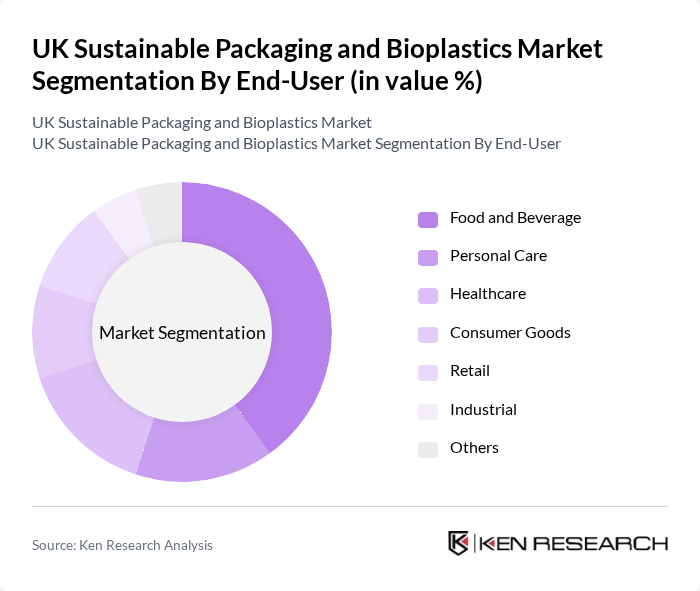

By End-User:The end-user segmentation includes Food and Beverage, Personal Care, Healthcare, Consumer Goods, Retail, Industrial, and Others. The Food and Beverage sector is the largest consumer of sustainable packaging solutions, driven by the need for eco-friendly packaging that meets regulatory standards and consumer preferences. The Healthcare sector is also increasingly adopting sustainable packaging to enhance its environmental footprint.

The UK Sustainable Packaging and Bioplastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, BASF SE, Novamont S.p.A., NatureWorks LLC, Biome Bioplastics Ltd., Tetra Pak International S.A., Smurfit Kappa Group plc, Mondi Group, Sealed Air Corporation, DS Smith plc, Eco-Products, Inc., Plantic Technologies Limited, Green Dot Bioplastics, BioBag International AS, Earthpack contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK sustainable packaging and bioplastics market appears promising, driven by increasing consumer awareness and government support for eco-friendly initiatives. As the market evolves, innovations in bioplastics technology will likely enhance product offerings, making them more competitive against conventional plastics. Furthermore, the shift towards circular economy practices will encourage businesses to adopt sustainable solutions, fostering collaboration across industries. This dynamic environment is expected to create new opportunities for growth and investment in sustainable packaging solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Biodegradable Plastics Compostable Plastics Recyclable Plastics Bio-based Plastics Multi-material Packaging Flexible Packaging Others |

| By End-User | Food and Beverage Personal Care Healthcare Consumer Goods Retail Industrial Others |

| By Application | Packaging Agriculture Textiles Automotive Electronics Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales Others |

| By Material | Starch-based Plastics Cellulose-based Plastics PLA (Polylactic Acid) PHA (Polyhydroxyalkanoates) Others |

| By Price Range | Economy Mid-range Premium |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Goods Packaging | 150 | Sustainability Managers, Product Development Leads |

| Food and Beverage Sector | 100 | Packaging Engineers, Quality Assurance Managers |

| Retail Packaging Solutions | 80 | Supply Chain Managers, Procurement Specialists |

| Bioplastics Manufacturing | 70 | Operations Managers, R&D Directors |

| Recycling and Waste Management | 60 | Environmental Compliance Officers, Waste Management Executives |

The UK Sustainable Packaging and Bioplastics Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by consumer demand for eco-friendly solutions and regulatory pressures aimed at reducing plastic waste.