Region:Middle East

Author(s):Geetanshi

Product Code:KRAA7025

Pages:93

Published On:January 2026

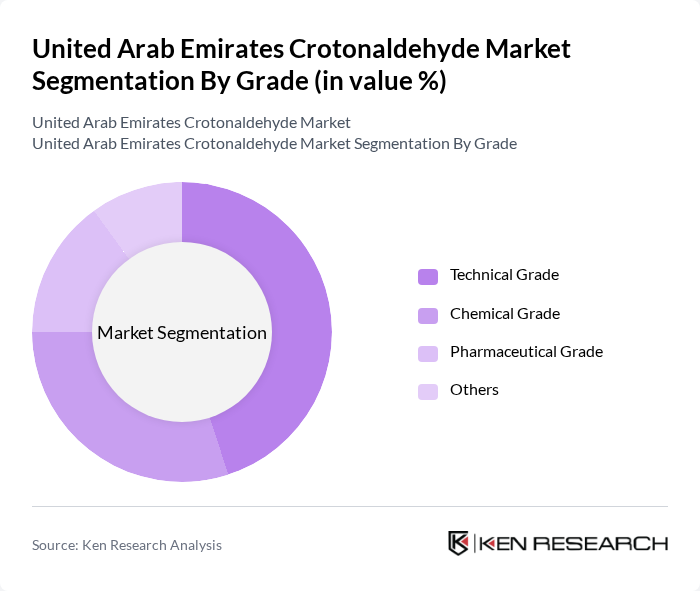

By Grade:

The market is segmented by grade into Technical Grade, Chemical Grade, Pharmaceutical Grade, and Others. Among these, the Technical Grade sub-segment is leading due to its widespread application in industrial processes and chemical manufacturing. The demand for Technical Grade crotonaldehyde is driven by its cost-effectiveness and versatility in various chemical reactions. The Chemical Grade and Pharmaceutical Grade segments are also significant, catering to specialized applications in the production of chemicals and pharmaceuticals, respectively.

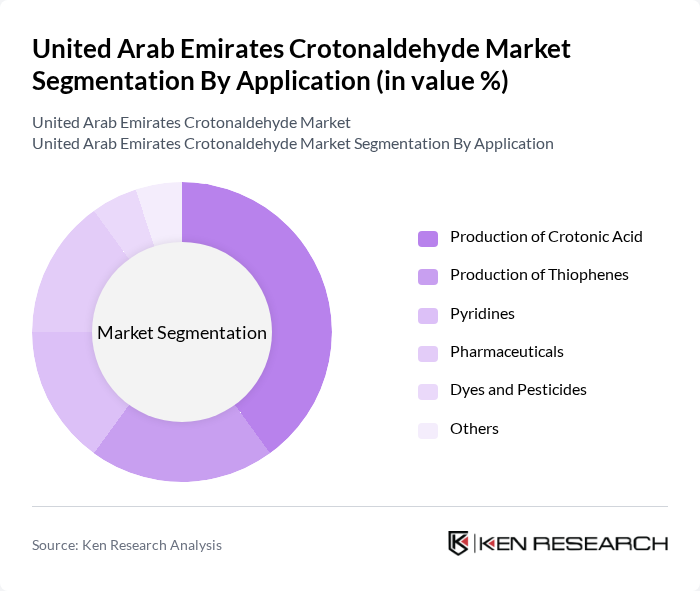

By Application:

The applications of crotonaldehyde include the production of Crotonic Acid, Thiophenes, Pyridines, Pharmaceuticals, Dyes and Pesticides, and Others. The production of Crotonic Acid is the leading application, driven by its use in the manufacture of various polymers and resins. The pharmaceutical sector is also a significant consumer, utilizing crotonaldehyde in the synthesis of active pharmaceutical ingredients. The growing agrochemical industry further supports the demand for crotonaldehyde in pesticide formulations.

The United Arab Emirates Crotonaldehyde Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, The Dow Chemical Company, Eastman Chemical Company, Huntsman Corporation, Oxea GmbH, Solvay S.A., Mitsubishi Chemical Corporation, Arkema S.A., INEOS Group, SABIC, LyondellBasell Industries, Chevron Phillips Chemical Company, Formosa Plastics Corporation, Celanese Corporation, Kraton Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the crotonaldehyde market in the UAE appears promising, driven by increasing demand across various sectors, including automotive and agrochemicals. As manufacturers adapt to stringent environmental regulations, there will be a notable shift towards sustainable production methods. Additionally, the ongoing investments in research and development are expected to foster innovation, leading to enhanced product offerings and improved production efficiencies, which will further stimulate market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Grade | Technical Grade Chemical Grade Pharmaceutical Grade Others |

| By Application | Production of Crotonic Acid Production of Thiophenes Pyridines Pharmaceuticals Dyes and Pesticides Others |

| By End-User | Chemical Manufacturing Agrochemicals Rubber Processing Pharmaceuticals Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crotonaldehyde Production Facilities | 100 | Plant Managers, Production Supervisors |

| Chemical Distribution Networks | 80 | Sales Managers, Distribution Coordinators |

| End-User Industries (Plastics, Agrochemicals) | 75 | Procurement Managers, Product Development Leads |

| Regulatory Bodies and Compliance Officers | 50 | Regulatory Affairs Managers, Environmental Compliance Officers |

| Research and Development Departments | 60 | R&D Managers, Chemical Engineers |

The United Arab Emirates Crotonaldehyde Market is valued at approximately USD 20 million, reflecting a five-year historical analysis that indicates growth driven by increasing demand across various applications, including pharmaceuticals and agrochemicals.