Region:Middle East

Author(s):Shubham

Product Code:KRAA6749

Pages:99

Published On:January 2026

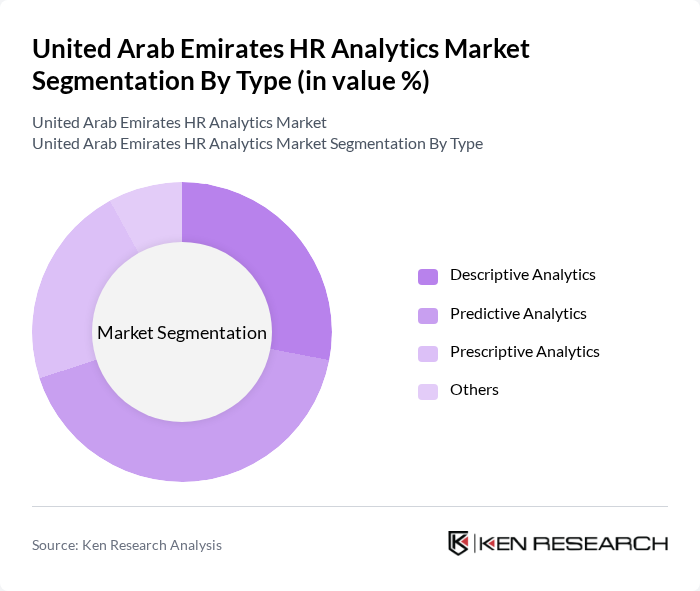

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, and Others. Each type serves distinct purposes, with Descriptive Analytics focusing on historical data analysis, Predictive Analytics forecasting future trends, and Prescriptive Analytics recommending actions based on data insights. The demand for these analytics types is driven by organizations' need to make informed HR decisions and improve overall workforce management.

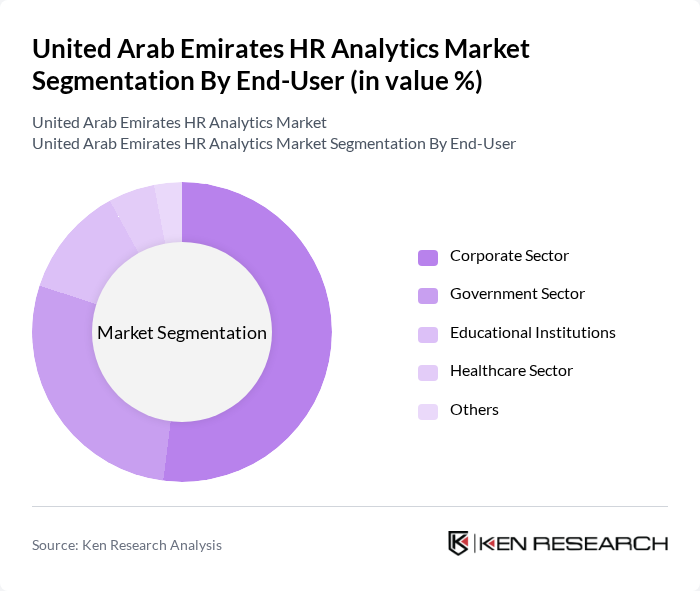

By End-User:The end-user segmentation includes Corporate Sector, Government Sector, Educational Institutions, Healthcare Sector, and Others. The Corporate Sector is the leading end-user, driven by the need for effective talent management and employee performance optimization. Government entities are increasingly adopting HR analytics to enhance public sector workforce efficiency and service delivery, with particular focus on nationalization strategies and workforce planning initiatives.

The United Arab Emirates HR Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SuccessFactors, Oracle HCM Cloud, Workday, ADP, IBM Watson Talent, Cornerstone OnDemand, BambooHR, Ultimate Software, Ceridian Dayforce, PeopleSoft, Zoho People, Gusto, Paycor, Namely, Sage People contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE HR analytics market appears promising, driven by technological advancements and a growing emphasis on data-driven strategies. Organizations are increasingly recognizing the value of predictive analytics, which is expected to enhance workforce planning and talent acquisition. Additionally, the shift towards employee-centric HR practices will likely lead to more personalized employee experiences, fostering higher engagement levels. As businesses continue to invest in innovative HR technologies, the market is poised for significant growth, with a focus on integrating AI and machine learning capabilities.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Others |

| By End-User | Corporate Sector Government Sector Educational Institutions Healthcare Sector Others |

| By Industry Vertical | IT and Telecommunications Financial Services Retail Manufacturing Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Functionality | Recruitment Analytics Performance Management Analytics Employee Engagement Analytics Others |

| By Company Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Geographic Presence | Dubai Abu Dhabi Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate HR Analytics Adoption | 120 | HR Managers, Chief Human Resource Officers |

| SME HR Technology Utilization | 80 | Business Owners, HR Consultants |

| Public Sector HR Analytics Implementation | 60 | Government HR Officials, Policy Makers |

| Industry-Specific HR Analytics Trends | 70 | Sector Analysts, HR Business Partners |

| Future of Work and HR Analytics | 70 | Workforce Strategists, Change Management Experts |

The United Arab Emirates HR Analytics Market is valued at approximately USD 1.15 billion, reflecting a significant growth trend driven by the increasing adoption of data-driven decision-making in human resources and digital transformation initiatives.