Region:Middle East

Author(s):Rebecca

Product Code:KRAE3445

Pages:100

Published On:February 2026

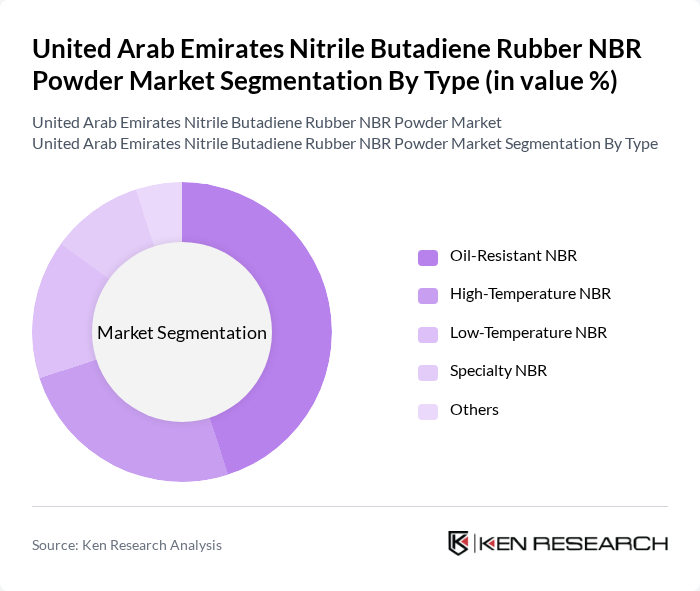

By Type:The Nitrile Butadiene Rubber NBR Powder market can be segmented into various types, including Oil-Resistant NBR, High-Temperature NBR, Low-Temperature NBR, Specialty NBR, and Others. Among these, Oil-Resistant NBR is the most dominant sub-segment due to its extensive application in automotive and industrial sectors where resistance to oils and fuels is critical. The growing automotive industry in the UAE significantly drives the demand for this type of NBR, as it is essential for manufacturing seals, gaskets, and hoses that require high durability and performance.

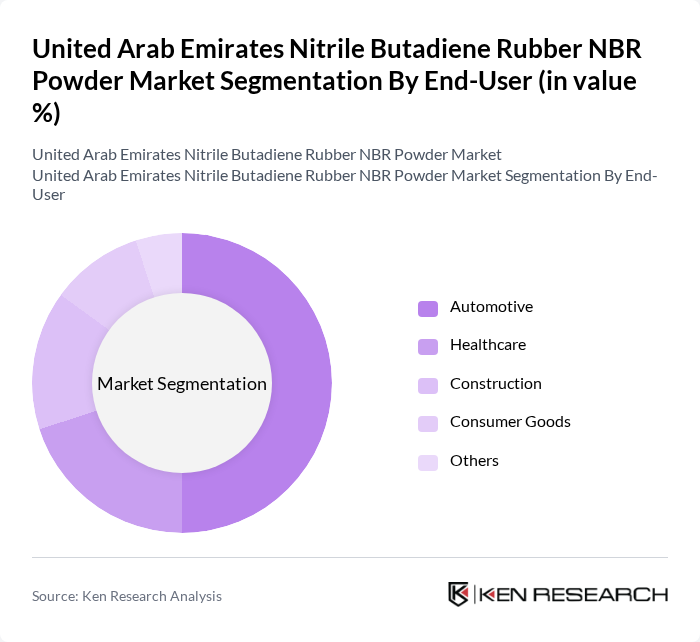

By End-User:The end-user segmentation of the Nitrile Butadiene Rubber NBR Powder market includes Automotive, Healthcare, Construction, Consumer Goods, and Others. The Automotive sector is the leading end-user, driven by the increasing production of vehicles and the need for high-performance materials in automotive components. The healthcare sector also shows significant demand due to the use of NBR in medical gloves and other healthcare products, which require high durability and resistance to chemicals.

The United Arab Emirates Nitrile Butadiene Rubber NBR Powder market is characterized by a dynamic mix of regional and international players. Leading participants such as Arlanxeo, Lanxess, Nitriflex, Zeon Chemicals, Kumho Petrochemical, LG Chem, Sinopec, JSR Corporation, Continental Carbon, Trelleborg, Hexpol, Huntsman Corporation, Dow Chemical, ExxonMobil, Bridgestone contribute to innovation, geographic expansion, and service delivery in this space.

The future of the NBR powder market in the UAE appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt eco-friendly materials, NBR powder manufacturers are likely to innovate in product development, enhancing performance while minimizing environmental impact. Additionally, the growing focus on digital transformation in supply chains will streamline operations, improve efficiency, and reduce costs, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Oil-Resistant NBR High-Temperature NBR Low-Temperature NBR Specialty NBR Others |

| By End-User | Automotive Healthcare Construction Consumer Goods Others |

| By Application | Seals and Gaskets Hoses Adhesives Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Product Form | Powder Granules Sheets Others |

| By Quality Grade | Industrial Grade Commercial Grade Specialty Grade Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 100 | Product Managers, Procurement Specialists |

| Construction Sector Utilization | 80 | Project Managers, Material Engineers |

| Healthcare Product Manufacturing | 70 | Quality Assurance Managers, R&D Directors |

| Consumer Goods Production | 60 | Supply Chain Managers, Product Development Leads |

| Industrial Applications of NBR | 90 | Operations Managers, Technical Sales Representatives |

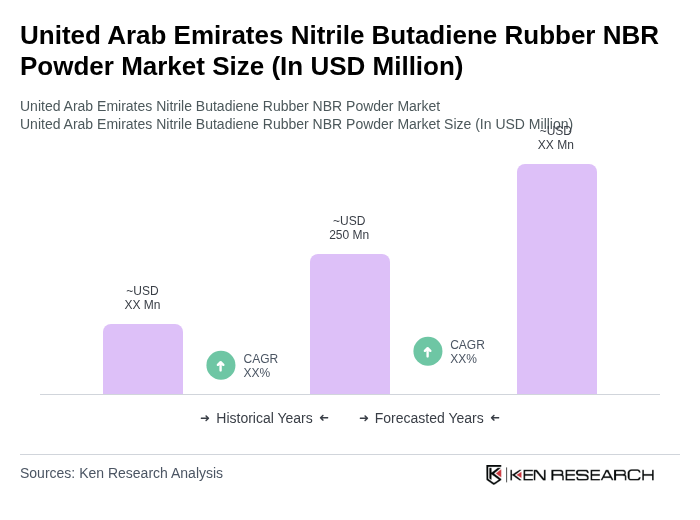

The United Arab Emirates Nitrile Butadiene Rubber (NBR) Powder market is valued at approximately USD 250 million, reflecting a robust growth trajectory driven by demand from the automotive and healthcare sectors.