Region:Asia

Author(s):Rebecca

Product Code:KRAE3448

Pages:100

Published On:February 2026

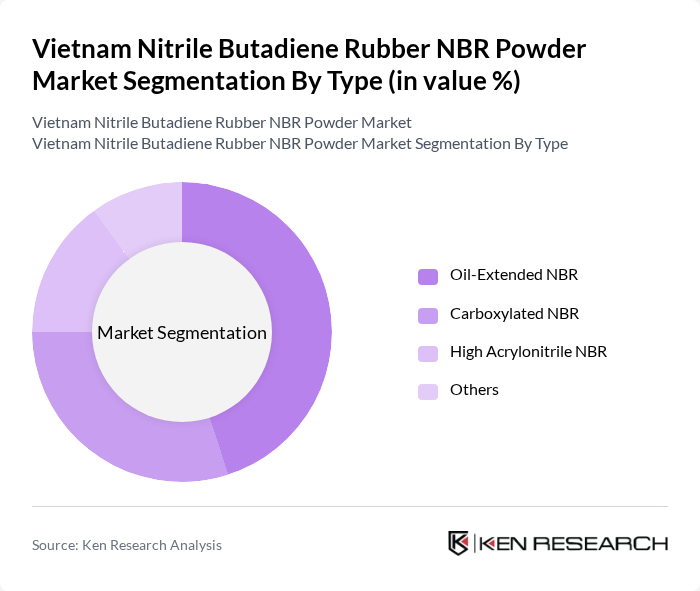

By Type:The NBR powder market can be segmented into various types, including Oil-Extended NBR, Carboxylated NBR, High Acrylonitrile NBR, and Others. Among these, Oil-Extended NBR is the most widely used due to its enhanced processing characteristics and cost-effectiveness, making it a preferred choice in the automotive and industrial sectors. Carboxylated NBR is gaining traction for applications requiring superior adhesion and durability, particularly in the healthcare sector. High Acrylonitrile NBR is utilized in specialized applications where high resistance to heat and chemicals is essential.

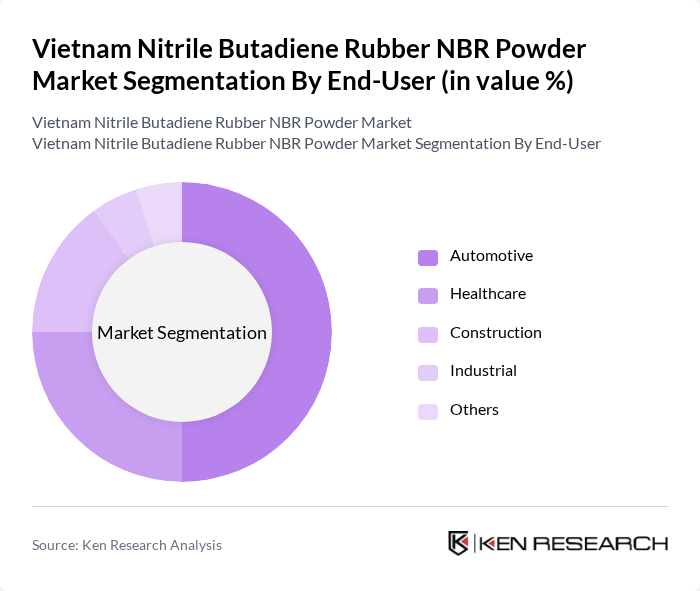

By End-User:The end-user segmentation includes Automotive, Healthcare, Construction, Industrial, and Others. The automotive sector is the leading end-user, driven by the increasing production of vehicles and the demand for high-performance materials that can withstand harsh conditions. The healthcare sector is also significant, as NBR is used in the production of medical gloves and other equipment. The construction industry is growing, with NBR being utilized in sealants and adhesives, further expanding its application scope.

The Vietnam Nitrile Butadiene Rubber NBR Powder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietnam Rubber Group, Lanxess AG, Kumho Petrochemical, LG Chem, Zeon Corporation, Sinopec, Continental AG, Asahi Kasei Corporation, TSRC Corporation, Hexpol AB, Kraton Corporation, Kordsa Teknik Tekstil A.S., Trelleborg AB, Showa Denko K.K., DOW Chemical Company contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam Nitrile Butadiene Rubber NBR Powder market is poised for significant growth, driven by increasing demand across various sectors, particularly automotive and healthcare. As manufacturers invest in sustainable practices and innovative production technologies, the market is expected to adapt to evolving consumer preferences. Additionally, the government's commitment to infrastructure development will further enhance opportunities for NBR applications, ensuring a robust market landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Oil-Extended NBR Carboxylated NBR High Acrylonitrile NBR Others |

| By End-User | Automotive Healthcare Construction Industrial Others |

| By Application | Adhesives Sealants Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| By Product Form | Powder Granules Others |

| By Customer Type | OEMs End Users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 100 | Product Managers, Procurement Specialists |

| Medical Device Manufacturing | 80 | Quality Assurance Managers, R&D Directors |

| Consumer Goods Sector | 70 | Supply Chain Managers, Product Development Leads |

| Industrial Applications | 60 | Operations Managers, Technical Directors |

| Export Market Insights | 90 | Export Managers, Trade Analysts |

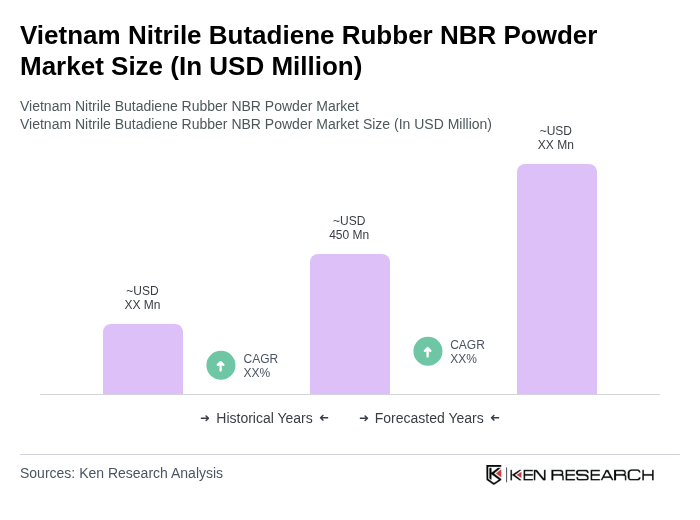

The Vietnam Nitrile Butadiene Rubber NBR Powder Market is valued at approximately USD 450 million, reflecting a robust growth trajectory driven by demand from the automotive and healthcare sectors, as well as increased construction activities.