Region:Global

Author(s):Rebecca

Product Code:KRAE3458

Pages:90

Published On:February 2026

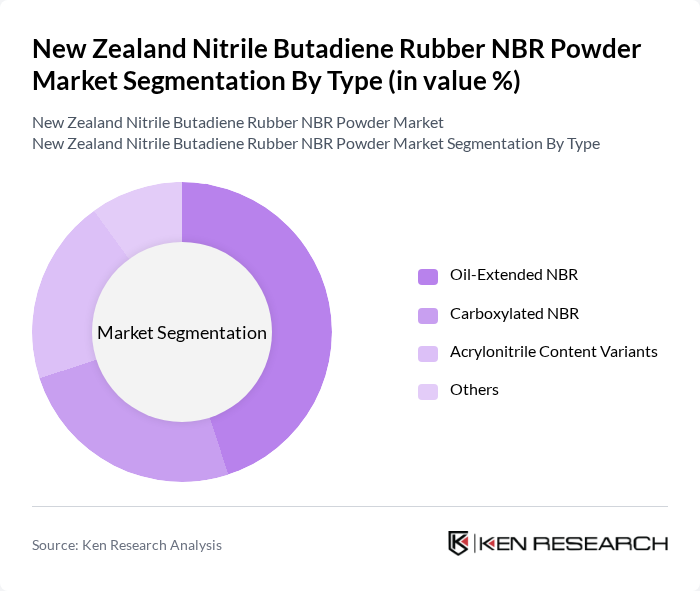

By Type:The market is segmented into various types of NBR powder, including Oil-Extended NBR, Carboxylated NBR, Acrylonitrile Content Variants, and Others. Among these, Oil-Extended NBR is the most dominant due to its superior flexibility and resistance to oils and chemicals, making it highly sought after in automotive and industrial applications.

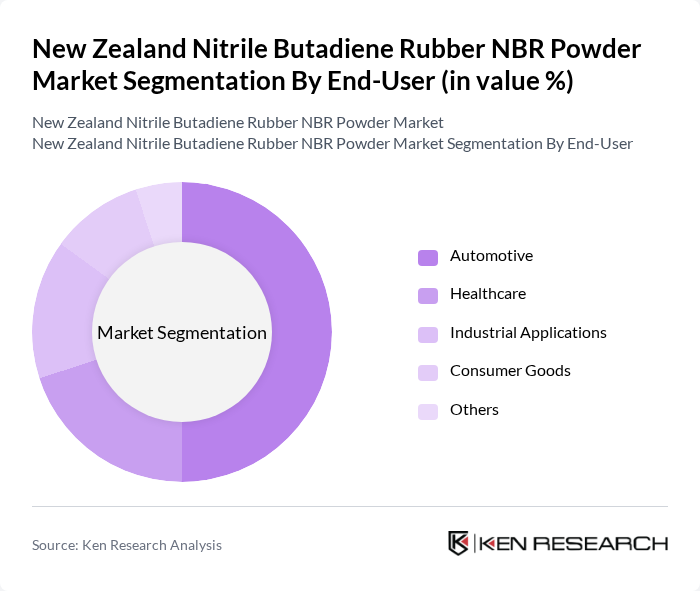

By End-User:The end-user segmentation includes Automotive, Healthcare, Industrial Applications, Consumer Goods, and Others. The Automotive sector leads the market, driven by the increasing production of vehicles and the demand for high-performance materials that can withstand harsh conditions.

The New Zealand Nitrile Butadiene Rubber NBR Powder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nitrile Rubber Company, Synthos S.A., LG Chem, Zeon Corporation, Kraton Corporation, Continental AG, Trelleborg AB, Hexpol AB, Asahi Kasei Corporation, Kossan Rubber Industries Bhd, Showa Denko K.K., Kumho Petrochemical Co., Ltd., Lanxess AG, Tosoh Corporation, China National Petroleum Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand Nitrile Butadiene Rubber NBR Powder market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As manufacturers adopt eco-friendly production methods, the demand for NBR in various applications is expected to rise. Additionally, the integration of digital technologies in manufacturing processes will enhance efficiency and product customization, catering to specific industry needs. This evolving landscape presents opportunities for growth and innovation, positioning NBR powder as a key material in multiple sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Oil-Extended NBR Carboxylated NBR Acrylonitrile Content Variants Others |

| By End-User | Automotive Healthcare Industrial Applications Consumer Goods Others |

| By Application | Seals and Gaskets Hoses Coatings Adhesives Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Geography | North Island South Island Others |

| By Product Form | Powder Granules Others |

| By Quality Grade | Industrial Grade Commercial Grade Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 100 | Product Managers, Quality Assurance Engineers |

| Construction Sector Usage | 80 | Project Managers, Procurement Specialists |

| Medical Device Manufacturing | 60 | Regulatory Affairs Managers, R&D Directors |

| Consumer Goods Production | 70 | Supply Chain Managers, Product Development Leads |

| Research Institutions and Academia | 50 | Research Scientists, Polymer Engineers |

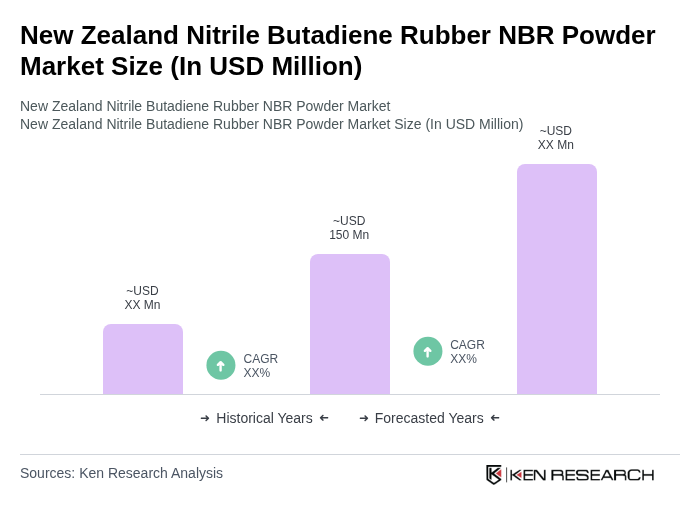

The New Zealand Nitrile Butadiene Rubber NBR Powder Market is valued at approximately USD 150 million, reflecting a robust growth trajectory driven by increasing demand across automotive and healthcare sectors, as well as a shift towards synthetic rubber materials.