Region:Middle East

Author(s):Geetanshi

Product Code:KRAD0042

Pages:89

Published On:August 2025

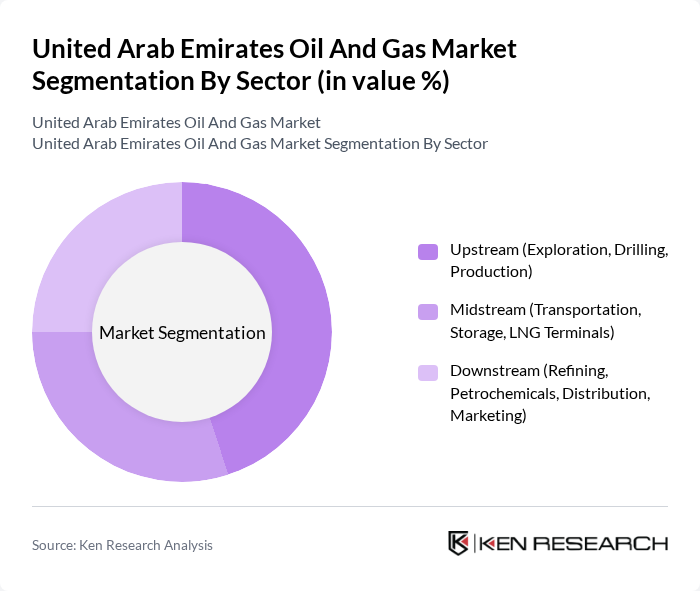

By Sector:The market is segmented by sector into upstream, midstream, and downstream activities. Theupstream sectorincludes exploration, drilling, and production, and is critical for the extraction of oil and gas resources. Themidstream sectorcovers transportation, storage, and processing, including LNG terminals, ensuring efficient movement and handling of hydrocarbons. Thedownstream sectorinvolves refining, petrochemicals, distribution, and marketing of oil and gas products, supporting both domestic consumption and export .

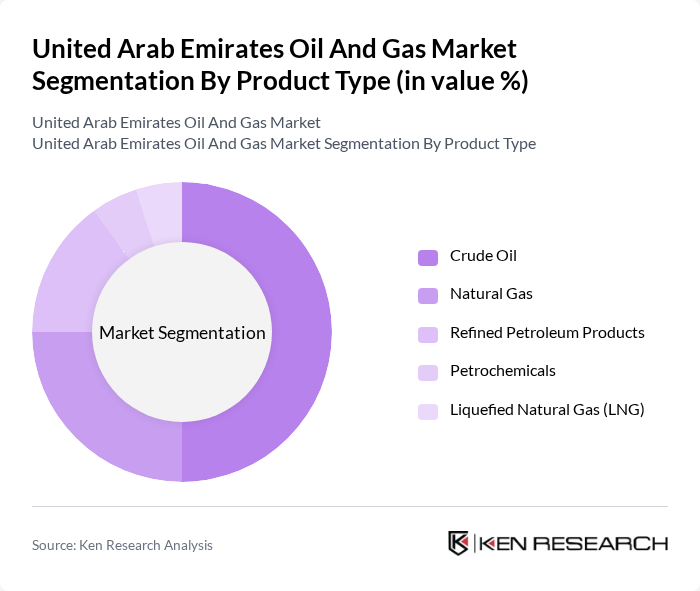

By Product Type:The market is also segmented by product type, including crude oil, natural gas, refined petroleum products, petrochemicals, and liquefied natural gas (LNG).Crude oilremains the primary product, supported by the UAE’s significant reserves and export capacity.Natural gasis gaining importance due to its role in power generation and industrial applications.Refined petroleum productsandpetrochemicalsare essential for both domestic and international markets, whileLNGis increasingly relevant for export and energy diversification strategies .

The United Arab Emirates Oil And Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi National Oil Company (ADNOC), Emirates National Oil Company (ENOC), Dubai Petroleum, Mubadala Energy, Sharjah National Oil Corporation (SNOC), ExxonMobil Corporation, BP PLC, TotalEnergies SE, Shell plc, Eni S.p.A., China National Petroleum Corporation (CNPC), Schlumberger Limited, Halliburton Company, Al Masaood Oil Industry Supplies & Services Co. LLC, and Expro Group contribute to innovation, geographic expansion, and service delivery in this space .

The UAE oil and gas market is poised for transformation, driven by a combination of technological advancements and a shift towards sustainability. As the government prioritizes renewable energy integration, the oil sector will increasingly adopt cleaner technologies. Additionally, the focus on local content and collaboration with international firms will enhance operational efficiencies. In future, these trends are expected to create a more resilient market, positioning the UAE as a leader in both traditional and renewable energy sectors.

| Segment | Sub-Segments |

|---|---|

| By Sector | Upstream (Exploration, Drilling, Production) Midstream (Transportation, Storage, LNG Terminals) Downstream (Refining, Petrochemicals, Distribution, Marketing) |

| By Product Type | Crude Oil Natural Gas Refined Petroleum Products Petrochemicals Liquefied Natural Gas (LNG) |

| By Application | Power Generation Transportation Industrial Residential & Commercial Others |

| By Region | Abu Dhabi Dubai Sharjah Northern Emirates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Production | 100 | Production Managers, Geologists |

| Midstream Transportation and Storage | 60 | Logistics Coordinators, Operations Directors |

| Downstream Refining and Distribution | 70 | Refinery Managers, Supply Chain Analysts |

| Natural Gas Sector | 50 | Gas Plant Operators, Regulatory Affairs Specialists |

| Renewable Energy Initiatives | 40 | Sustainability Managers, Project Developers |

The United Arab Emirates oil and gas market is valued at approximately USD 112 billion, driven by significant hydrocarbon reserves, advanced recovery technologies, and a focus on energy diversification, contributing to the country's economic stability and growth.