Region:Middle East

Author(s):Rebecca

Product Code:KRAC0221

Pages:86

Published On:August 2025

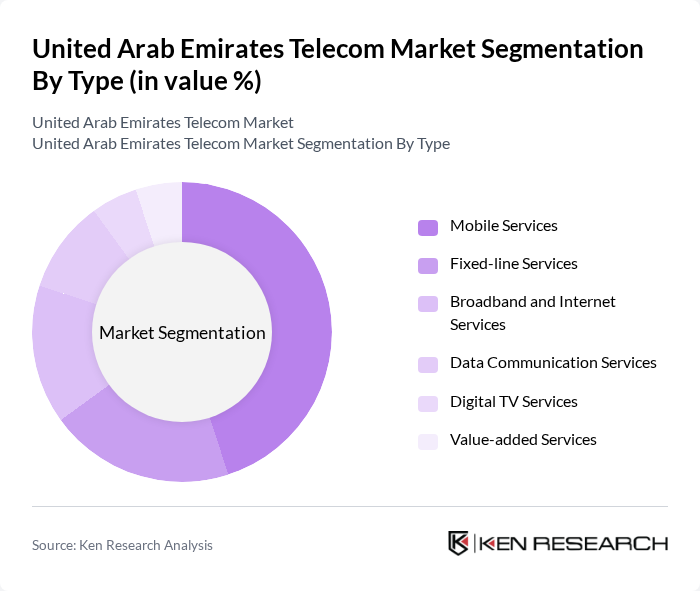

By Type:The telecom market can be segmented into Mobile Services, Fixed-line Services, Broadband and Internet Services, Data Communication Services, Digital TV Services, and Value-added Services. Among these, Mobile Services have emerged as the dominant segment, driven by the increasing penetration of smartphones, the growing demand for mobile data, and the rapid rollout of 5G networks. The shift towards mobile-first solutions has led to a surge in mobile subscriptions, making it a critical area for telecom operators. The market is also witnessing growth in OTT and Pay-TV services as digital entertainment consumption rises.

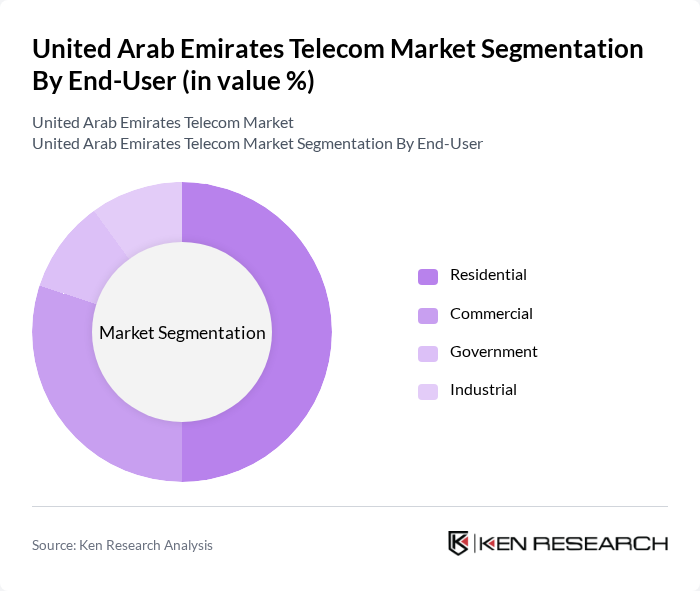

By End-User:The end-user segmentation includes Residential, Commercial, Government, and Industrial users. The Residential segment is the largest, driven by the increasing number of households requiring internet and mobile services. The growing trend of remote work, online education, and digital entertainment has further accelerated the demand for reliable telecom services among residential users, making it a key focus area for service providers.

The United Arab Emirates Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Etisalat Group (Emirates Telecommunications Group Company PJSC), du (Emirates Integrated Telecommunications Company PJSC), Virgin Mobile UAE (a brand of Emirates Integrated Telecommunications Company PJSC), Thuraya Telecommunications Company, Al Yah Satellite Communications Company PJSC (Yahsat), Axiom Telecom, E-Vision (Etisalat Group), StarzPlay Arabia, OSN (Orbit Showtime Network), Huawei UAE, Nokia Solutions and Networks FZ-LLC, Cisco UAE, Ericsson Middle East & Africa, Ooredoo Group (regional presence, not direct UAE operator), STC (Saudi Telecom Company, regional presence) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE telecom market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As 5G networks become more widespread, operators will likely focus on enhancing service quality and expanding their digital offerings. Additionally, the integration of AI and machine learning into customer service and network management will improve operational efficiency. The emphasis on customer experience will further shape competitive strategies, ensuring that telecom providers remain agile in a rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Services Fixed-line Services Broadband and Internet Services Data Communication Services Digital TV Services Value-added Services |

| By End-User | Residential Commercial Government Industrial |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Others |

| By Pricing Model | Subscription-based Pay-as-you-go Bundled Packages |

| By Service Package | Basic Packages Premium Packages Family Packages |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Enterprises |

| By Technology | G LTE G Fiber Optic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 100 | Consumers aged 18-65, diverse demographics |

| Fixed-line Service Subscribers | 60 | Household decision-makers, small business owners |

| Broadband Internet Users | 80 | Tech-savvy individuals, remote workers |

| Enterprise Telecom Solutions | 50 | IT Managers, Procurement Officers in large firms |

| Telecom Infrastructure Providers | 40 | Executives from infrastructure and technology firms |

The United Arab Emirates Telecom Market is valued at approximately USD 12 billion, reflecting significant growth driven by mobile services, high-speed internet demand, and the expansion of 5G technology.