Region:Europe

Author(s):Rebecca

Product Code:KRAB0286

Pages:94

Published On:August 2025

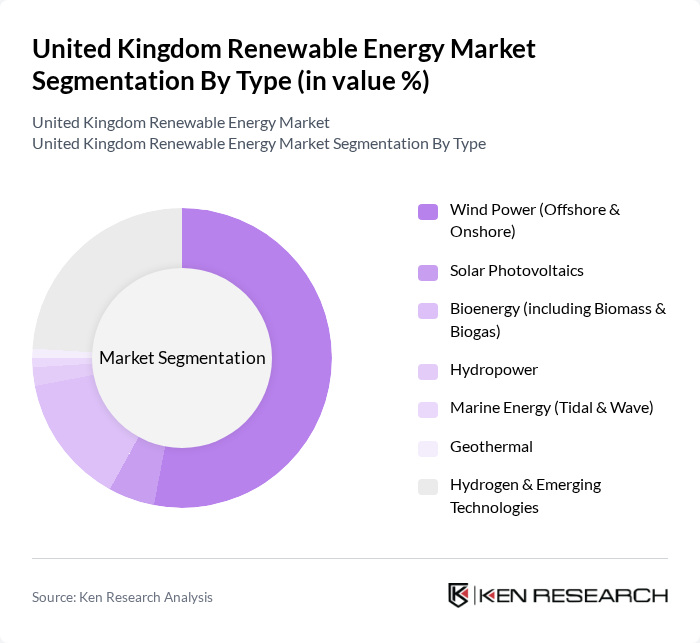

By Type:The market is segmented into Wind Power (Offshore & Onshore), Solar Photovoltaics, Bioenergy (including Biomass & Biogas), Hydropower, Marine Energy (Tidal & Wave), Geothermal, and Hydrogen & Emerging Technologies. Among these, Wind Power—particularly offshore—has emerged as the dominant segment due to the UK's extensive coastline, favorable wind conditions, and large-scale investments in offshore wind farms. Solar photovoltaics and bioenergy also represent significant shares, driven by declining technology costs and supportive policy frameworks .

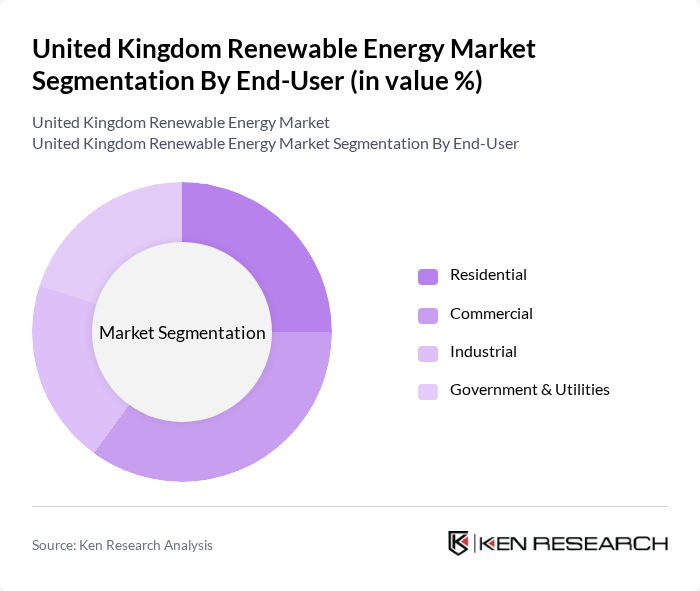

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Commercial and Government & Utilities segments currently lead the market, driven by large-scale procurement of renewable energy and aggressive decarbonization targets. The Residential segment is growing steadily due to increased adoption of rooftop solar and energy-efficient technologies, supported by financial incentives and rising energy costs .

The United Kingdom Renewable Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ørsted A/S, SSE Renewables, E.ON SE, ScottishPower Renewables, RWE AG, Vattenfall AB, Engie SA, Octopus Energy Group, Centrica plc, EDF Renewables, TotalEnergies SE, Drax Group plc, BP plc, Siemens Gamesa Renewable Energy, Brookfield Renewable Partners L.P. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK renewable energy market appears promising, driven by increasing investments in innovative technologies and a strong policy framework. The government’s commitment to achieving net-zero emissions by 2050 will likely spur further advancements in energy efficiency and storage solutions. Additionally, the integration of smart grid technologies is expected to enhance energy management, facilitating a more resilient energy infrastructure. As consumer preferences shift towards sustainability, the market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Wind Power (Offshore & Onshore) Solar Photovoltaics Bioenergy (including Biomass & Biogas) Hydropower Marine Energy (Tidal & Wave) Geothermal Hydrogen & Emerging Technologies |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes & Grants |

| By Application | Grid-Connected Utility-Scale Distributed Generation (Rooftop & Community) Off-Grid & Remote Installations Energy Storage Integration |

| By Policy Support | Subsidies & Incentives Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors & Installers |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Solar Energy Providers | 100 | CEOs, Project Managers, Technical Directors |

| Wind Energy Developers | 80 | Operations Managers, Business Development Executives |

| Biomass Energy Firms | 50 | Procurement Managers, Sustainability Officers |

| Government Energy Policy Makers | 40 | Policy Advisors, Regulatory Affairs Managers |

| Energy Consultants and Analysts | 60 | Market Analysts, Research Directors, Energy Economists |

The United Kingdom Renewable Energy Market is valued at approximately USD 24 billion, reflecting significant growth driven by government policies, investments in wind and solar capacity, and increasing public awareness of climate change.