Region:Europe

Author(s):Shubham

Product Code:KRAA1913

Pages:100

Published On:August 2025

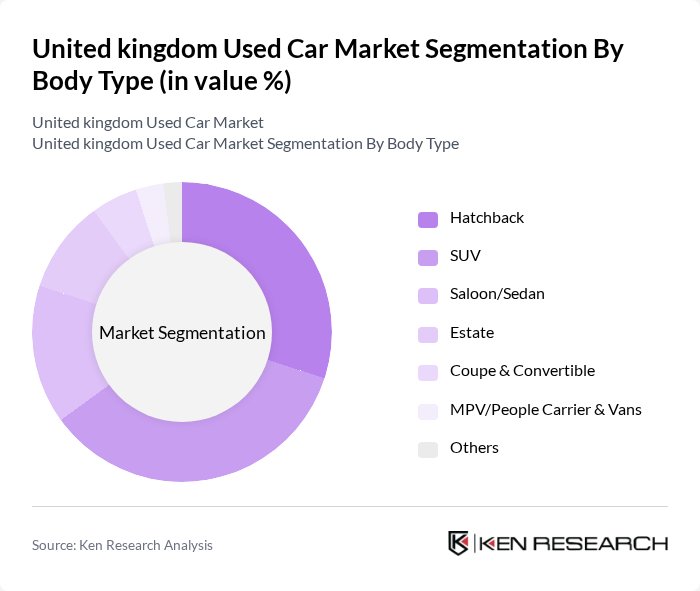

By Body Type:The used car market in the UK is segmented by body type, which includes various categories such as hatchbacks, SUVs, saloon/sedans, estates, coupes & convertibles, MPVs/people carriers & vans, and others. Among these, hatchbacks and SUVs are particularly popular due to their practicality and versatility. Industry data show hatchbacks remain a core share of the UK parc and transactions, while SUV demand has risen with family buyers prioritizing space, higher seating, and perceived safety; this shift is reflected in the growing share of SUVs in used transactions over recent years .

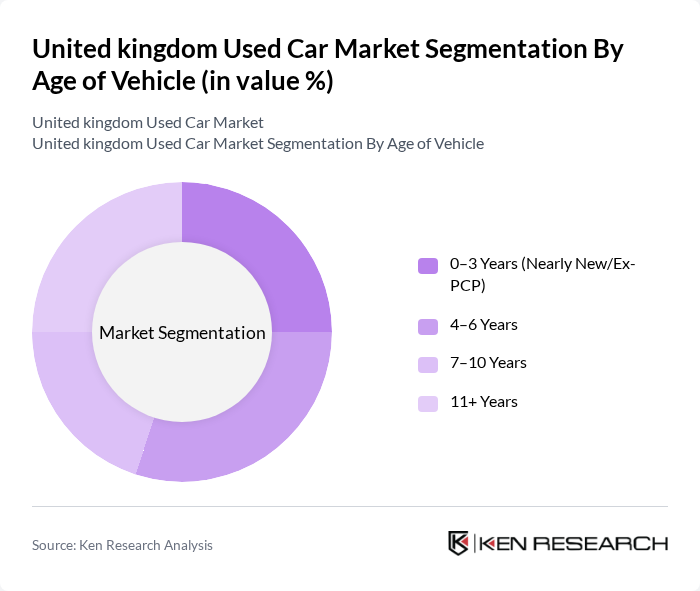

By Age of Vehicle:The segmentation by age of vehicle includes categories such as 0–3 years (nearly new/ex-PCP), 4–6 years, 7–10 years, and 11+ years. The nearly new segment attracts buyers seeking modern tech and warranty cover without the new-car price, while 4–6-year vehicles balance price and reliability; sustained supply constraints from prior new-car shortfalls have also supported residuals for younger used stock .

The United Kingdom Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Auto Trader Group plc, Cazoo Group Ltd, carwow Ltd, We Buy Any Car (BCA Group), Evans Halshaw (Pendragon plc), Arnold Clark Automobiles Ltd, Lookers plc, Sytner Group (Penske Automotive UK), Inchcape plc, Vertu Motors plc, Motorpoint Group plc, CarGurus, Inc., Auto Trader Retailer Stores (Dealer Partners), Cinch (Constellation Automotive Group), and Marshall Motor Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the United Kingdom's used car market appears promising, driven by technological advancements and changing consumer preferences. The increasing adoption of online sales platforms is expected to enhance accessibility and convenience for buyers. Additionally, the growing interest in electric and hybrid vehicles will likely create new market segments. As the economy stabilizes post-pandemic, consumer confidence is anticipated to rise, further stimulating demand for used cars in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Body Type | Hatchback SUV Saloon/Sedan Estate Coupe & Convertible MPV/People Carrier & Vans Others |

| By Age of Vehicle | –3 Years (Nearly New/Ex-PCP) –6 Years –10 Years + Years |

| By Fuel/Powertrain | Petrol Diesel Hybrid (HEV) Plug-in Hybrid (PHEV) Battery Electric (BEV) |

| By Sales Channel | Franchised Dealers Independent Dealers & Supermarkets Online-first Platforms Auctions (Physical & Digital) Private Sales |

| By Price Band | Under £5,000 £5,000–£10,000 £10,000–£15,000 £15,000–£20,000 Over £20,000 |

| By Condition | Certified/Approved Used Non-Certified Retail Trade/Damaged/Repairable |

| By Region | England Scotland Wales Northern Ireland |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 120 | Dealership Owners, Sales Managers |

| Private Used Car Buyers | 140 | Recent Car Buyers, First-time Buyers |

| Automotive Financing Institutions | 100 | Loan Officers, Financial Advisors |

| Online Car Marketplaces | 80 | Platform Managers, Marketing Directors |

| Automotive Industry Experts | 50 | Market Analysts, Automotive Consultants |

The United Kingdom used car market is valued at approximately GBP 8085 billion, with recent estimates indicating revenues exceeding USD 100 billion. This growth is driven by increasing consumer demand for affordable transportation options and strong transaction volumes.