Region:Asia

Author(s):Dev

Product Code:KRAB0601

Pages:92

Published On:August 2025

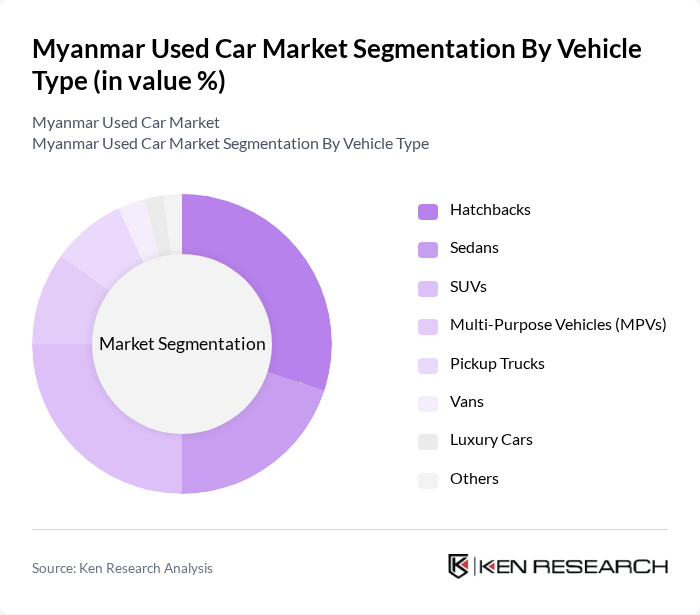

By Vehicle Type:The vehicle type segmentation includes various categories such as hatchbacks, sedans, SUVs, multi-purpose vehicles (MPVs), pickup trucks, vans, luxury cars, and others. Among these, hatchbacks and SUVs are particularly popular due to their compact size and versatility, making them suitable for urban driving conditions. The demand for pickup trucks is also significant, driven by their utility in both personal and commercial applications. The market is also witnessing growing interest in electric vehicles, especially among urban consumers seeking lower running costs and government-backed incentives .

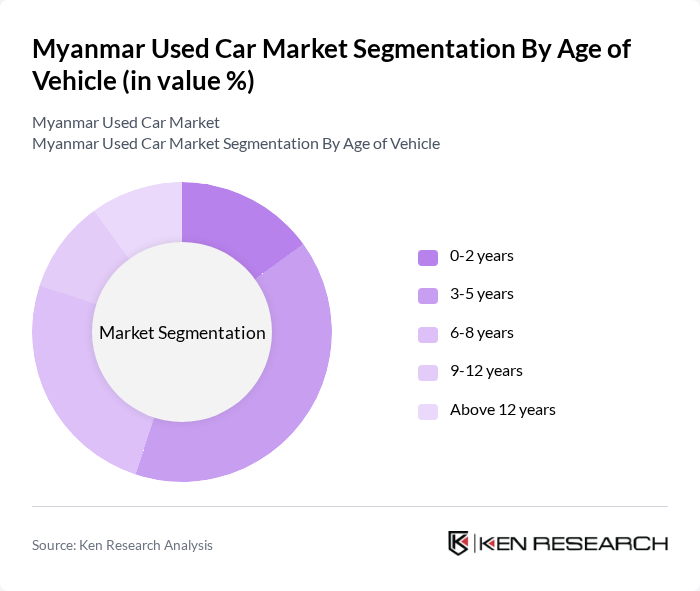

By Age of Vehicle:The age of vehicle segmentation categorizes used cars into five groups: 0-2 years, 3-5 years, 6-8 years, 9-12 years, and above 12 years. The 3-5 years category is the most dominant, as these vehicles offer a balance between affordability and reliability. Consumers often prefer slightly older vehicles that have already depreciated in value but still possess modern features and lower maintenance costs. The market also reflects a growing preference for certified pre-owned vehicles, which provide additional assurance regarding vehicle condition and history .

The Myanmar Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Aye and Sons, CarsDB, Japan Auto Showroom, SBT Co., Ltd., Capital Diamond Star Group Limited (TrustyCars), Hyundai Motor Myanmar, Nissan Myanmar, Suzuki Myanmar, Ford Myanmar, Honda Myanmar, Isuzu Myanmar, Mazda Myanmar, BYD Myanmar, MG Myanmar, Neta Myanmar, Leap Motor Myanmar, Great Wall Motors Myanmar, Changan Myanmar, Kia Myanmar, Tata Motors Myanmar, Volkswagen Myanmar contribute to innovation, geographic expansion, and service delivery in this space.

The Myanmar used car market is poised for significant transformation in future, driven by technological advancements and changing consumer preferences. The shift towards online sales platforms is expected to streamline the purchasing process, making it easier for consumers to access a wider range of vehicles. Additionally, the growing interest in electric vehicles will likely reshape the market landscape, as more consumers seek sustainable transportation options. These trends indicate a dynamic future for the used car sector in Myanmar.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Hatchbacks Sedans SUVs Multi-Purpose Vehicles (MPVs) Pickup Trucks Vans Luxury Cars Others |

| By Age of Vehicle | 2 years 5 years 8 years 12 years Above 12 years |

| By Price Range (USD) | Below $5,000 $5,000 - $9,999 $10,000 - $14,999 $15,000 - $19,999 $20,000 - $29,999 Above $30,000 |

| By Sales Channel | Online Platforms Dealerships (Organized) Dealerships (Unorganized) Private Sales Auctions |

| By Fuel Type | Petrol Diesel Hybrid (HEV & PHEV) Battery-Electric (BEV) Others |

| By Financing Options | Cash Purchases Bank Loans Hire Purchase Leasing |

| By Condition | Certified Pre-Owned Non-Certified Used |

| By Brand Origin | Japanese Brands Korean Brands American Brands European Brands Chinese Brands Others |

| By Region | Yangon Mandalay Naypyitaw & Central Corridor Border States (Shan, Kachin, others) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 80 | Dealership Owners, Sales Managers |

| Recent Used Car Buyers | 120 | Consumers aged 25-45, First-time Buyers |

| Automotive Financing Institutions | 50 | Loan Officers, Financial Advisors |

| Vehicle Importers | 40 | Import Managers, Compliance Officers |

| Automotive Aftermarket Service Providers | 45 | Service Managers, Parts Retailers |

The Myanmar Used Car Market is valued at approximately USD 720 million, reflecting significant growth driven by urbanization, rising disposable incomes, and a preference for affordable transportation options among consumers.