United States Crop Protection Chemicals Market Overview

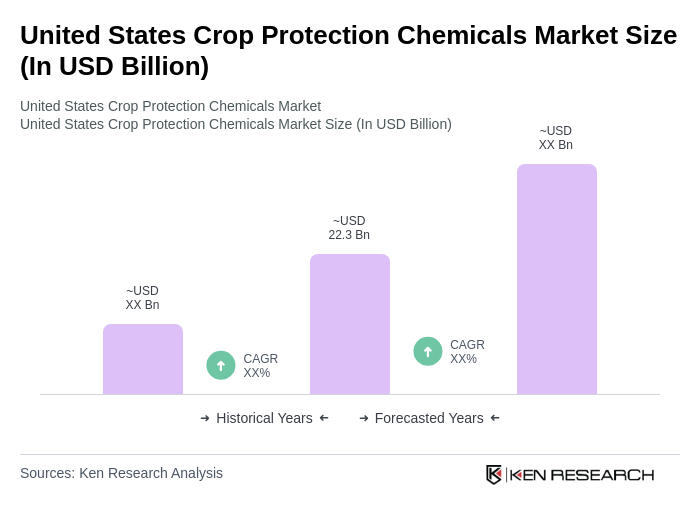

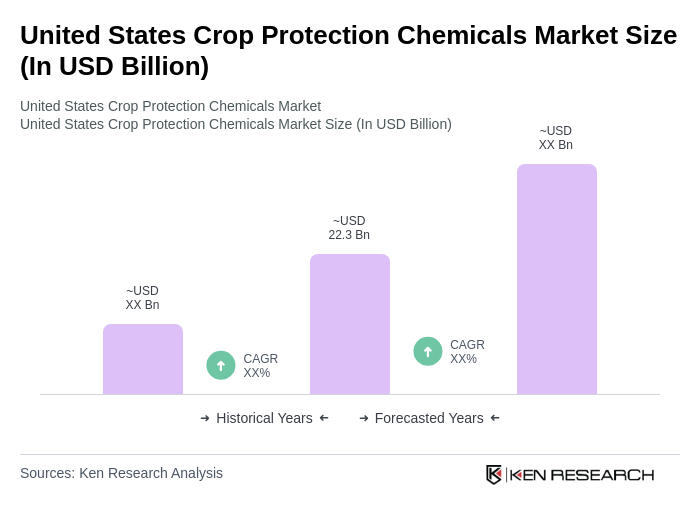

- The United States Crop Protection Chemicals Market is valued at USD 22.3 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for food production, advancements in agricultural technology, and the need for effective pest management solutions. The market has seen a significant rise in the adoption of innovative crop protection products that enhance yield and ensure food security. The adoption of precision agriculture, digital farming platforms, and bio-based crop protection solutions are notable trends shaping the market’s evolution .

- Key players in this market include states like California, Iowa, and Illinois, which dominate due to their extensive agricultural activities and favorable climatic conditions. These regions are known for high crop yields and diverse agricultural practices, making them critical hubs for crop protection chemicals. The concentration of agricultural research institutions and a strong distribution network further bolster their market presence .

- In 2023, the United States Environmental Protection Agency (EPA) implemented stricter regulations on pesticide usage, mandating comprehensive risk assessments for new chemical products. This regulatory framework is governed by the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), as administered by the EPA, which requires all pesticides sold or distributed in the United States to be registered and evaluated for safety, efficacy, and environmental impact. The EPA’s updated risk assessment protocols ensure that crop protection chemicals are used responsibly while maintaining agricultural productivity .

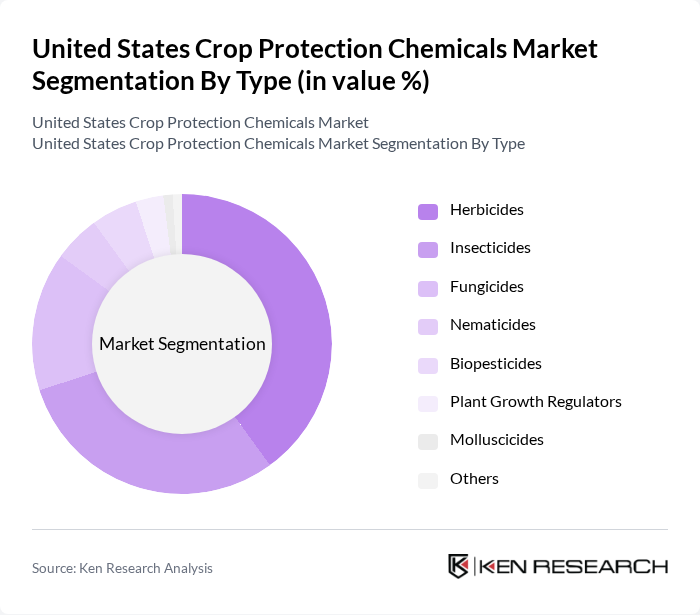

United States Crop Protection Chemicals Market Segmentation

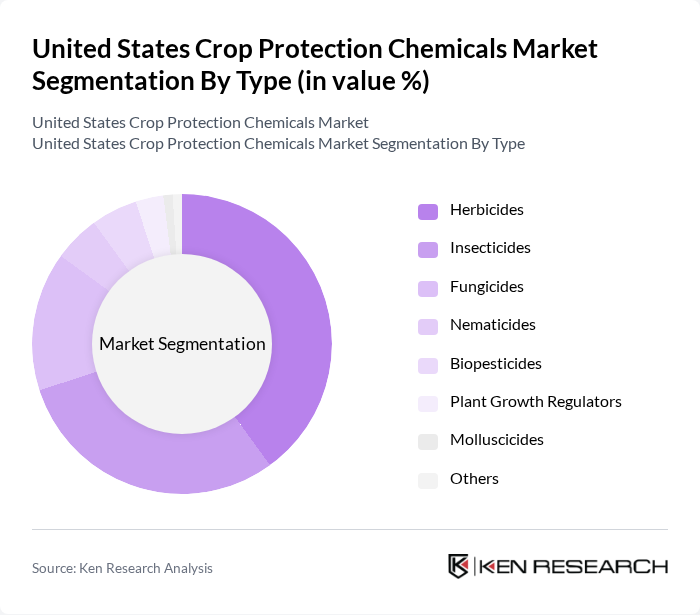

By Type:The market is segmented into various types of crop protection chemicals, including herbicides, insecticides, fungicides, nematicides, biopesticides, plant growth regulators, molluscicides, and others. Among these, herbicides and insecticides are the most widely used due to their effectiveness in controlling weeds and pests, which are significant threats to crop yields. The increasing focus on sustainable agriculture is also driving the growth of biopesticides, which are gaining popularity for their eco-friendly attributes .

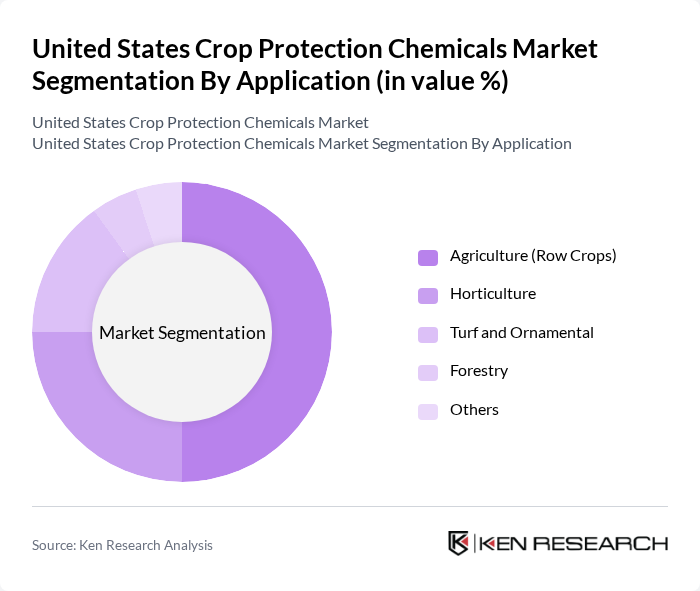

By Application:The applications of crop protection chemicals are diverse, including agriculture (row crops such as corn, soybeans, wheat, and cotton), horticulture (fruits, vegetables, and nuts), turf and ornamental, forestry, and others. The agriculture segment is the largest, driven by the need to protect high-value crops from pests and diseases. Horticulture is also growing, as consumers demand fresh produce, leading to increased use of crop protection products in this sector .

United States Crop Protection Chemicals Market Competitive Landscape

The United States Crop Protection Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer CropScience AG, Syngenta Group, Corteva Agriscience, BASF SE, FMC Corporation, ADAMA Ltd., Nufarm Limited, UPL Ltd., Sumitomo Chemical Co., Ltd., Valent BioSciences LLC, Albaugh, LLC, AMVAC Chemical Corporation, Gowan Company, LLC, Certis Biologicals (Certis USA LLC), Marrone Bio Innovations, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

United States Crop Protection Chemicals Market Industry Analysis

Growth Drivers

- Increasing Demand for Food Security:The U.S. population is projected to reach approximately 335 million in future, driving the need for enhanced agricultural productivity. The USDA estimates that food production must increase by 70% in future to meet global demand. This urgency propels the crop protection chemicals market, as farmers seek effective solutions to maximize yields and ensure food security amidst growing population pressures and climate variability.

- Adoption of Precision Agriculture:The precision agriculture market in the U.S. is expected to grow to $8 billion in future, reflecting a shift towards data-driven farming practices. This trend enhances the efficiency of crop protection chemicals, allowing for targeted applications that minimize waste and environmental impact. Farmers increasingly utilize technologies such as GPS and IoT devices, which optimize pesticide use and improve overall crop management, thus driving market growth.

- Rising Awareness of Sustainable Farming Practices:The U.S. organic food market reached $60 billion in future, indicating a significant consumer shift towards sustainable practices. This trend encourages the development of eco-friendly crop protection solutions. As farmers adopt integrated pest management (IPM) strategies, the demand for sustainable crop protection chemicals rises, aligning with consumer preferences for environmentally responsible agricultural practices and contributing to market expansion.

Market Challenges

- Stringent Regulatory Frameworks:The U.S. crop protection chemicals market faces significant challenges due to stringent regulations imposed by agencies like the EPA. Compliance with the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) requires extensive testing and documentation, which can delay product launches and increase costs. In future, the regulatory landscape is expected to tighten further, complicating market entry for new products and hindering innovation.

- Environmental Concerns and Public Perception:Growing public awareness of environmental issues has led to increased scrutiny of chemical pesticides. Reports indicate that a majority of consumers prefer organic or sustainably sourced products, pressuring manufacturers to adapt. This shift can result in reduced market share for traditional crop protection chemicals, as consumers demand safer, eco-friendly alternatives, challenging companies to innovate while addressing public concerns.

United States Crop Protection Chemicals Market Future Outlook

The future of the U.S. crop protection chemicals market is poised for transformation, driven by technological advancements and evolving consumer preferences. As farmers increasingly adopt precision agriculture and integrated pest management, the demand for innovative, sustainable solutions will rise. Additionally, the market will likely see a surge in bio-based products, aligning with the growing emphasis on environmental sustainability. Companies that invest in research and development will be well-positioned to capitalize on these trends, ensuring long-term growth and competitiveness in the industry.

Market Opportunities

- Expansion into Emerging Markets:The U.S. crop protection chemicals industry can leverage growth opportunities in emerging markets, where agricultural practices are evolving. With a projected increase in agricultural spending in regions like Asia-Pacific in future, companies can tap into new customer bases, driving revenue growth and enhancing global market presence.

- Development of Innovative Formulations:There is a significant opportunity for companies to invest in the development of innovative formulations that meet the demand for sustainable and effective crop protection solutions. By focusing on bio-based and environmentally friendly products, firms can differentiate themselves in a competitive market, appealing to both consumers and regulatory bodies.