Region:North America

Author(s):Dev

Product Code:KRAB3076

Pages:94

Published On:October 2025

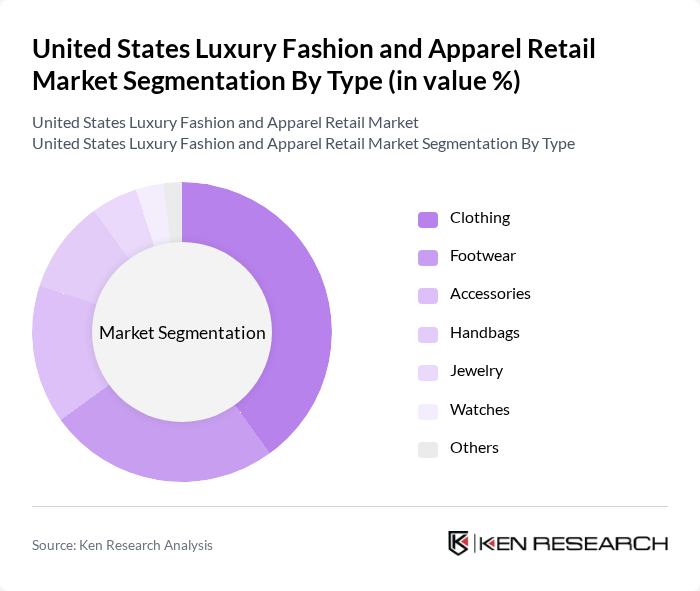

By Type:The luxury fashion and apparel market is segmented into various types, including clothing, footwear, accessories, handbags, jewelry, watches, and others. Among these, clothing remains the dominant segment due to its broad appeal and essential nature in luxury consumption. The increasing trend of athleisure and high-end casual wear has further propelled the clothing segment, making it a focal point for luxury brands. Footwear and accessories also play significant roles, driven by consumer preferences for branded items that complement their overall style.

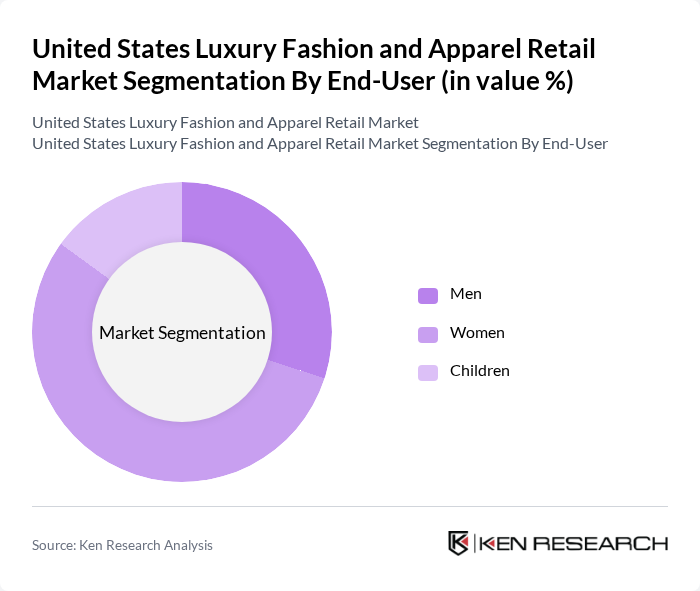

By End-User:The market is segmented by end-user demographics, including men, women, and children. Women represent the largest segment, driven by their higher spending power and a greater inclination towards luxury fashion. The increasing focus on gender-neutral and children's luxury apparel is also gaining traction, contributing to the overall growth of the market. Men's luxury fashion is witnessing a rise as well, with brands increasingly targeting male consumers through tailored offerings and marketing strategies.

The United States Luxury Fashion and Apparel Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Kering SA, Gucci Group, Prada S.p.A., Chanel S.A., Hermès International S.A., Burberry Group plc, Ralph Lauren Corporation, Tory Burch LLC, Michael Kors Holdings Limited, Versace S.p.A., Valentino S.p.A., Dolce & Gabbana S.r.l., Fendi S.r.l., Coach, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. luxury fashion and apparel market appears promising, driven by evolving consumer preferences and technological advancements. As brands increasingly focus on personalization and sustainability, they are likely to attract a broader customer base. The integration of advanced technologies, such as AI and AR, will enhance the shopping experience, making it more engaging. Additionally, the growth of the second-hand luxury market will reshape consumer behavior, promoting circular fashion and sustainability in luxury retail.

| Segment | Sub-Segments |

|---|---|

| By Type | Clothing Footwear Accessories Handbags Jewelry Watches Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Department Stores Specialty Stores Direct Sales Others |

| By Price Range | Premium Super Premium Affordable Luxury |

| By Brand Positioning | Established Luxury Brands Emerging Luxury Brands Designer Collaborations |

| By Consumer Demographics | Age Group Gender Income Level |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Retailers | 150 | Store Managers, Regional Directors |

| High-End Accessories Market | 100 | Product Managers, Brand Strategists |

| Footwear Segment Analysis | 80 | Merchandising Managers, Sales Executives |

| Consumer Insights on Luxury Purchases | 200 | Affluent Consumers, Fashion Enthusiasts |

| Online Luxury Shopping Trends | 120 | E-commerce Managers, Digital Marketing Specialists |

The United States Luxury Fashion and Apparel Retail Market is valued at approximately USD 90 billion, reflecting a significant growth driven by increasing disposable incomes and a rising trend in luxury consumption among consumers.