United States Oil And Gas Market Overview

- The United States Oil and Gas Market is valued at USD 1.6 trillion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for energy, robust export growth, technological advancements in extraction methods, and the continued rise of shale oil and natural gas liquids production. The market has experienced significant fluctuations in oil prices, which have influenced investment and production strategies across the sector .

- Key producing states in this market include Texas, North Dakota, and Pennsylvania, which dominate due to their rich natural resources and established infrastructure. Texas, in particular, is a leader in both oil and natural gas production, benefiting from its extensive pipeline network, the prolific Permian Basin, and a favorable regulatory environment, making it a hub for energy companies .

- In 2023, the U.S. government implemented the Inflation Reduction Act, which includes provisions for tax incentives aimed at promoting clean energy technologies and reducing greenhouse gas emissions in the oil and gas sector. This regulation is designed to encourage investment in renewable energy sources while maintaining the viability of traditional fossil fuel operations .

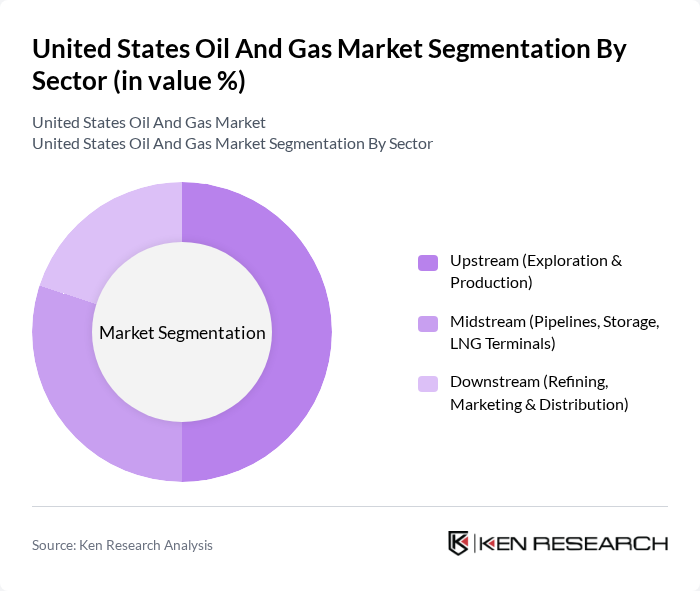

United States Oil And Gas Market Segmentation

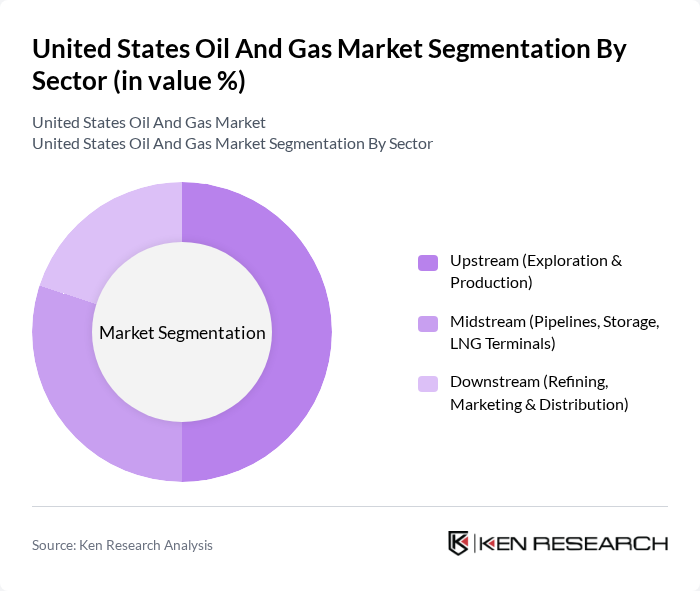

By Sector:The market is segmented into upstream (exploration and production), midstream (pipelines, storage, LNG terminals), and downstream (refining, marketing, and distribution). The upstream sector remains the most dominant, driven by advancements in horizontal drilling and hydraulic fracturing, as well as increased production from shale formations, particularly in the Permian Basin. The midstream sector is essential for the transportation, storage, and export of oil and gas, while the downstream sector focuses on refining and delivering finished products to end-users .

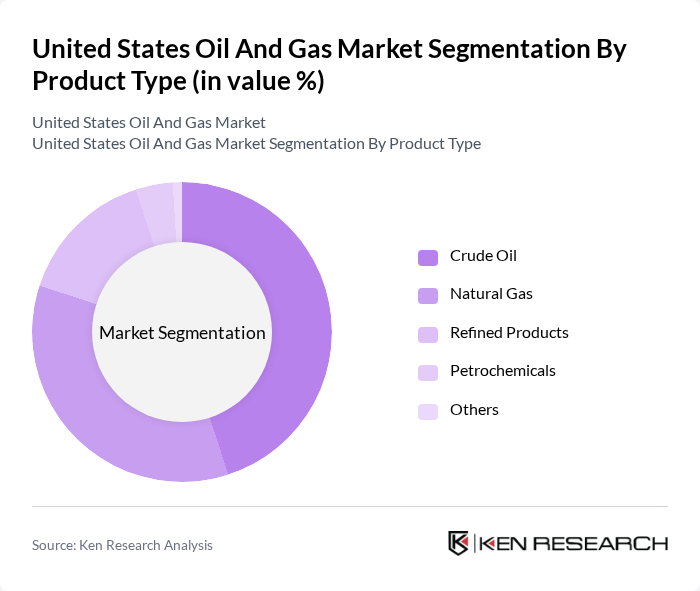

By Product Type:The market is segmented by product type into crude oil, natural gas, refined products, petrochemicals, and others. Crude oil remains the leading product type due to its essential role in energy production and transportation fuels. Natural gas continues to gain traction as a cleaner-burning alternative, with the U.S. being the world's largest natural gas liquids producer. Refined products and petrochemicals are critical for a wide range of industrial and consumer applications, while the "others" category includes specialty products such as lubricants and asphalt .

United States Oil And Gas Market Competitive Landscape

The United States Oil And Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation, Chevron Corporation, ConocoPhillips, Occidental Petroleum Corporation, EOG Resources, Inc., Pioneer Natural Resources Company, Devon Energy Corporation, Hess Corporation, Marathon Oil Corporation, Phillips 66, Cheniere Energy, Inc., Kinder Morgan, Inc., Williams Companies, Inc., Enterprise Products Partners L.P., EQT Corporation contribute to innovation, geographic expansion, and service delivery in this space.

United States Oil And Gas Market Industry Analysis

Growth Drivers

- Increasing Energy Demand:The United States is projected to consume approximately 20 million barrels of oil per day in future, driven by a growing population and industrial activities. The U.S. Energy Information Administration (EIA) anticipates that energy consumption will rise by approximately 1.5% annually, reflecting increased demand in transportation and manufacturing sectors. This surge in energy needs is a significant driver for oil and gas production, necessitating enhanced extraction and production capabilities to meet the rising consumption levels.

- Technological Advancements in Extraction:Innovations in extraction technologies, such as hydraulic fracturing and horizontal drilling, have significantly increased U.S. oil production, reaching approximately 12.9 million barrels per day in future. The adoption of advanced technologies has reduced production costs by approximately 30%, making previously uneconomical reserves viable. As companies invest in these technologies, the efficiency and output of oil and gas extraction are expected to improve, further driving market growth in the coming years.

- Regulatory Support for Domestic Production:The U.S. government has implemented policies that support domestic oil and gas production, including tax incentives and streamlined permitting processes. In future, the federal government allocated substantial funding for infrastructure improvements in oil and gas regions. This regulatory environment encourages investment and development in the sector, fostering a more robust domestic production landscape that can respond effectively to both national and global energy demands.

Market Challenges

- Environmental Regulations:Stricter environmental regulations pose significant challenges for the oil and gas industry. The implementation of the Clean Air Act and other environmental policies has led to increased compliance costs, estimated at approximately 2 billion annually for major producers. These regulations require companies to invest in cleaner technologies and practices, which can hinder operational efficiency and profitability, particularly for smaller firms struggling to meet these standards.

- Market Volatility:The oil and gas market is subject to significant price volatility, influenced by geopolitical tensions and global supply-demand dynamics. Oil prices have fluctuated within a broad range in future, creating uncertainty for producers. This volatility complicates long-term planning and investment decisions, as companies must navigate unpredictable market conditions that can impact revenue and operational stability, leading to cautious investment strategies.

United States Oil And Gas Market Future Outlook

The future of the U.S. oil and gas market appears promising, driven by ongoing technological advancements and a shift towards cleaner energy sources. As companies increasingly adopt digital transformation strategies, operational efficiencies are expected to improve, reducing costs and enhancing productivity. Additionally, the integration of renewable energy sources into traditional oil and gas operations will likely create new avenues for growth, positioning the industry to adapt to evolving energy demands and environmental expectations.

Market Opportunities

- Expansion of Natural Gas Usage:The U.S. natural gas market is projected to grow, with consumption expected to reach approximately 89.1 billion cubic feet per day in future. This growth is driven by the transition from coal to natural gas in power generation, which is anticipated to reduce carbon emissions significantly. Companies that invest in natural gas infrastructure and production will benefit from this increasing demand, positioning themselves favorably in the energy landscape.

- Investment in Renewable Integration:The integration of renewable energy sources presents a significant opportunity for oil and gas companies. By investing in hybrid systems that combine traditional fossil fuels with renewables, companies can enhance their sustainability profiles. The U.S. government has earmarked substantial funding for renewable energy projects in future, encouraging oil and gas firms to diversify their portfolios and capitalize on the growing demand for cleaner energy solutions.