Region:North America

Author(s):Rebecca

Product Code:KRAD0290

Pages:80

Published On:August 2025

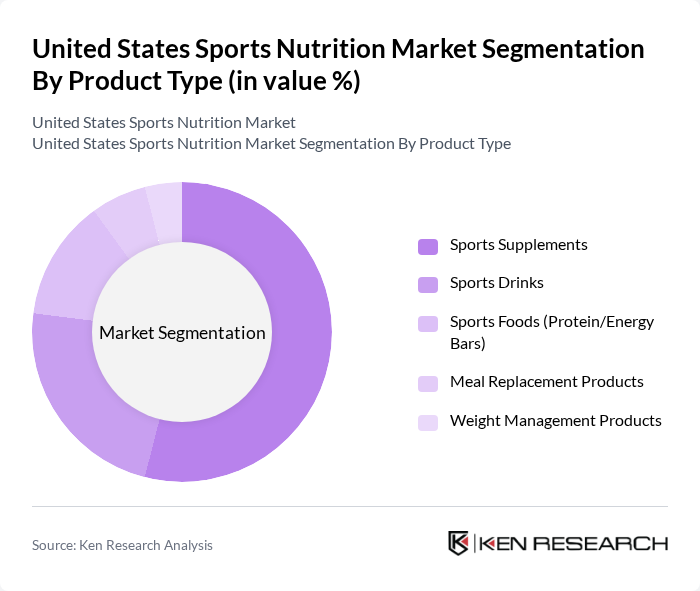

By Product Type:The product type segmentation includes various categories such as Sports Supplements, Sports Drinks, Sports Foods (Protein/Energy Bars), Meal Replacement Products, and Weight Management Products. Among these, Sports Supplements dominate the market due to their widespread use among athletes and fitness enthusiasts seeking to enhance performance and recovery. The increasing trend of personalized nutrition, clean-label ingredients, and the growing awareness of the benefits of supplements contribute to their leading position.

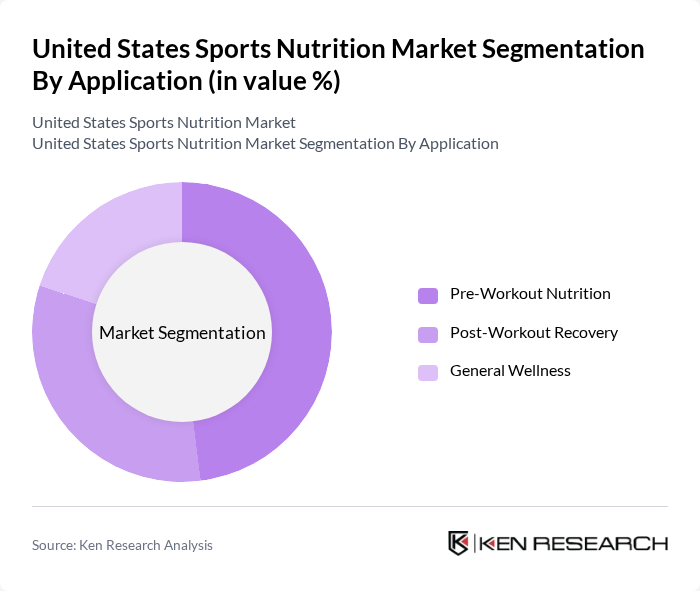

By Application:The application segmentation includes Pre-Workout Nutrition, Post-Workout Recovery, and General Wellness. Pre-Workout Nutrition is the leading sub-segment, driven by the increasing number of fitness enthusiasts looking to maximize their workout performance. The growing trend of fitness classes, personal training sessions, and the adoption of functional ingredients such as amino acids and hydration boosters has further fueled the demand for pre-workout products, making it a significant contributor to the market.

The United States Sports Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as GNC Holdings, Inc., Herbalife Nutrition Ltd., MusclePharm Corporation, Optimum Nutrition (a Glanbia Performance Nutrition brand), BSN (Bio-Engineered Supplements and Nutrition), Quest Nutrition LLC, Bodybuilding.com LLC, Isagenix International LLC, Cellucor (Nutrabolt), Nature's Best (Isopure), ProMix Nutrition, Vega (Danone Company), JYM Supplement Science, Klean Athlete (a Douglas Laboratories brand), RSP Nutrition contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States sports nutrition market appears promising, driven by ongoing trends in health and wellness. As consumers increasingly prioritize personalized nutrition, companies are expected to innovate and tailor products to meet individual dietary needs. Additionally, the integration of technology in product development, such as app-based tracking and smart supplements, will likely enhance consumer engagement. The market is also anticipated to benefit from the growing popularity of plant-based nutrition, appealing to a broader audience seeking sustainable options.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sports Supplements Sports Drinks Sports Foods (Protein/Energy Bars) Meal Replacement Products Weight Management Products |

| By Application | Pre-Workout Nutrition Post-Workout Recovery General Wellness |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Pharmacies/Drug Stores Specialty Stores Online Retailers |

| By Ingredient Source | Animal-Based Plant-Based Synthetic |

| By Product Form | Powder Liquid (RTD) Capsule/Tablet Bar |

| By End-User | Athletes Fitness Enthusiasts Casual Consumers Health-Conscious Individuals |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Nutrition Outlets | 100 | Store Managers, Sales Associates |

| Online Sports Nutrition Consumers | 150 | Frequent Online Shoppers, Fitness Enthusiasts |

| Fitness Centers and Gyms | 80 | Gym Owners, Personal Trainers |

| Health and Wellness Influencers | 60 | Social Media Influencers, Bloggers |

| Nutritionists and Dietitians | 50 | Registered Dietitians, Sports Nutrition Experts |

The United States Sports Nutrition Market is valued at approximately USD 10 billion, reflecting a significant growth trend driven by increased health consciousness, fitness activities, and the popularity of sports among youth.