Region:Middle East

Author(s):Shubham

Product Code:KRAE0360

Pages:83

Published On:December 2025

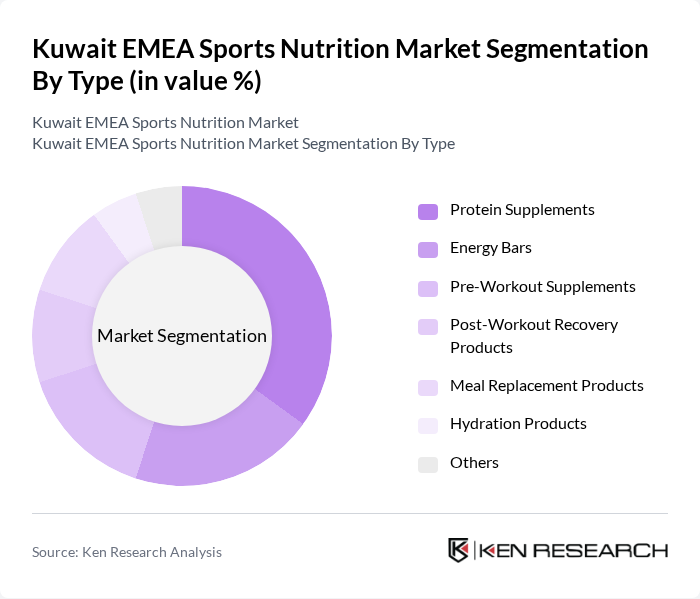

By Type:The sports nutrition market in Kuwait is segmented into various types, including protein supplements, energy bars, pre-workout supplements, post-workout recovery products, meal replacement products, hydration products, and others. Among these, protein supplements dominate the market due to their widespread acceptance among athletes and fitness enthusiasts seeking to enhance muscle recovery and growth. The increasing trend of fitness and health consciousness among the population has led to a surge in demand for these products, making them a staple in the sports nutrition category.

By End-User:The end-user segmentation of the sports nutrition market includes athletes, fitness enthusiasts, casual consumers, health-conscious individuals, and others. Athletes represent the largest segment, driven by their need for specialized nutrition to enhance performance and recovery. The growing number of fitness enthusiasts and health-conscious individuals also contributes significantly to the market, as they increasingly incorporate sports nutrition products into their daily routines to support their active lifestyles.

The Kuwait EMEA Sports Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Optimum Nutrition, BSN (Bio-Engineered Supplements and Nutrition), MusclePharm Corporation, MyProtein, Quest Nutrition, GNC Holdings, Inc., Isagenix International, EAS (Energy Athletic Supplements), Dymatize Nutrition, Cellucor, Vega, ProMix Nutrition, Kaged Muscle, RSP Nutrition contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sports nutrition market in Kuwait appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on personalized nutrition solutions is expected to reshape product offerings, catering to individual dietary needs. Additionally, the rise of health-conscious millennials and Gen Z consumers will likely propel demand for innovative, clean-label products. As e-commerce continues to expand, brands that leverage digital marketing strategies will gain a competitive edge, enhancing their market presence and consumer engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Supplements Energy Bars Pre-Workout Supplements Post-Workout Recovery Products Meal Replacement Products Hydration Products Others |

| By End-User | Athletes Fitness Enthusiasts Casual Consumers Health-Conscious Individuals Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Fitness Centers Others |

| By Packaging Type | Bottles Sachets Tubs Cans Others |

| By Ingredient Type | Whey Protein Casein Protein Soy Protein Pea Protein Others |

| By Flavor | Chocolate Vanilla Strawberry Mixed Berry Others |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Nutrition Outlets | 100 | Store Managers, Sales Representatives |

| Fitness Centers and Gyms | 80 | Gym Owners, Personal Trainers |

| Health and Wellness Events | 60 | Event Organizers, Nutrition Experts |

| Online Sports Nutrition Retailers | 90 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Focus Groups | 75 | Athletes, Fitness Enthusiasts |

The Kuwait EMEA Sports Nutrition Market is valued at approximately USD 120 million, driven by increasing health awareness, gym participation, and demand for convenient meal replacements and sports foods as part of a preventive health approach.