Region:North America

Author(s):Rebecca

Product Code:KRAC4032

Pages:91

Published On:October 2025

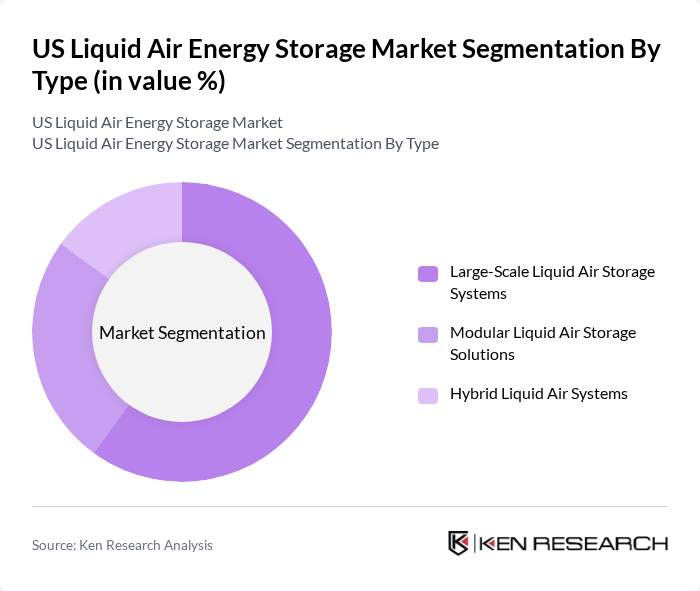

By Type:The market is segmented into three main types: Large-Scale Liquid Air Storage Systems, Modular Liquid Air Storage Solutions, and Hybrid Liquid Air Systems. Each type serves different applications and customer needs, with large-scale systems being favored for utility-scale projects due to their capacity and efficiency. Modular solutions are gaining traction among smaller enterprises looking for flexible storage options, while hybrid systems combine the benefits of various technologies to optimize performance. Large-scale systems are particularly prominent in grid-scale applications, while modular and hybrid solutions are increasingly adopted for distributed energy and industrial use .

The Large-Scale Liquid Air Storage Systems segment is currently leading the market due to its ability to provide substantial energy storage capacity, which is essential for large utility projects. These systems are particularly attractive for grid operators looking to balance supply and demand effectively. The trend towards renewable energy sources has further propelled the demand for large-scale solutions, as they can store excess energy generated during peak production times for later use. This segment's dominance is supported by ongoing technological advancements that enhance efficiency and reduce costs. Industrial and grid-scale applications account for the majority of installations, reflecting the preference for high-capacity, long-duration storage solutions in the US market .

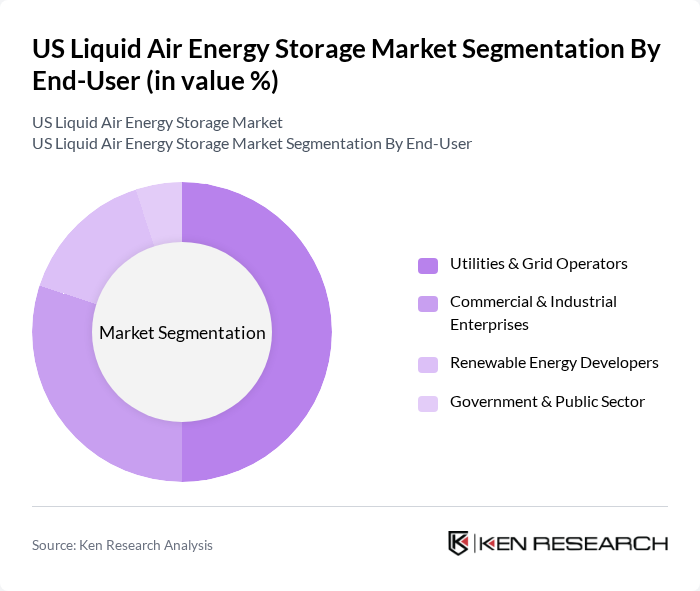

By End-User:The market is categorized into Utilities & Grid Operators, Commercial & Industrial Enterprises, Renewable Energy Developers, and Government & Public Sector. Utilities and grid operators are the primary end-users, leveraging liquid air energy storage for grid stability and peak load management. Commercial and industrial enterprises are increasingly adopting these solutions to enhance energy efficiency and reduce operational costs. Utilities and grid operators account for the largest share, driven by regulatory mandates and the need for reliable, long-duration storage to support renewable energy integration .

Utilities & Grid Operators dominate the end-user segment, accounting for a significant portion of the market. Their primary focus is on enhancing grid reliability and integrating renewable energy sources, which aligns with the capabilities of liquid air energy storage systems. The increasing need for energy storage solutions to manage peak demand and provide ancillary services has made this segment a key driver of market growth. Additionally, the push for decarbonization and sustainability initiatives has led utilities to invest heavily in advanced energy storage technologies. Commercial and industrial enterprises are also increasing adoption to improve energy resilience and reduce costs .

The US Liquid Air Energy Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Highview Power, GE Vernova, Linde plc, Siemens Energy, MAN Energy Solutions, Messer Group, Atlas Copco, Cryostar, Viridor, Heatric, Mitsubishi Heavy Industries, Air Products and Chemicals, Inc., ENGIE, NRG Energy, Inc., Duke Energy, AES Corporation contribute to innovation, geographic expansion, and service delivery in this space. These companies are actively involved in pilot projects, technology partnerships, and expansion of storage capacity, with the top five players accounting for a significant share of installed capacity in operational projects .

The future of the US liquid air energy storage market appears promising, driven by increasing investments in energy storage technologies and a shift towards decentralized energy systems. As more states adopt aggressive renewable energy targets, the demand for efficient storage solutions will rise. Furthermore, advancements in energy management systems will enhance the integration of LAES into existing grids, facilitating smoother transitions to renewable sources. The focus on sustainability and carbon neutrality will further propel the adoption of LAES technologies in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Large-Scale Liquid Air Storage Systems Modular Liquid Air Storage Solutions Hybrid Liquid Air Systems |

| By End-User | Utilities & Grid Operators Commercial & Industrial Enterprises Renewable Energy Developers Government & Public Sector |

| By Application | Grid-Scale Energy Storage Renewable Integration Backup Power & Peak Shaving |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Federal and State Subsidies Tax Incentives for Energy Storage Renewable Energy Certificates (RECs) |

| By Capacity Range | –15 MW –50 MW –100 MW MW+ |

| By Technology Provider | OEMs (Original Equipment Manufacturers) System Integrators EPC (Engineering, Procurement, Construction) Firms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies Implementing Liquid Air Storage | 60 | Energy Managers, Operations Directors |

| Manufacturers of Liquid Air Energy Storage Systems | 40 | Product Development Engineers, Sales Managers |

| Research Institutions Focused on Energy Storage | 40 | Research Scientists, Policy Analysts |

| Government Agencies Regulating Energy Storage | 40 | Regulatory Affairs Specialists, Energy Policy Advisors |

| End-users of Liquid Air Energy Storage Solutions | 50 | Facility Managers, Sustainability Coordinators |

The US Liquid Air Energy Storage Market is valued at approximately USD 390 million, reflecting significant growth driven by the demand for renewable energy integration, grid stability, and advancements in liquid air technology.