Region:Middle East

Author(s):Shubham

Product Code:KRAB7851

Pages:83

Published On:October 2025

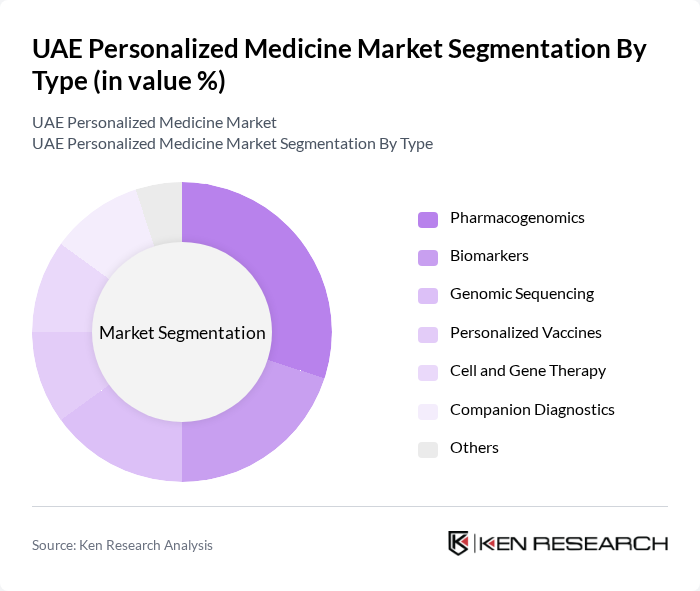

By Type:The market is segmented into various types, including Pharmacogenomics, Biomarkers, Genomic Sequencing, Personalized Vaccines, Cell and Gene Therapy, Companion Diagnostics, and Others. Among these, Pharmacogenomics is currently the leading sub-segment due to its critical role in tailoring drug therapies based on individual genetic profiles, which enhances treatment efficacy and minimizes adverse effects.

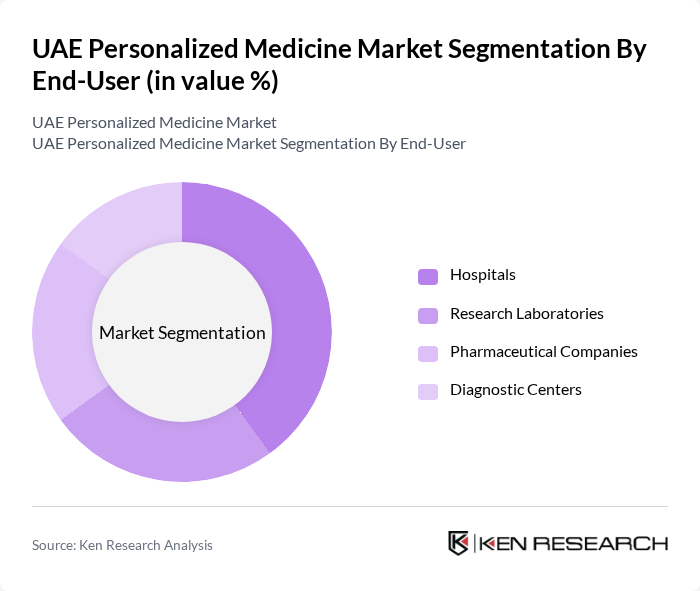

By End-User:The end-user segmentation includes Hospitals, Research Laboratories, Pharmaceutical Companies, and Diagnostic Centers. Hospitals are the dominant end-user segment, driven by the increasing adoption of personalized treatment protocols and the need for advanced diagnostic tools to cater to diverse patient needs.

The UAE Personalized Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roche Diagnostics, Illumina, Inc., Novartis AG, Pfizer Inc., Merck & Co., Inc., Siemens Healthineers, Genentech, Inc., GSK (GlaxoSmithKline), Amgen Inc., AstraZeneca PLC, Bayer AG, Sanofi S.A., AbbVie Inc., Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of personalized medicine in the UAE appears promising, driven by ongoing advancements in technology and increasing government support. As healthcare providers become more educated about personalized approaches, the integration of artificial intelligence and big data analytics will enhance treatment precision. Additionally, the growing emphasis on preventive healthcare will likely shift patient care paradigms, fostering a more proactive approach to health management and disease prevention in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmacogenomics Biomarkers Genomic Sequencing Personalized Vaccines Cell and Gene Therapy Companion Diagnostics Others |

| By End-User | Hospitals Research Laboratories Pharmaceutical Companies Diagnostic Centers |

| By Application | Oncology Cardiovascular Diseases Neurological Disorders Rare Diseases |

| By Distribution Channel | Direct Sales Online Sales Distributors |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Policy Support | Government Grants Tax Incentives Research Funding Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Personalized Treatments | 100 | Oncologists, Clinical Researchers |

| Genetic Testing Services | 80 | Laboratory Managers, Genetic Counselors |

| Pharmaceutical Development | 70 | R&D Directors, Regulatory Affairs Specialists |

| Patient Experience in Personalized Medicine | 90 | Patients, Healthcare Advocates |

| Healthcare Policy and Regulation | 60 | Health Policy Analysts, Government Officials |

The UAE Personalized Medicine Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by advancements in genomics, the rising prevalence of chronic diseases, and increasing demand for tailored healthcare solutions.