Region:North America

Author(s):Dev

Product Code:KRAC3456

Pages:94

Published On:October 2025

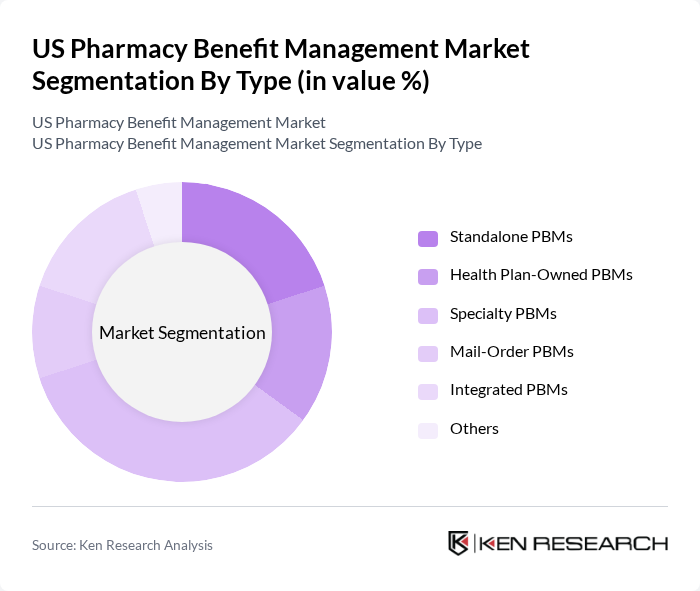

By Type:The market is segmented into various types of pharmacy benefit managers, including Standalone PBMs, Health Plan-Owned PBMs, Specialty PBMs, Mail-Order PBMs, Integrated PBMs, and Others. Among these, Specialty PBMs are gaining traction due to the increasing demand for specialty medications, which are often high-cost and require specialized management. The rise in chronic diseases, complex treatment regimens, and the growing pipeline of specialty pharmaceuticals have led to a greater focus on specialty pharmacy services, making this subsegment a leader in the market .

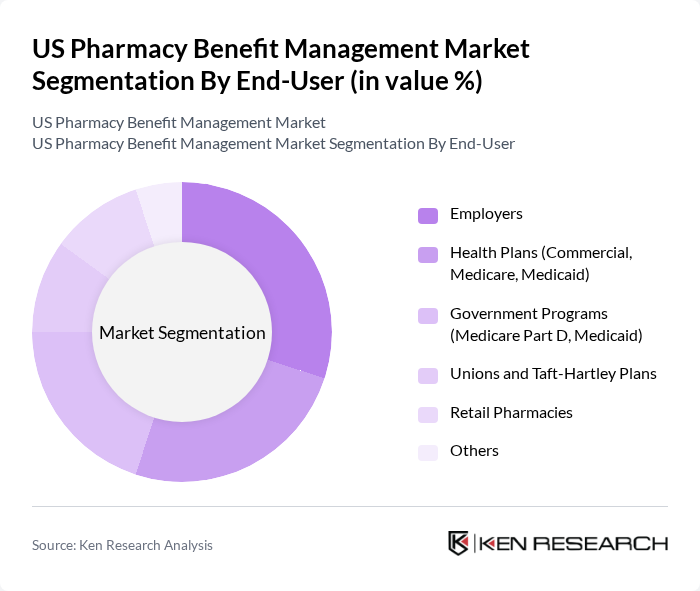

By End-User:The end-user segmentation includes Employers, Health Plans (Commercial, Medicare, Medicaid), Government Programs (Medicare Part D, Medicaid), Unions and Taft-Hartley Plans, Retail Pharmacies, and Others. Employers are a significant segment as they often provide pharmacy benefits as part of their health insurance offerings. The increasing focus on employee health and wellness programs, combined with the need for cost control and improved medication adherence, has led to a rise in employer-sponsored pharmacy benefit plans, making this subsegment a key player in the market .

The US Pharmacy Benefit Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as CVS Health Corporation (Caremark), Express Scripts (Cigna Corporation), OptumRx, Inc. (UnitedHealth Group), Prime Therapeutics LLC, MedImpact Healthcare Systems, Inc., Humana Pharmacy Solutions (Humana Inc.), Envolve Pharmacy Solutions (Centene Corporation), PerformRx, LLC, Magellan Rx Management (Magellan Health, Inc.), Elixir Rx Solutions (formerly EnvisionRxOptions), WellDyneRx, LLC, Anthem, Inc. (IngenioRx, now CarelonRx), Aetna Pharmacy Management (CVS Health), Navitus Health Solutions, LLC, RxAdvance (now AscellaHealth) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US Pharmacy Benefit Management market is poised for transformation, driven by the increasing integration of technology and a shift towards patient-centric care models. As healthcare providers and PBMs collaborate more closely, the focus will be on delivering personalized medicine and improving patient outcomes. Additionally, the expansion of telehealth services is expected to enhance access to medications, further influencing the dynamics of the PBM landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Standalone PBMs Health Plan-Owned PBMs Specialty PBMs Mail-Order PBMs Integrated PBMs Others |

| By End-User | Employers Health Plans (Commercial, Medicare, Medicaid) Government Programs (Medicare Part D, Medicaid) Unions and Taft-Hartley Plans Retail Pharmacies Others |

| By Service Type | Claims Processing Formulary Management Drug Utilization Review Clinical Management Programs Specialty Pharmacy Management Pharmacy Network Management Rebate Negotiation & Administration Others |

| By Distribution Channel | Direct Contracts Online Platforms Third-Party Distributors Others |

| By Customer Type | Individual Consumers Small Businesses Large Enterprises Government Entities Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage Others |

| By Pricing Model | Cost-Plus Pricing Flat Fee Pricing Performance-Based Pricing Spread Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Pharmacy Benefit Management | 120 | Pharmacy Managers, Benefit Coordinators |

| Health Plan PBM Relationships | 100 | Health Plan Executives, Pharmacy Directors |

| Specialty Drug Management | 80 | Clinical Pharmacists, Specialty Drug Managers |

| Patient Experience with PBMs | 120 | Patients, Care Coordinators |

| Regulatory Impact on PBM Operations | 90 | Compliance Officers, Regulatory Affairs Specialists |

The US Pharmacy Benefit Management market is valued at approximately USD 555 billion, driven by factors such as the increasing prevalence of chronic diseases, rising healthcare costs, and the growing demand for prescription medications.