Region:North America

Author(s):Dev

Product Code:KRAC4190

Pages:86

Published On:October 2025

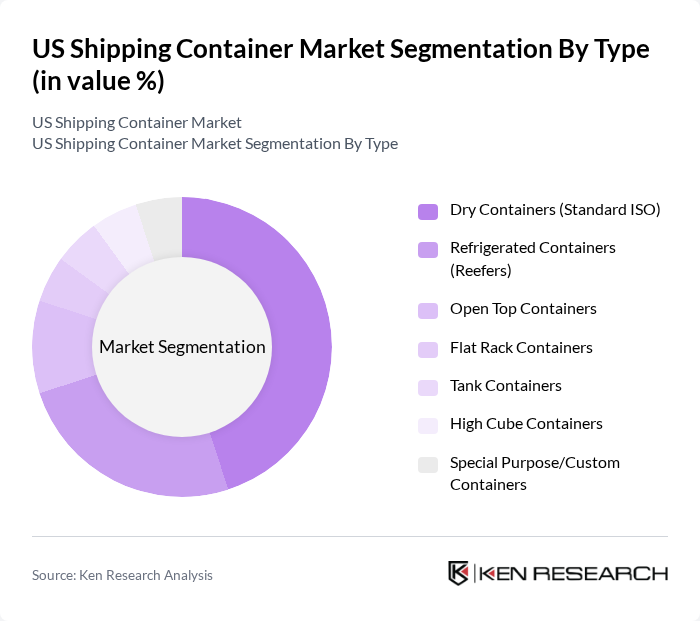

By Type:The market is segmented into various types of containers, including Dry Containers (Standard ISO), Refrigerated Containers (Reefers), Open Top Containers, Flat Rack Containers, Tank Containers, High Cube Containers, and Special Purpose/Custom Containers. Each type serves specific shipping needs: dry containers are most commonly used for general cargo and consumer goods, refrigerated containers are essential for temperature-sensitive items such as food and pharmaceuticals, open top containers accommodate oversized cargo, flat rack containers are used for heavy machinery and vehicles, tank containers transport liquids and chemicals, high cube containers offer increased storage capacity, and special purpose/custom containers serve niche requirements in construction, retail, and mobile office applications .

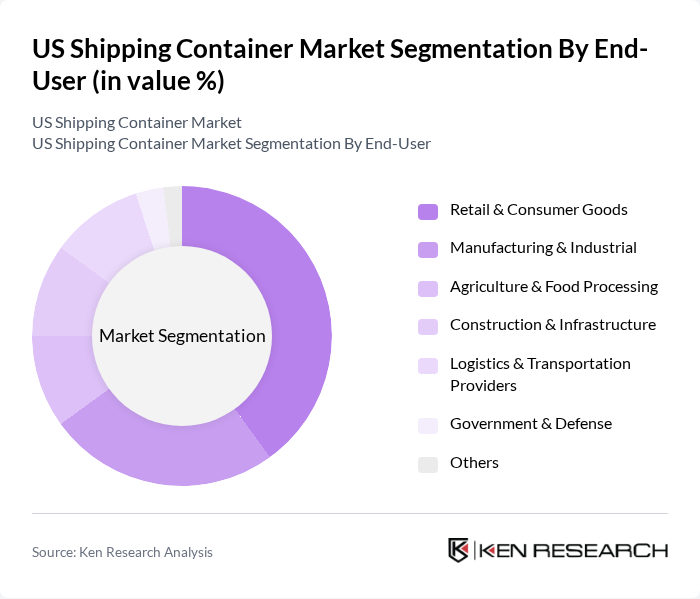

By End-User:The end-user segmentation includes Retail & Consumer Goods, Manufacturing & Industrial, Agriculture & Food Processing, Construction & Infrastructure, Logistics & Transportation Providers, Government & Defense, and Others. The retail and consumer goods sector is the largest end-user, driven by the increasing demand for imported goods and the growth of online shopping. Manufacturing and industrial users rely on containers for raw material and equipment transport, agriculture and food processing require specialized containers for perishables, construction and infrastructure utilize containers for mobile offices and storage, logistics providers manage intermodal transport, and government and defense sectors use containers for secure and specialized cargo .

The US Shipping Container Market is characterized by a dynamic mix of regional and international players. Leading participants such as Triton International Limited, Textainer Group Holdings Limited, CAI International, Inc., Seaco Global Ltd., Beacon Intermodal Leasing, LLC, Cronos Containers, DCLI (Direct ChassisLink, Inc.), Maersk Container Industry, Hapag-Lloyd AG, ZIM Integrated Shipping Services Ltd., APL (American President Lines), Yang Ming Marine Transport Corporation, MSC (Mediterranean Shipping Company), COSCO Shipping Lines Co., Ltd., ONE (Ocean Network Express), Sea Box Inc., PODS Enterprises LLC, W&K Containers Inc., CARU Group BV, Singamas Container Holdings Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The U.S. shipping container market is poised for significant transformation driven by technological advancements and sustainability initiatives. The adoption of smart containers equipped with IoT technology is expected to enhance tracking and efficiency, while the shift towards modular shipping solutions will optimize space utilization. Additionally, as companies increasingly prioritize sustainable practices, the market will likely see a rise in demand for eco-friendly containers, aligning with global efforts to reduce carbon footprints and promote circular economy principles.

| Segment | Sub-Segments |

|---|---|

| By Type | Dry Containers (Standard ISO) Refrigerated Containers (Reefers) Open Top Containers Flat Rack Containers Tank Containers High Cube Containers Special Purpose/Custom Containers |

| By End-User | Retail & Consumer Goods Manufacturing & Industrial Agriculture & Food Processing Construction & Infrastructure Logistics & Transportation Providers Government & Defense Others |

| By Application | International Shipping Domestic Shipping Storage Solutions (On-site, Mobile) Intermodal Transport (Rail, Road, Sea) Container Modification/Conversion Others |

| By Sales Channel | Direct Sales (Manufacturers/Leasing Companies) Distributors/Dealers Online Platforms/Marketplaces Auctions/Secondary Market Others |

| By Distribution Mode | Road Transport Rail Transport Sea Transport Air Transport Others |

| By Price Range | Low Price Range (Budget) Mid Price Range (Standard) High Price Range (Premium/Specialized) Others |

| By Condition | New Containers Used Containers Refurbished Containers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Shipping Line Operations | 60 | Operations Managers, Fleet Directors |

| Port Authority Management | 50 | Port Directors, Terminal Managers |

| Freight Forwarding Services | 40 | Logistics Coordinators, Business Development Managers |

| Container Leasing Companies | 40 | Sales Managers, Account Executives |

| Customs Brokerage Services | 40 | Compliance Officers, Brokerage Managers |

The US Shipping Container Market is valued at approximately USD 1.7 billion. This valuation is driven by the increasing demand for efficient logistics, the expansion of e-commerce, and the globalization of trade, among other factors.