Region:North America

Author(s):Shubham

Product Code:KRAB5617

Pages:92

Published On:October 2025

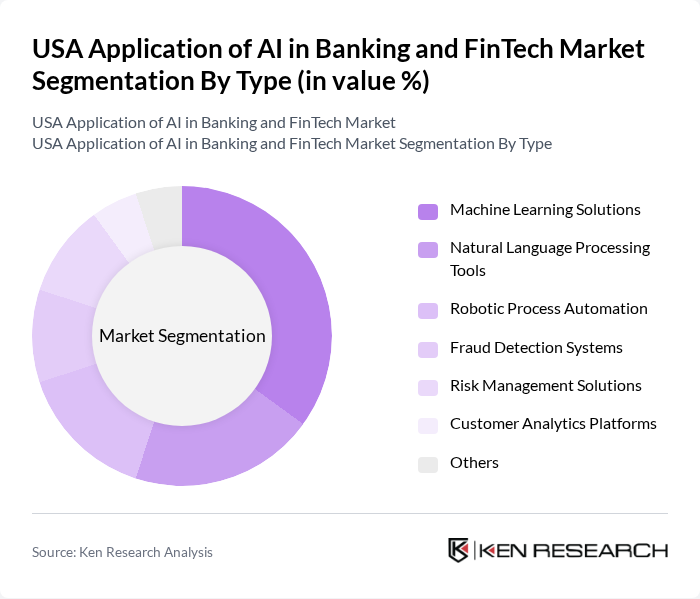

By Type:The market is segmented into various types of AI solutions, including Machine Learning Solutions, Natural Language Processing Tools, Robotic Process Automation, Fraud Detection Systems, Risk Management Solutions, Customer Analytics Platforms, and Others. Among these, Machine Learning Solutions are leading the market due to their ability to analyze vast amounts of data and provide predictive insights, which are crucial for decision-making in banking and finance.

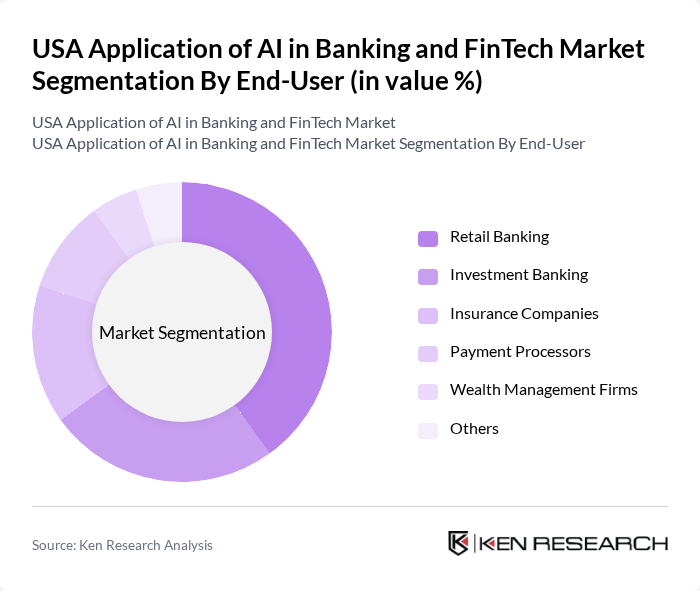

By End-User:The end-user segmentation includes Retail Banking, Investment Banking, Insurance Companies, Payment Processors, Wealth Management Firms, and Others. Retail Banking is the dominant segment, driven by the increasing demand for personalized banking experiences and the need for efficient customer service automation. The shift towards digital banking has further accelerated the adoption of AI solutions in this sector.

The USA Application of AI in Banking and FinTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as JPMorgan Chase & Co., Bank of America, Wells Fargo & Company, Citigroup Inc., Goldman Sachs Group, Inc., American Express Company, PayPal Holdings, Inc., Square, Inc., FIS Global, Intuit Inc., Zelle, Stripe, Inc., SoFi Technologies, Inc., Robinhood Markets, Inc., Chime Financial, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in the USA banking and FinTech sectors appears promising, driven by technological advancements and evolving consumer expectations. As institutions increasingly adopt AI solutions, the focus will shift towards enhancing operational efficiency and customer engagement. Additionally, the integration of AI with emerging technologies, such as blockchain and advanced analytics, will likely reshape financial services. The emphasis on cybersecurity will also grow, ensuring that AI applications are secure and trustworthy, fostering greater consumer confidence in digital banking solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Machine Learning Solutions Natural Language Processing Tools Robotic Process Automation Fraud Detection Systems Risk Management Solutions Customer Analytics Platforms Others |

| By End-User | Retail Banking Investment Banking Insurance Companies Payment Processors Wealth Management Firms Others |

| By Application | Customer Service Automation Credit Scoring Compliance Monitoring Investment Analysis Personalized Banking Services Others |

| By Deployment Mode | On-Premises Cloud-Based Solutions Hybrid Solutions |

| By Sales Channel | Direct Sales Online Sales Partnerships with Financial Institutions Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Corporations |

| By Pricing Model | Subscription-Based Pay-Per-Use Licensing Fees Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI in Retail Banking | 150 | Branch Managers, Digital Transformation Officers |

| AI in Investment Management | 100 | Portfolio Managers, Financial Analysts |

| AI in Payment Processing | 80 | Payment Operations Managers, Compliance Officers |

| AI in Risk Assessment | 70 | Risk Managers, Data Scientists |

| AI in Customer Service Automation | 90 | Customer Experience Managers, IT Support Leads |

The USA Application of AI in Banking and FinTech Market is valued at approximately USD 50 billion, reflecting significant growth driven by the adoption of AI technologies to enhance customer experience, operational efficiency, and risk mitigation in financial transactions.