Region:North America

Author(s):Geetanshi

Product Code:KRAA0178

Pages:90

Published On:August 2025

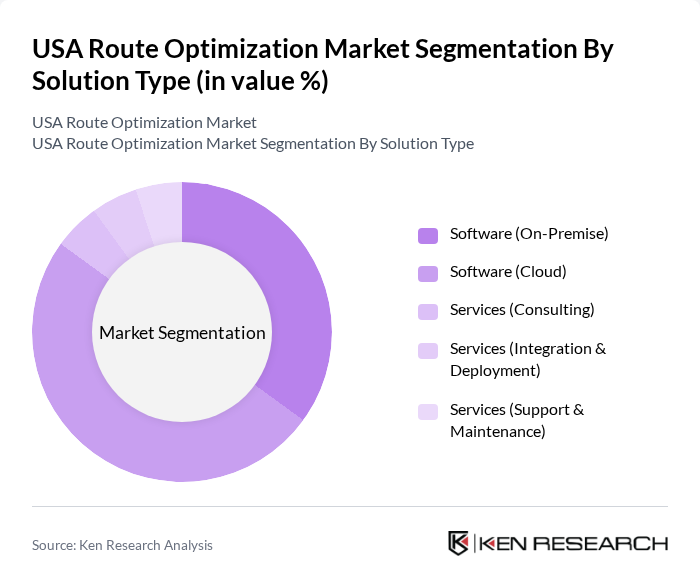

By Solution Type:The solution type segmentation includes Software (On-Premise, Cloud) and Services (Consulting, Integration & Deployment, Support & Maintenance). The software segment is gaining traction due to the increasing adoption of cloud-based solutions, which offer flexibility, scalability, and seamless integration with telematics, CRM, and inventory systems. Services remain essential as companies seek expert guidance for implementation, integration, and ongoing support .

By Deployment Mode:The deployment mode segmentation consists of Cloud-Based and On-Premise solutions. Cloud-based deployment is increasingly preferred due to its cost-effectiveness, scalability, and ease of access, allowing businesses to scale operations and implement real-time route adjustments without significant upfront investments. On-Premise solutions, while still relevant for organizations with strict data security requirements, are gradually being overshadowed by the flexibility and lower total cost of ownership offered by cloud technologies .

The USA Route Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Route4Me, OptimoRoute, Verizon Connect, Teletrac Navman, Descartes Systems Group, Trimble, Fleet Complete, Locus.sh, WorkWave, Routific, MyRouteOnline, Glympse, MapQuest, Sygic, and Omnitracs contribute to innovation, geographic expansion, and service delivery in this space.

The USA route optimization market is poised for significant transformation as technological advancements continue to reshape logistics operations. The integration of AI and machine learning will enhance predictive analytics, enabling companies to optimize routes dynamically. Additionally, the growing emphasis on sustainability will drive the adoption of eco-friendly transportation solutions. As businesses increasingly prioritize efficiency and customer satisfaction, the demand for innovative route optimization technologies will likely surge, fostering a competitive landscape in the logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Software (On-Premise, Cloud) Services (Consulting, Integration & Deployment, Support & Maintenance) |

| By Deployment Mode | Cloud-Based On-Premise |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By End-User Industry | Retail & FMCG On-Demand Food & Grocery Delivery Ride Hailing & Taxi Services Homecare & Field Services Logistics & Transportation Others |

| By Fleet Size | Small Fleets Medium Fleets Large Fleets |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Technology Used | GPS Tracking Route Planning Software Fleet Management Systems Telematics Integration |

| By Service Type | On-Demand Services Scheduled Services Managed Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Transportation Firms | 100 | Logistics Managers, Operations Directors |

| Route Optimization Software Providers | 60 | Product Managers, Software Engineers |

| E-commerce Delivery Services | 50 | Supply Chain Analysts, Delivery Coordinators |

| Manufacturing Sector Logistics | 40 | Procurement Managers, Warehouse Supervisors |

| Public Sector Transportation Agencies | 40 | Policy Makers, Transportation Planners |

The USA Route Optimization Market is valued at approximately USD 1.1 billion, driven by the increasing demand for efficient logistics and transportation solutions, particularly in the context of rising e-commerce and the need for real-time tracking.