Region:North America

Author(s):Geetanshi

Product Code:KRAA3398

Pages:83

Published On:January 2026

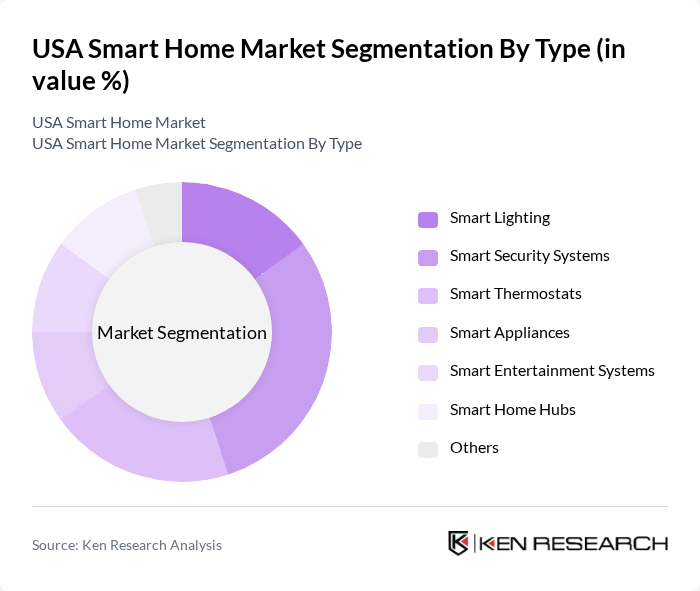

By Type:The smart home market can be segmented into various types, including Smart Lighting, Smart Security Systems, Smart Thermostats, Smart Appliances, Smart Entertainment Systems, Smart Home Hubs, and Others. Among these, Smart Security Systems are currently leading the market due to increasing concerns about home safety and security. Consumers are increasingly investing in advanced security solutions that offer remote monitoring and control, contributing to the growth of this segment.

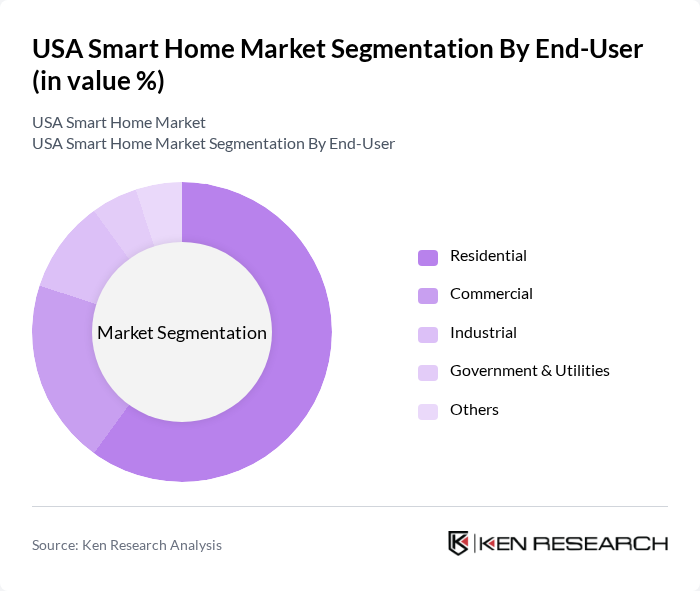

By End-User:The smart home market is segmented by end-user into Residential, Commercial, Industrial, Government & Utilities, and Others. The Residential segment is the most significant contributor to market growth, driven by the increasing adoption of smart home devices among homeowners seeking convenience, energy efficiency, and enhanced security. The trend of home automation is particularly strong in urban areas, where consumers are more inclined to invest in smart technologies.

The USA Smart Home Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon, Google, Apple, Samsung, Philips Hue, Ring, Nest Labs, Ecobee, Honeywell, August Home, Arlo Technologies, Wyze Labs, Lutron Electronics, SimpliSafe, and Logitech contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA smart home market appears promising, driven by continuous technological advancements and increasing consumer awareness. As more households embrace smart home solutions, the integration of artificial intelligence and machine learning will enhance user experiences and operational efficiency. Additionally, the growing emphasis on energy efficiency and sustainability will likely propel the adoption of smart devices, creating a more interconnected and energy-conscious living environment for consumers across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Lighting Smart Security Systems Smart Thermostats Smart Appliances Smart Entertainment Systems Smart Home Hubs Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | Northeast Midwest South West |

| By Technology | Wireless Technology Wired Technology Cloud-Based Technology AI and Machine Learning Others |

| By Application | Home Security Energy Management Home Automation Health Monitoring Others |

| By Investment Source | Private Investments Venture Capital Government Grants Crowdfunding Others |

| By Policy Support | Tax Incentives Subsidies for Smart Devices Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Security Systems | 120 | Homeowners, Security System Installers |

| Smart Lighting Solutions | 100 | Interior Designers, Home Automation Specialists |

| HVAC Control Systems | 80 | HVAC Technicians, Homeowners |

| Smart Appliances | 100 | Retail Managers, Product Development Teams |

| Energy Management Systems | 90 | Energy Consultants, Homeowners |

The USA Smart Home Market is valued at approximately USD 25 billion, driven by advancements in IoT technology, consumer demand for energy-efficient solutions, and the rising trend of home automation and security systems.