Region:North America

Author(s):Geetanshi

Product Code:KRAA7902

Pages:96

Published On:September 2025

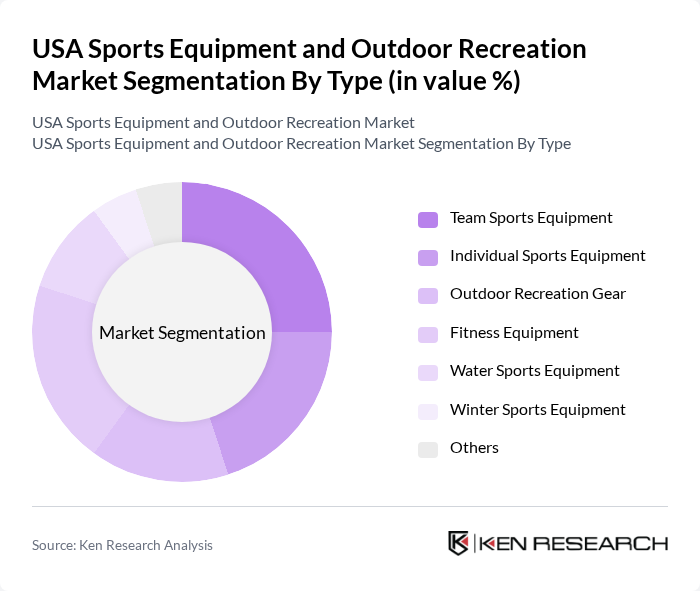

By Type:The market is segmented into various types of sports equipment and outdoor recreation gear. The subsegments include Team Sports Equipment, Individual Sports Equipment, Outdoor Recreation Gear, Fitness Equipment, Water Sports Equipment, Winter Sports Equipment, and Others. Each of these subsegments caters to different consumer needs and preferences, reflecting the diverse nature of the market.

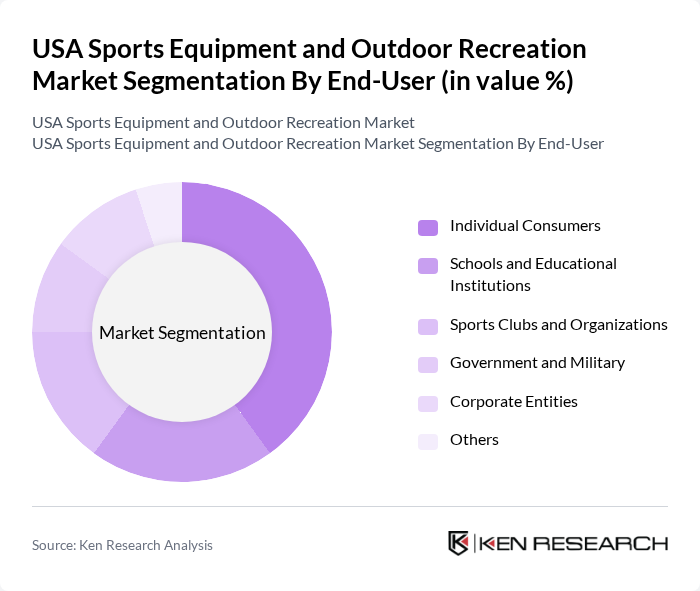

By End-User:The market is segmented based on end-users, which include Individual Consumers, Schools and Educational Institutions, Sports Clubs and Organizations, Government and Military, Corporate Entities, and Others. This segmentation highlights the various customer bases that drive demand for sports equipment and outdoor recreation products.

The USA Sports Equipment and Outdoor Recreation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Under Armour, Inc., Puma SE, Amer Sports Corporation, Wilson Sporting Goods Co., Callaway Golf Company, The North Face, Inc., Columbia Sportswear Company, REI Co-op, Newell Brands Inc., Johnson Outdoors Inc., Brunswick Corporation, Head N.V., Yakima Products, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The USA sports equipment and outdoor recreation market is poised for significant transformation in the coming years, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, coupled with a growing interest in outdoor activities, the market is expected to adapt by integrating smart technologies and sustainable practices. Companies that embrace innovation and prioritize eco-friendly products will likely capture a larger share of the market, positioning themselves favorably for future growth and consumer loyalty.

| Segment | Sub-Segments |

|---|---|

| By Type | Team Sports Equipment Individual Sports Equipment Outdoor Recreation Gear Fitness Equipment Water Sports Equipment Winter Sports Equipment Others |

| By End-User | Individual Consumers Schools and Educational Institutions Sports Clubs and Organizations Government and Military Corporate Entities Others |

| By Distribution Channel | Online Retail Specialty Sports Stores Department Stores Direct Sales Wholesale Distributors Others |

| By Price Range | Budget Mid-range Premium Luxury |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers Quality-focused Customers Trend-driven Customers |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage |

| By Occasion | Recreational Use Competitive Use Training Use Casual Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Sports Equipment Retailers | 150 | Store Managers, Sales Representatives |

| Outdoor Recreation Participants | 200 | Outdoor Enthusiasts, Casual Users |

| Manufacturers of Outdoor Gear | 100 | Product Development Managers, Marketing Directors |

| Fitness Equipment Suppliers | 80 | Supply Chain Managers, Business Development Executives |

| Industry Experts and Analysts | 50 | Market Analysts, Industry Consultants |

The USA Sports Equipment and Outdoor Recreation Market is valued at approximately USD 80 billion, reflecting a significant growth driven by increased health consciousness and participation in sports and outdoor activities, particularly accelerated by the COVID-19 pandemic.