Region:Asia

Author(s):Geetanshi

Product Code:KRAD4069

Pages:86

Published On:December 2025

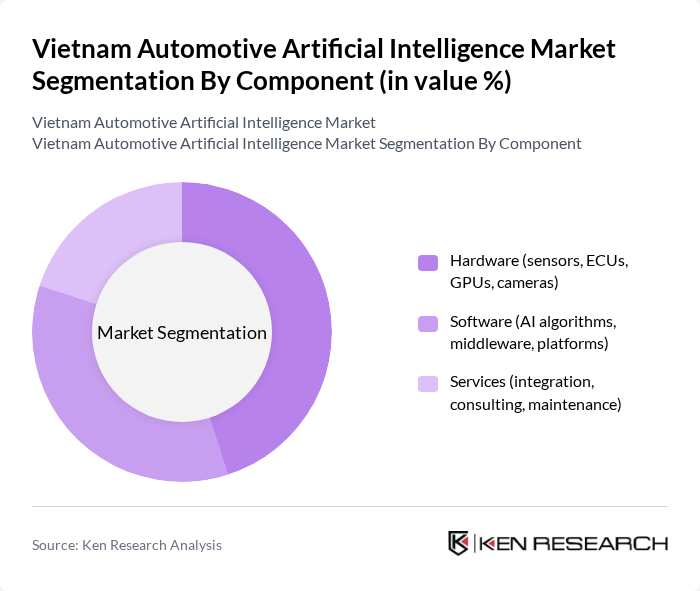

By Component:The components of the automotive AI market can be categorized into hardware, software, and services. Hardware includes sensors, ECUs, GPUs, and cameras, which are essential for data collection and processing. Software encompasses AI algorithms, middleware, and platforms that enable machine learning and data analysis. Services involve integration, consulting, and maintenance, which are crucial for implementing AI solutions effectively.

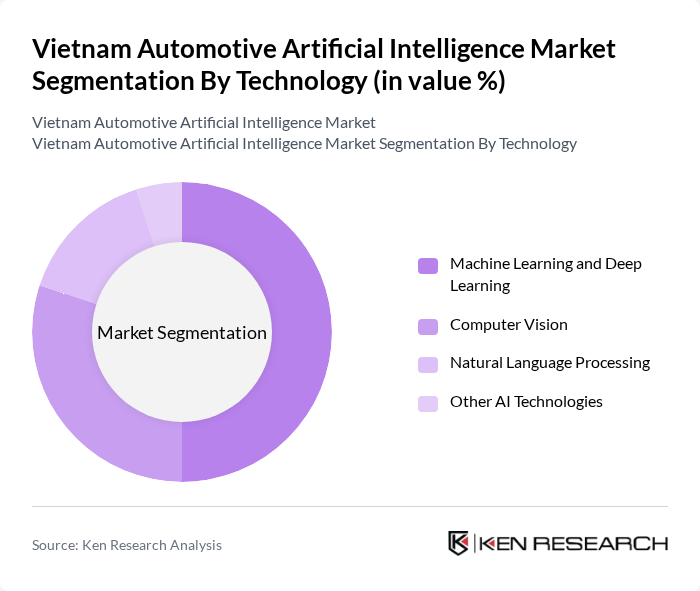

By Technology:The technology segment of the automotive AI market includes machine learning and deep learning, computer vision, natural language processing, and other AI technologies. Machine learning and deep learning are pivotal for developing intelligent systems that can learn from data. Computer vision is essential for enabling vehicles to interpret their surroundings, while natural language processing enhances human-machine interaction. Other AI technologies also contribute to various applications within the automotive sector.

The Vietnam Automotive Artificial Intelligence Market is characterized by a dynamic mix of regional and international players. Leading participants such as VinAI Technology (Vingroup), VinFast Auto, FPT Software, Viettel High Technology Industries Corporation (Viettel High Tech), Bosch Global Software Technologies (Vietnam), Robert Bosch Vietnam Co., Ltd., Toyota Motor Vietnam Co., Ltd., Honda Vietnam Co., Ltd., Ford Vietnam Limited, Hyundai Thanh Cong Vietnam Automobile Joint Stock Company (HTV), Truong Hai Auto Corporation (THACO), Siemens Industry Software (Vietnam) Co., Ltd., Panasonic Vietnam Co., Ltd., MITSUBISHI MOTORS Vietnam Co., Ltd., Nissan Vietnam Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam automotive AI market appears promising, driven by technological advancements and increasing consumer demand for smart vehicles. By future, the market is expected to see significant growth in AI applications, particularly in autonomous driving and vehicle connectivity. As the government continues to support AI initiatives, local manufacturers are likely to enhance their capabilities, leading to innovative solutions that cater to evolving consumer preferences. This dynamic environment will foster collaboration between automotive and tech sectors, paving the way for sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (sensors, ECUs, GPUs, cameras) Software (AI algorithms, middleware, platforms) Services (integration, consulting, maintenance) |

| By Technology | Machine Learning and Deep Learning Computer Vision Natural Language Processing Other AI Technologies |

| By Process | Data Mining and Data Analytics Image and Pattern Recognition Signal and Sensor Recognition |

| By Application | Advanced Driver Assistance Systems (ADAS) Autonomous and Semi-autonomous Driving Predictive Maintenance and Vehicle Health Monitoring In-vehicle Infotainment and Human–Machine Interface Fleet and Traffic Management Manufacturing and Quality Inspection |

| By Vehicle Type | Passenger Vehicles Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles |

| By Level of Autonomy | Level 1–2 (Driver Assistance) Level 3 (Conditional Automation) Level 4–5 (High and Full Automation) |

| By Deployment | On-board / Edge Deployment Cloud-based Deployment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 120 | Product Managers, R&D Directors |

| AI Technology Providers | 90 | Business Development Managers, Technical Leads |

| Automotive Industry Analysts | 60 | Market Analysts, Research Directors |

| End-Users of AI in Vehicles | 80 | Vehicle Owners, Fleet Managers |

| Government and Regulatory Bodies | 50 | Policy Makers, Regulatory Affairs Managers |

The Vietnam Automotive Artificial Intelligence Market is valued at approximately USD 25 million, driven by government initiatives, increasing AI adoption in vehicles, and the integration of smart technologies in automotive manufacturing.