Region:Asia

Author(s):Shubham

Product Code:KRAB1328

Pages:84

Published On:October 2025

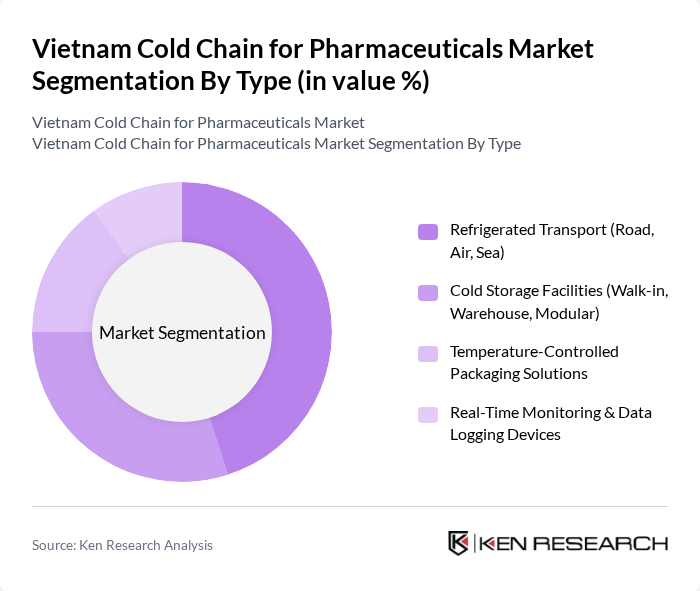

By Type:The cold chain for pharmaceuticals is segmented into refrigerated transport, cold storage facilities, temperature-controlled packaging solutions, and real-time monitoring devices. Among these, refrigerated transport—especially via road and air—remains the most dominant segment, driven by the urgent need for timely and secure delivery of temperature-sensitive pharmaceuticals. The adoption of advanced temperature-controlled vehicles and last-mile delivery solutions further accelerates this segment’s growth, ensuring product safety and regulatory compliance .

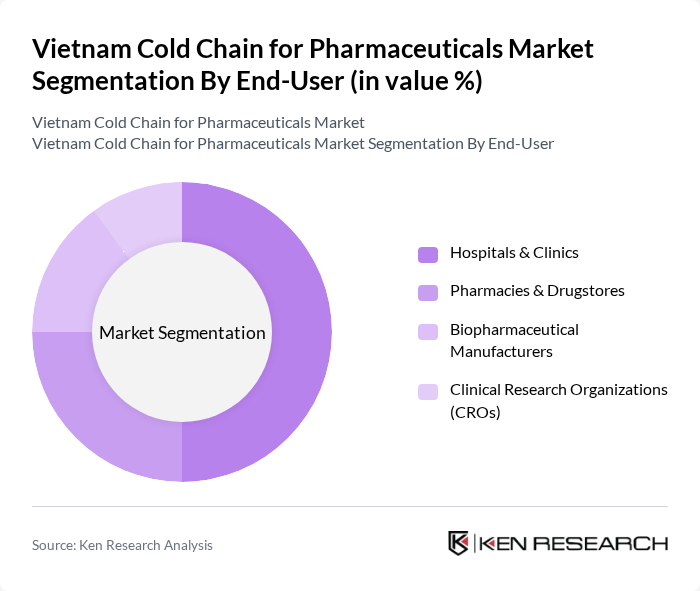

By End-User:End-user segmentation includes hospitals and clinics, pharmacies and drugstores, biopharmaceutical manufacturers, and clinical research organizations (CROs). Hospitals and clinics represent the largest segment, attributed to the increasing number of healthcare facilities, rising demand for vaccines and biologics, and the necessity for reliable cold chain solutions to ensure the efficacy and safety of administered pharmaceuticals .

The Vietnam Cold Chain for Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as VIETPHAT Group, Transimex Corporation, ABA Cooltrans, Cold Storage Thang Loi, Mekong Logistics, CJ Logistics Vietnam, Gemadept Corporation, DHL Supply Chain Vietnam, DB Schenker Vietnam, Kuehne + Nagel Vietnam, Agility Logistics Vietnam, Lineage Logistics, FedEx Express Vietnam, UPS Healthcare Vietnam, Vinamilk (Vietnam Dairy Products JSC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain for pharmaceuticals in Vietnam appears promising, driven by technological advancements and increased investment in infrastructure. The integration of IoT technologies is expected to enhance monitoring and tracking capabilities, ensuring compliance with storage requirements. Additionally, as the biopharmaceutical sector expands, the demand for sophisticated cold chain solutions will likely grow, prompting further innovation and partnerships within the logistics sector to meet evolving market needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport (Road, Air, Sea) Cold Storage Facilities (Walk-in, Warehouse, Modular) Temperature-Controlled Packaging Solutions Real-Time Monitoring & Data Logging Devices |

| By End-User | Hospitals & Clinics Pharmacies & Drugstores Biopharmaceutical Manufacturers Clinical Research Organizations (CROs) |

| By Distribution Mode | Direct Distribution (Manufacturer to End-User) Third-Party Logistics (3PL) Providers E-commerce & Online Pharmacies Retail & Wholesale Channels |

| By Application | Vaccines & Immunobiologicals Biologics & Biosimilars Blood & Blood Products Insulin & Hormones Other Temperature-Sensitive Pharmaceuticals |

| By Sales Channel | Online Sales (B2B, B2C) Offline Sales (Distributors, Retailers) Wholesale Distribution Direct Sales to Healthcare Providers |

| By Price Range | Economy Mid-Range Premium |

| By Others | Specialized Cold Chain Solutions (e.g., Ultra-Low Temperature) Customized Packaging & Last-Mile Delivery Emerging Technologies (IoT, Blockchain, AI-enabled Monitoring) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 40 | Production Managers, Quality Assurance Heads |

| Cold Chain Logistics Providers | 40 | Operations Managers, Logistics Coordinators |

| Healthcare Distributors | 40 | Supply Chain Directors, Inventory Managers |

| Regulatory Bodies | 30 | Policy Makers, Compliance Officers |

| Pharmacy Chains | 40 | Pharmacy Managers, Procurement Specialists |

The Vietnam Cold Chain for Pharmaceuticals Market is valued at approximately USD 1.2 billion, driven by the increasing demand for temperature-sensitive pharmaceuticals, expansion of healthcare infrastructure, and advancements in logistics capabilities across the country.