Region:Asia

Author(s):Dev

Product Code:KRAA4626

Pages:90

Published On:September 2025

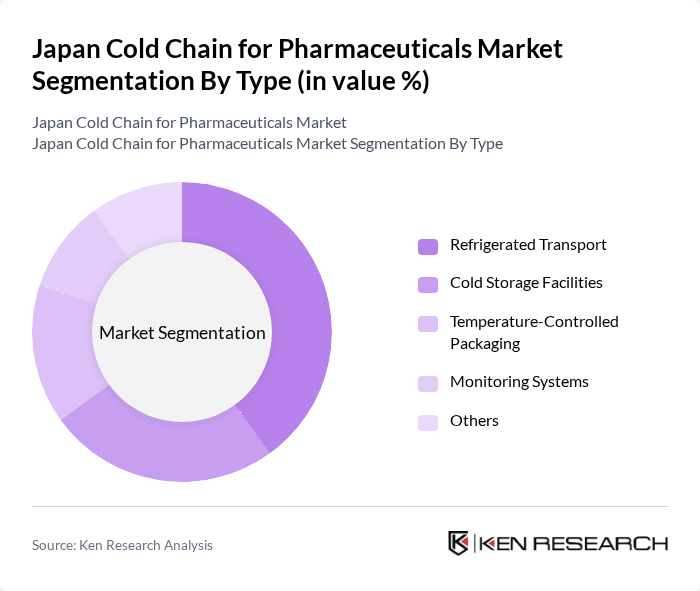

By Type:The cold chain for pharmaceuticals can be segmented into several types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring Systems, and Others. Among these, Refrigerated Transport is the most significant segment, driven by the increasing need for efficient and reliable transportation of temperature-sensitive products. The demand for Cold Storage Facilities is also rising, as pharmaceutical companies seek to ensure the integrity of their products during storage. Monitoring Systems are gaining traction due to regulatory requirements and the need for real-time tracking of temperature-sensitive shipments.

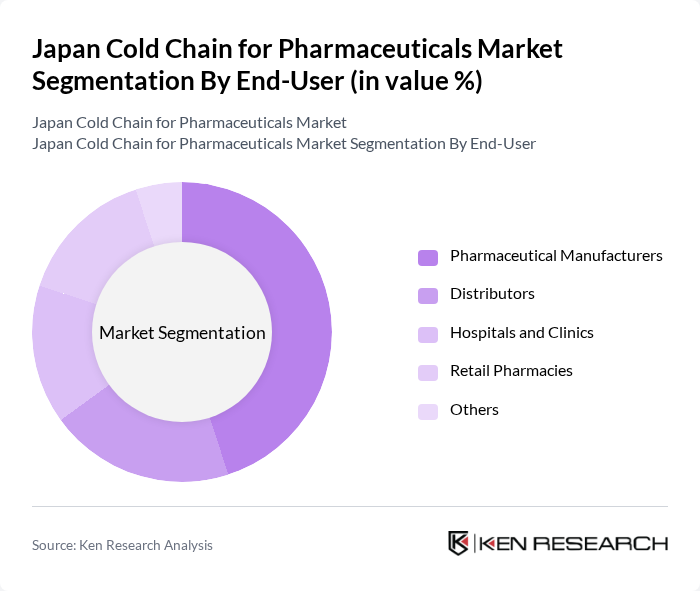

By End-User:The end-users of cold chain logistics in pharmaceuticals include Pharmaceutical Manufacturers, Distributors, Hospitals and Clinics, Retail Pharmacies, and Others. Pharmaceutical Manufacturers are the leading segment, as they require stringent cold chain solutions to maintain product efficacy. Hospitals and Clinics also represent a significant portion of the market, driven by the need for reliable storage and transportation of vaccines and other temperature-sensitive medications. Retail Pharmacies are increasingly adopting cold chain practices to ensure the availability of critical products.

The Japan Cold Chain for Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express Co., Ltd., Kuehne + Nagel International AG, DB Schenker, DHL Supply Chain, FedEx Corporation, UPS Supply Chain Solutions, Yusen Logistics Co., Ltd., Panasonic Corporation, Lineage Logistics, AmerisourceBergen Corporation, Cardinal Health, Inc., Thermo Fisher Scientific Inc., Maersk Group, XPO Logistics, Inc., Geodis contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain logistics market for pharmaceuticals in Japan appears promising, driven by technological innovations and increasing demand for temperature-sensitive products. As the market adapts to the growing e-commerce trend, companies are likely to invest in advanced tracking and monitoring systems. Additionally, the expansion of vaccine distribution networks will further enhance the need for efficient cold chain solutions, ensuring that pharmaceuticals maintain their efficacy throughout the supply chain.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Systems Others |

| By End-User | Pharmaceutical Manufacturers Distributors Hospitals and Clinics Retail Pharmacies Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Product Type | Vaccines Biologics Blood Products Others |

| By Temperature Range | 8°C °C °C Others |

| By Service Type | Transportation Services Storage Services Packaging Services Others |

| By Region | Kanto Kansai Chubu Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | Supply Chain Managers, Quality Assurance Officers |

| Cold Chain Logistics Providers | 80 | Operations Managers, Business Development Executives |

| Regulatory Bodies | 50 | Compliance Officers, Policy Makers |

| Healthcare Institutions | 70 | Pharmacy Directors, Procurement Managers |

| Technology Providers for Cold Chain | 60 | Product Managers, Technical Sales Representatives |

The Japan Cold Chain for Pharmaceuticals Market is valued at approximately USD 2.5 billion, driven by the increasing demand for temperature-sensitive pharmaceuticals, including vaccines and biologics, and the rising prevalence of chronic diseases requiring consistent medication.