Region:Asia

Author(s):Geetanshi

Product Code:KRAA8105

Pages:89

Published On:September 2025

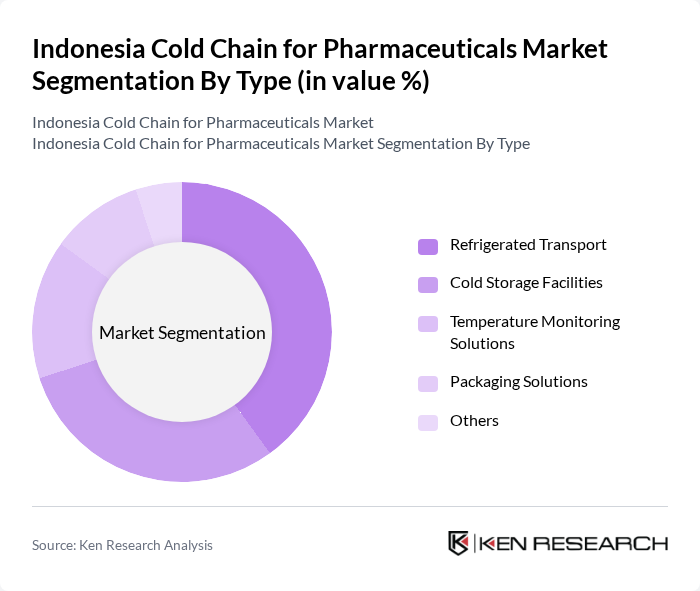

By Type:The cold chain for pharmaceuticals can be segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature Monitoring Solutions, Packaging Solutions, and Others. Each of these segments plays a crucial role in maintaining the required temperature for pharmaceuticals during transportation and storage.

The Refrigerated Transport segment is currently dominating the market due to the increasing need for efficient and reliable transportation of temperature-sensitive pharmaceuticals. This segment is essential for ensuring that products such as vaccines and biologics maintain their efficacy from the point of manufacture to the end-user. The growing demand for home healthcare services and the rise in e-commerce for pharmaceuticals are also contributing to the expansion of this segment.

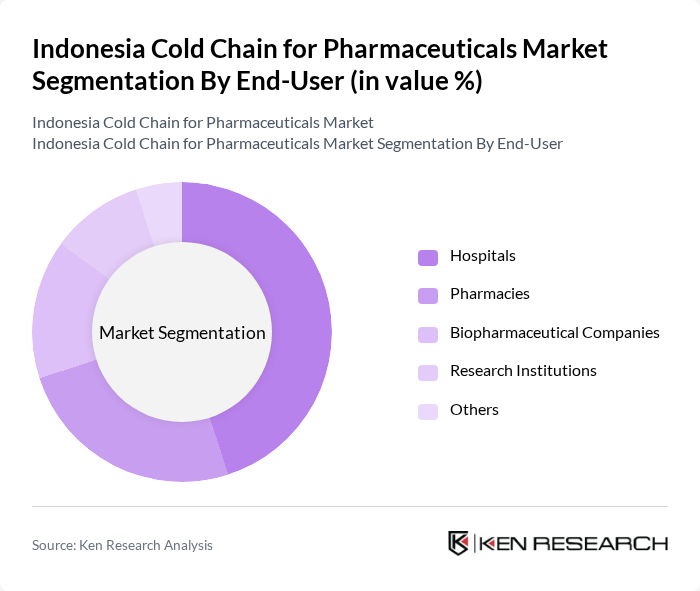

By End-User:The end-user segmentation includes Hospitals, Pharmacies, Biopharmaceutical Companies, Research Institutions, and Others. Each of these end-users has specific requirements for cold chain logistics, driven by the nature of the pharmaceuticals they handle.

Hospitals are the leading end-user segment, accounting for a significant share of the market. This dominance is attributed to the high volume of temperature-sensitive medications they handle, including vaccines and critical care drugs. The increasing number of hospitals and healthcare facilities in Indonesia, coupled with the rising demand for advanced medical treatments, further solidifies the hospitals' position as the primary consumers of cold chain logistics.

The Indonesia Cold Chain for Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Tiki Jalur Nugraha Ekakurir, PT. JNE, PT. Indofarma Tbk, PT. Kimia Farma Tbk, PT. Bio Farma, PT. Sido Muncul, PT. Darya-Varia Laboratoria Tbk, PT. Kalbe Farma Tbk, PT. Merck Sharp & Dohme, PT. Sanofi Indonesia, PT. Pfizer Indonesia, PT. Novartis Indonesia, PT. AstraZeneca Indonesia, PT. GlaxoSmithKline Indonesia, PT. Johnson & Johnson Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's cold chain for pharmaceuticals market appears promising, driven by technological advancements and increased government support. The integration of IoT for real-time monitoring and data analytics is expected to enhance operational efficiency. Additionally, as telemedicine and remote healthcare services expand, the demand for reliable cold chain logistics will grow. This evolution will likely lead to improved infrastructure and partnerships, fostering a more robust and responsive healthcare system in Indonesia.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature Monitoring Solutions Packaging Solutions Others |

| By End-User | Hospitals Pharmacies Biopharmaceutical Companies Research Institutions Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Application | Vaccines Biologics Blood Products Others |

| By Packaging Type | Insulated Containers Refrigerated Boxes Temperature-Controlled Pallets Others |

| By Sales Channel | Online Sales Offline Sales Distributors Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | Production Managers, Supply Chain Directors |

| Cold Chain Logistics Providers | 80 | Operations Managers, Logistics Coordinators |

| Healthcare Distributors | 70 | Distribution Managers, Sales Directors |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Pharmacy Chains | 60 | Pharmacy Managers, Procurement Officers |

The Indonesia Cold Chain for Pharmaceuticals Market is valued at approximately USD 1.2 billion, driven by the increasing demand for temperature-sensitive pharmaceuticals, including vaccines and biologics, and the expansion of healthcare infrastructure in the region.