Region:Middle East

Author(s):Rebecca

Product Code:KRAB1728

Pages:99

Published On:October 2025

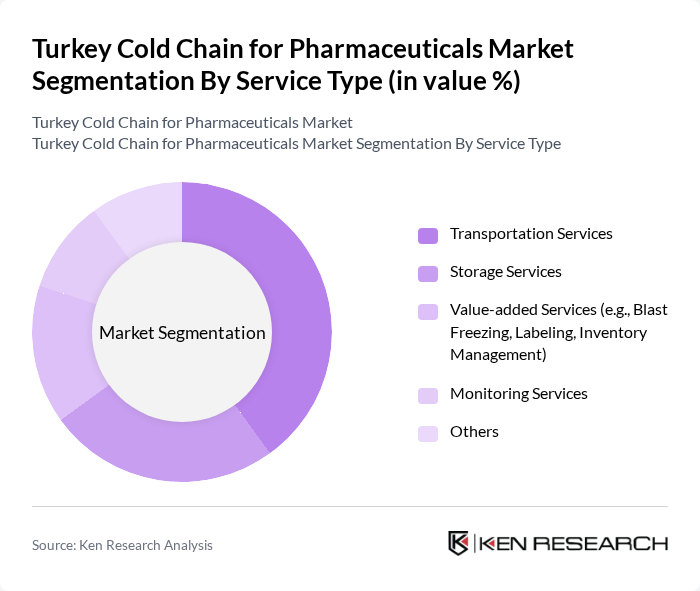

By Service Type:The service type segmentation includes various services essential for maintaining the cold chain for pharmaceuticals. The primary subsegments are Transportation Services, Storage Services, Value-added Services (e.g., Blast Freezing, Labeling, Inventory Management), Monitoring Services, and Others. Among these, Transportation Services dominate the market due to the increasing need for efficient and reliable delivery of temperature-sensitive products across the country. The rise in e-commerce and direct-to-consumer models has further amplified the demand for specialized transportation solutions, with IoT-enabled real-time monitoring becoming a standard requirement for pharmaceutical logistics.

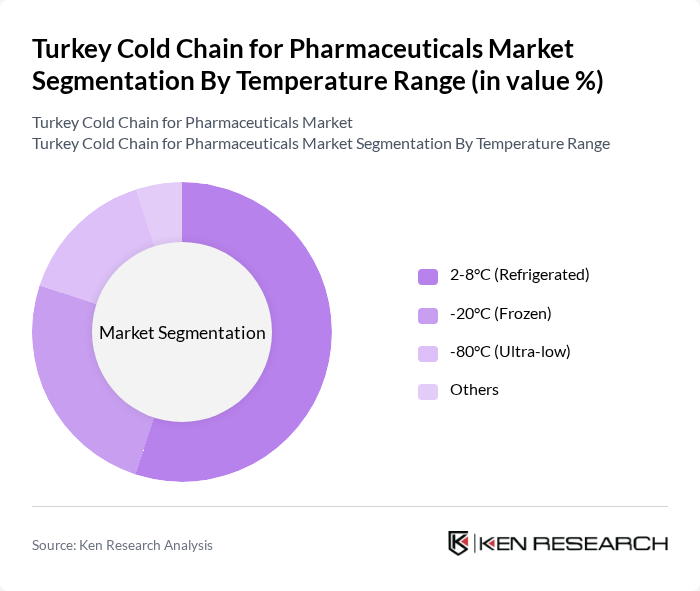

By Temperature Range:The temperature range segmentation is critical for ensuring the efficacy of pharmaceuticals. The subsegments include 2-8°C (Refrigerated), -20°C (Frozen), -80°C (Ultra-low), and Others. The 2-8°C (Refrigerated) segment is the most significant due to the vast majority of pharmaceuticals, including vaccines and insulin, requiring this temperature range. The increasing focus on vaccine distribution, especially post-pandemic, has further solidified the dominance of this segment, with advanced refrigeration systems and automated storage solutions becoming standard infrastructure investments.

The Turkey Cold Chain for Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, UPS Healthcare, FedEx, Biocair, Cold Chain Technologies, Lineage Logistics,Sistem Lojistik A.?.,Mars Logistics, Thermo King, Pelican BioThermal, Envirotainer, Cryoport,TCDD Ta??mac?l?k A.?.,Netlog Logistics,Horoz Logistics,Ekol Logisticscontribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain logistics market for pharmaceuticals in Turkey appears promising, driven by technological advancements and increasing regulatory support. The adoption of IoT technologies for real-time monitoring is expected to enhance operational efficiency and product safety. Additionally, the focus on sustainability will likely lead to the development of eco-friendly cold chain solutions, aligning with global trends. As the pharmaceutical industry continues to expand, the demand for specialized logistics will create new opportunities for growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation Services Storage Services Value-added Services (e.g., Blast Freezing, Labeling, Inventory Management) Monitoring Services Others |

| By Temperature Range | 8°C (Refrigerated) °C (Frozen) °C (Ultra-low) Others |

| By Packaging Type | Insulated Containers Active Packaging Passive Packaging Temperature-Controlled Packaging Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By End-User | Pharmaceutical Manufacturers Distributors Hospitals and Clinics Retail Pharmacies Others |

| By Market Channel | B2B B2C Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 120 | Supply Chain Managers, Quality Assurance Officers |

| Cold Chain Logistics Providers | 100 | Operations Directors, Fleet Managers |

| Regulatory Bodies | 60 | Compliance Officers, Policy Makers |

| Healthcare Institutions | 90 | Pharmacy Managers, Procurement Specialists |

| Technology Providers for Cold Chain | 80 | Product Managers, Technical Sales Representatives |

The Turkey Cold Chain for Pharmaceuticals Market is valued at approximately USD 1.1 billion, driven by the increasing demand for temperature-sensitive pharmaceuticals, including vaccines and biologics, and the expansion of the healthcare sector.