Region:Central and South America

Author(s):Dev

Product Code:KRAA7218

Pages:85

Published On:September 2025

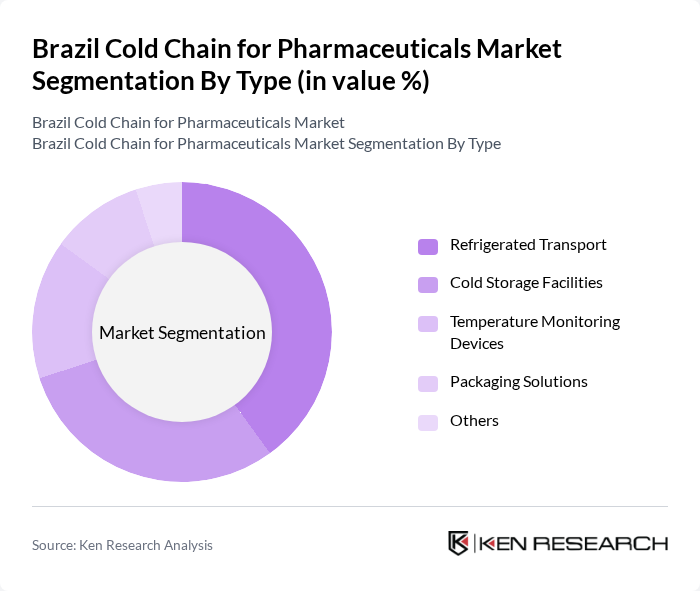

By Type:The cold chain for pharmaceuticals can be segmented into several types, including Refrigerated Transport, Cold Storage Facilities, Temperature Monitoring Devices, Packaging Solutions, and Others. Among these, Refrigerated Transport is the leading sub-segment due to the increasing demand for efficient and reliable transportation of temperature-sensitive products. The rise in e-commerce and direct-to-consumer delivery models has further amplified the need for specialized refrigerated transport solutions.

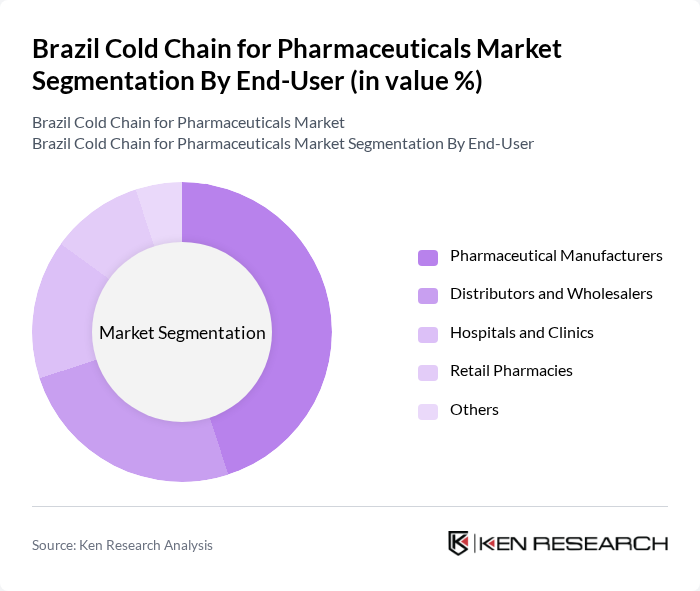

By End-User:The end-user segmentation includes Pharmaceutical Manufacturers, Distributors and Wholesalers, Hospitals and Clinics, Retail Pharmacies, and Others. Pharmaceutical Manufacturers dominate this segment as they require extensive cold chain solutions to maintain the efficacy of their products during production and distribution. The increasing focus on biologics and vaccines has further solidified their position as the primary end-users of cold chain services.

The Brazil Cold Chain for Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, UPS Healthcare, FedEx, Lineage Logistics, AmerisourceBergen, Cardinal Health, Thermo Fisher Scientific, Maersk, Panalpina, CEVA Logistics, XPO Logistics, Agility Logistics, Kintetsu World Express contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain for pharmaceuticals in Brazil appears promising, driven by technological advancements and increasing regulatory support. The integration of IoT and data analytics is expected to enhance operational efficiency, ensuring better temperature monitoring and compliance. Additionally, the government's focus on improving healthcare infrastructure will likely facilitate the expansion of cold chain logistics, enabling broader access to temperature-sensitive products. As the market evolves, companies that adapt to these trends will be well-positioned for success in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature Monitoring Devices Packaging Solutions Others |

| By End-User | Pharmaceutical Manufacturers Distributors and Wholesalers Hospitals and Clinics Retail Pharmacies Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Application | Vaccines Biologics Blood Products Others |

| By Temperature Range | 8°C °C °C Others |

| By Sales Channel | Online Sales Offline Sales Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | Supply Chain Managers, Quality Assurance Officers |

| Cold Chain Logistics Providers | 80 | Operations Directors, Fleet Managers |

| Healthcare Institutions | 70 | Pharmacy Directors, Procurement Managers |

| Regulatory Bodies | 50 | Compliance Officers, Policy Analysts |

| Technology Providers for Cold Chain | 60 | Product Managers, R&D Specialists |

The Brazil Cold Chain for Pharmaceuticals Market is valued at approximately USD 1.5 billion, driven by the increasing demand for temperature-sensitive pharmaceuticals, including vaccines and biologics, and the expansion of the healthcare sector.