Region:Asia

Author(s):Rebecca

Product Code:KRAB5295

Pages:95

Published On:October 2025

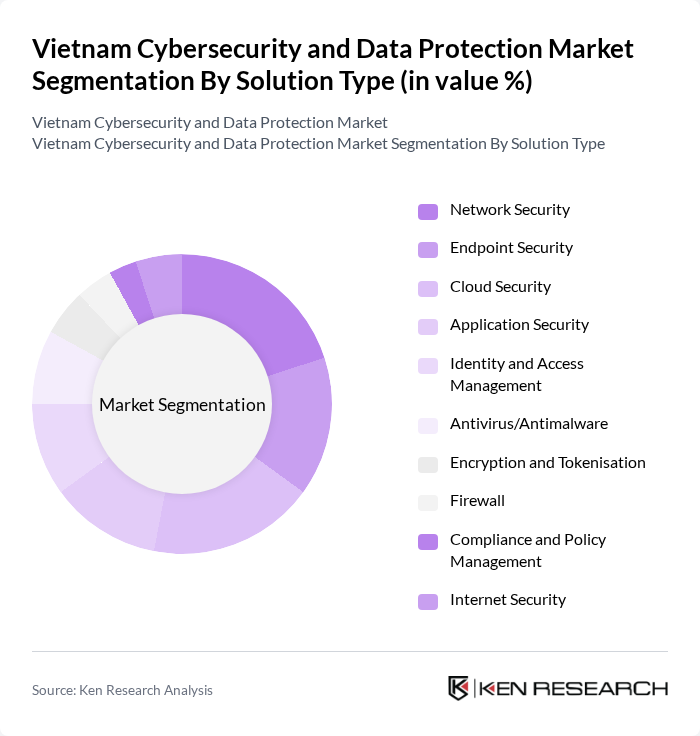

By Solution Type:The solution type segmentation includes various subsegments that cater to different aspects of cybersecurity and data protection. The subsegments are Network Security, Endpoint Security, Cloud Security, Application Security, Identity and Access Management, Antivirus/Antimalware, Encryption and Tokenisation, Firewall, Compliance and Policy Management, and Internet Security. Each of these subsegments plays a crucial role in addressing specific security challenges faced by organizations. Cloud Security, in particular, is experiencing accelerated growth due to widespread cloud adoption and the need for scalable protection as enterprises migrate workloads to local hyperscale datacenters .

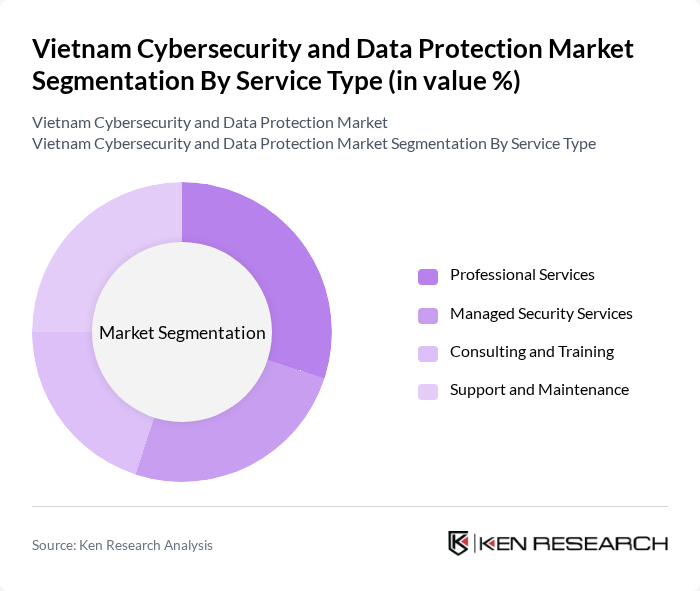

By Service Type:The service type segmentation encompasses Professional Services, Managed Security Services, Consulting and Training, and Support and Maintenance. These services are essential for organizations to effectively implement and manage their cybersecurity strategies, ensuring that they are equipped to handle evolving threats and compliance requirements. The demand for managed security services is notably increasing as organizations seek expert providers for threat monitoring, incident response, and compliance management .

The Vietnam Cybersecurity and Data Protection Market is characterized by a dynamic mix of regional and international players. Leading participants such as FPT Corporation, Viettel Cybersecurity, BKAV Corporation, CMC Telecom, VNPT Technology, VNG Corporation, TMA Solutions, NashTech, CMC Corporation, MobiFone, IBM Vietnam Co., Ltd, HPT Vietnam Corporation, Kaspersky Lab Vietnam, Symantec Vietnam, Trend Micro Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam cybersecurity and data protection market appears promising, driven by increasing digitalization and regulatory compliance. As businesses continue to embrace digital transformation, the demand for advanced cybersecurity solutions is expected to rise. Furthermore, the government's commitment to enhancing cybersecurity infrastructure will likely foster innovation and attract foreign investments, creating a more resilient cybersecurity ecosystem. This evolving landscape will necessitate continuous adaptation to emerging threats and technologies, ensuring sustained growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Network Security Endpoint Security Cloud Security Application Security Identity and Access Management Antivirus/Antimalware Encryption and Tokenisation Firewall Compliance and Policy Management Internet Security |

| By Service Type | Professional Services Managed Security Services Consulting and Training Support and Maintenance |

| By Deployment Mode | On-Premises Cloud Hybrid |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Industry Vertical | BFSI (Banking, Financial Services and Insurance) Government and Defence Healthcare and Life Sciences IT and Telecommunication Manufacturing Energy and Utilities Retail Aerospace and Defence |

| By Region | Southeast Region Red River Delta Mekong River Delta South Central Coast Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 60 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection | 50 | Data Protection Officers, IT Administrators |

| Manufacturing Cybersecurity Solutions | 40 | Operations Managers, Cybersecurity Analysts |

| Government Cybersecurity Initiatives | 40 | Policy Makers, IT Security Directors |

| SME Cybersecurity Practices | 50 | Business Owners, IT Consultants |

The Vietnam Cybersecurity and Data Protection Market is valued at approximately USD 2.4 billion, reflecting significant growth driven by increasing cyber threats, digital transformation, and heightened data privacy awareness among businesses and consumers.