Region:Asia

Author(s):Dev

Product Code:KRAA5403

Pages:87

Published On:September 2025

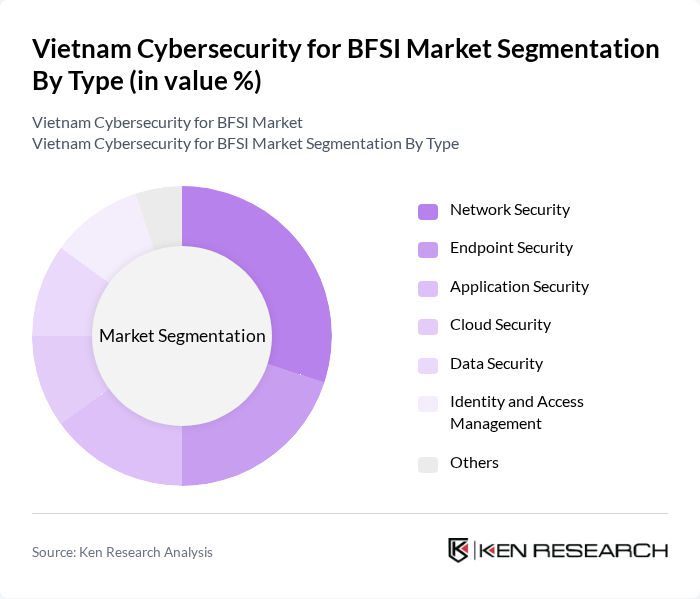

By Type:The cybersecurity market for BFSI is segmented into various types, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, and Others. Among these, Network Security is the leading sub-segment due to the increasing number of cyberattacks targeting financial networks. Organizations are investing heavily in network security solutions to safeguard their infrastructure and data from breaches.

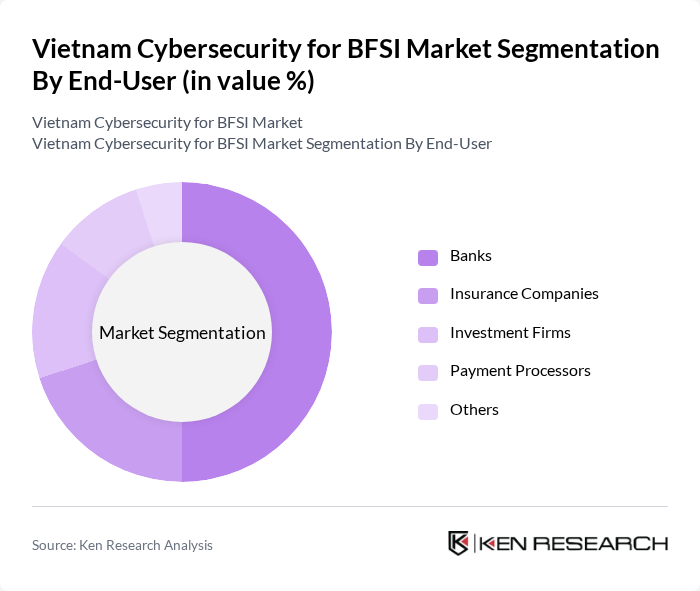

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Processors, and Others. Banks are the dominant end-user in the cybersecurity market for BFSI, driven by the need to protect sensitive financial data and comply with stringent regulations. The increasing adoption of digital banking services has further amplified the demand for robust cybersecurity solutions among banks.

The Vietnam Cybersecurity for BFSI Market is characterized by a dynamic mix of regional and international players. Leading participants such as VNPT Security, Bkav Corporation, CMC Cyber Security, FPT Information System, SecureNet, Cyber Security Vietnam, VSEC, Viettel Cyber Security, MobiFone Cyber Security, TMA Solutions, NCS Technology, CMC Telecom, VNG Corporation, Bkav Security, FPT Software contribute to innovation, geographic expansion, and service delivery in this space.

As Vietnam's BFSI sector continues to evolve, the demand for advanced cybersecurity solutions is expected to grow significantly. The integration of artificial intelligence and machine learning technologies will enhance threat detection and response capabilities. Additionally, the increasing focus on data privacy regulations will drive financial institutions to adopt more robust security measures. Overall, the market is poised for substantial growth as organizations prioritize cybersecurity to protect their digital assets and maintain customer trust in an increasingly digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Processors Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Managed Security Services Training and Awareness Services |

| By Compliance Standards | ISO 27001 PCI DSS GDPR Others |

| By Company Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Cybersecurity Strategies | 100 | IT Security Managers, Risk Officers |

| Insurance Industry Cyber Threat Management | 80 | Compliance Officers, Cybersecurity Analysts |

| Investment Firms' Data Protection Measures | 70 | Data Protection Officers, IT Directors |

| Fintech Companies' Security Protocols | 60 | CTOs, Security Architects |

| Regulatory Compliance in BFSI Cybersecurity | 90 | Legal Advisors, Compliance Managers |

The Vietnam Cybersecurity for BFSI Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digitization in banking and financial services, as well as rising cyber threats necessitating enhanced security measures.