Region:Asia

Author(s):Rebecca

Product Code:KRAC2586

Pages:84

Published On:October 2025

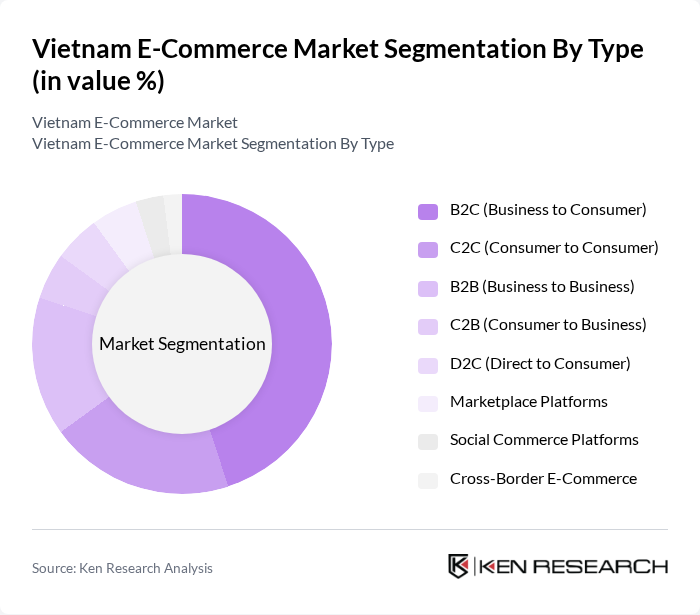

By Type:The e-commerce market in Vietnam can be segmented into various types, including B2C, C2C, B2B, C2B, D2C, marketplace platforms, social commerce platforms, and cross-border e-commerce. Among these, B2C is the most dominant segment, driven by the increasing number of online shoppers and the growing preference for convenience in purchasing goods and services. C2C and marketplace platforms also show significant growth, as they cater to the rising trend of peer-to-peer transactions and the popularity of platforms like Shopee and Lazada. Social commerce and mobile-first platforms are rapidly gaining traction, reflecting the evolving digital habits of Vietnamese consumers .

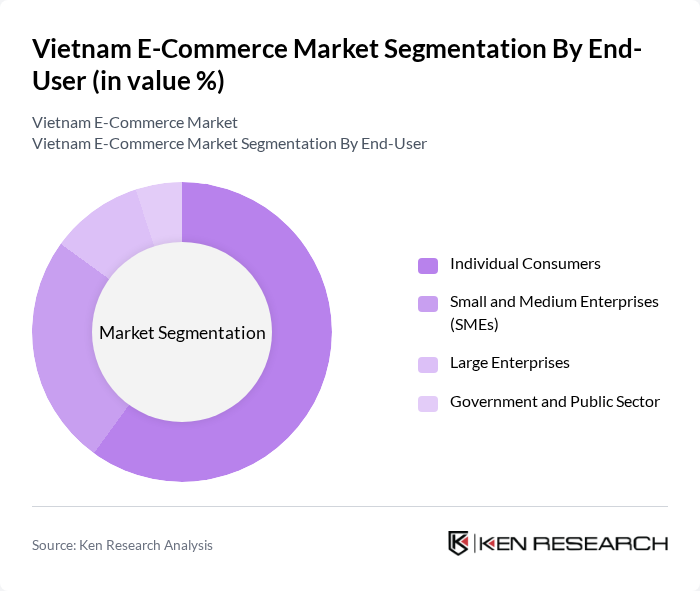

By End-User:The end-user segmentation of the e-commerce market includes individual consumers, small and medium enterprises (SMEs), large enterprises, and the government and public sector. Individual consumers represent the largest segment, driven by the increasing number of online shoppers seeking convenience and variety. SMEs are also significant contributors, leveraging e-commerce platforms to reach broader markets and enhance their sales channels. The adoption of e-commerce among SMEs is further supported by government initiatives and digital transformation programs .

The Vietnam E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tiki Corporation, Shopee Vietnam (Sea Group), Lazada Vietnam (Alibaba Group), Sendo (Sen Do Technology JSC), FPT Retail (FPT Digital Retail Joint Stock Company), The Gioi Di Dong (Mobile World Investment Corporation), Dien May Xanh (Mobile World Investment Corporation), VinID (One Mount Group), TikTok Shop Vietnam (ByteDance Ltd.), Chotot.vn (Carousell Group), Yes24 Vietnam (Hansae Yes24 Holdings Co., Ltd.), Lotte Vietnam (Lotte Group), AeonEshop (AEON Vietnam Co., Ltd.), Voso.vn (Viettel Post Joint Stock Corporation), Postmart.vn (Vietnam Post Corporation) contribute to innovation, geographic expansion, and service delivery in this space .

The future of Vietnam's e-commerce market appears promising, driven by technological advancements and changing consumer behaviors. As internet access and smartphone penetration continue to rise, more consumers are expected to engage in online shopping. Additionally, the integration of AI and machine learning will enhance personalized shopping experiences, while sustainability trends will shape consumer preferences. The government's support for digital transformation will further bolster the sector, creating a conducive environment for growth and innovation in e-commerce.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C (Business to Consumer) C2C (Consumer to Consumer) B2B (Business to Business) C2B (Consumer to Business) D2C (Direct to Consumer) Marketplace Platforms Social Commerce Platforms Cross-Border E-Commerce |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Enterprises Government and Public Sector |

| By Sales Channel | Online Marketplaces (e.g., Shopee, Lazada, Tiki, TikTok Shop) Brand Websites Social Media Commerce (e.g., Facebook, TikTok Shop) Mobile Applications Omnichannel Retail |

| By Product Category | Electronics & Appliances Fashion & Apparel Home & Living Health & Beauty Groceries & FMCG Digital Products & Services Mother & Baby Food & Beverage Others |

| By Payment Method | Credit/Debit Cards E-Wallets (e.g., MoMo, ZaloPay, ShopeePay) Bank Transfers Cash on Delivery (COD) Buy Now, Pay Later (BNPL) |

| By Delivery Method | Standard Delivery Express Delivery Click and Collect Same-Day Delivery Third-Party Logistics (3PL) |

| By Customer Demographics | Age Groups (Gen Z, Millennials, Gen X, Boomers) Income Levels Urban vs Rural Gender |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer E-commerce Behavior | 150 | Online Shoppers, Frequent Buyers |

| SME E-commerce Adoption | 120 | Business Owners, E-commerce Managers |

| Logistics and Delivery Services | 90 | Logistics Coordinators, Operations Managers |

| Payment Solutions in E-commerce | 60 | Payment Gateway Providers, Financial Officers |

| Market Trends and Innovations | 50 | Industry Analysts, Technology Innovators |

The Vietnam E-Commerce Market is valued at approximately USD 25 billion, driven by factors such as increased internet and smartphone penetration, the adoption of digital payment methods, and a growing middle class that prefers online shopping.