Region:Asia

Author(s):Rebecca

Product Code:KRAB2947

Pages:92

Published On:October 2025

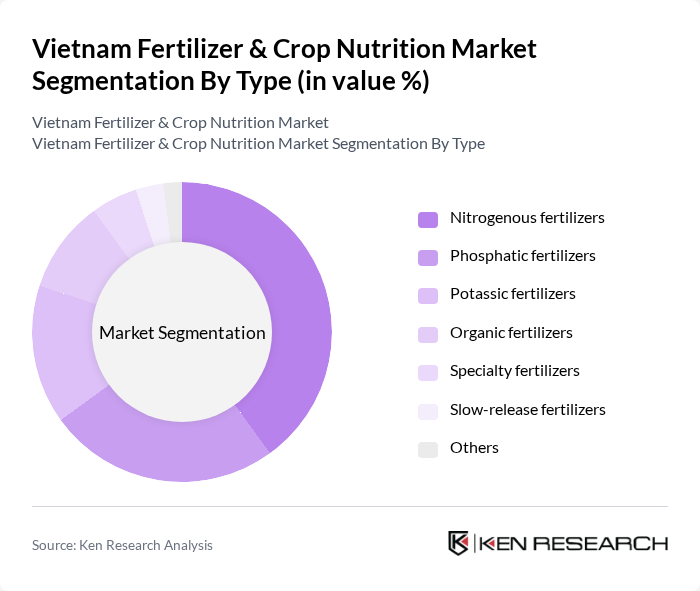

By Type:The market is segmented into various types of fertilizers, including nitrogenous, phosphatic, potassic, organic, specialty, slow-release, and others. Each type serves specific agricultural needs, with nitrogenous fertilizers being the most widely used due to their essential role in plant growth and development. The increasing focus on sustainable agriculture has also led to a rise in the adoption of organic and specialty fertilizers.

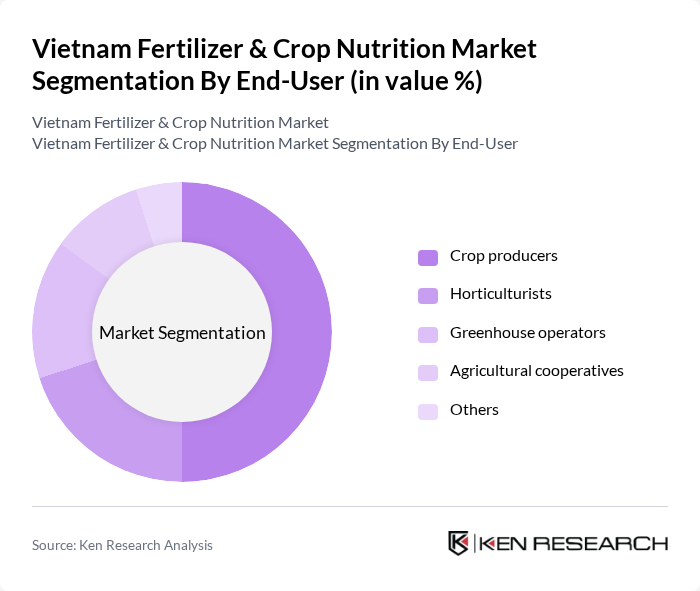

By End-User:The end-user segmentation includes crop producers, horticulturists, greenhouse operators, agricultural cooperatives, and others. Crop producers dominate the market as they represent the largest segment, driven by the need for high-yield crops to meet the growing food demand. Horticulturists and greenhouse operators are also significant users, focusing on quality and specialized fertilizers to enhance their produce.

The Vietnam Fertilizer & Crop Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietnam National Chemical Group (Vinachem), Southern Fertilizer Joint Stock Company (SFG), Ha Bac Nitrogenous Fertilizer and Chemical Company, Binh Dien Fertilizer Joint Stock Company, Phu My Fertilizer Plant, Lam Thao Fertilizer and Chemical Company, Central Fertilizer Company, An Giang Plant Protection Joint Stock Company, Viet Phap Fertilizer Company, Green Fertilizer Company, Agrochemicals Vietnam, NutriFert Vietnam, International Fertilizer Development Center (IFDC), Cuu Long Delta Rice Research Institute, Vietnam Fertilizer Association contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam fertilizer and crop nutrition market is poised for significant transformation as it adapts to emerging trends such as precision agriculture and sustainable practices. With the government’s commitment to enhancing agricultural productivity and the rising demand for organic solutions, the market is likely to see increased investment in innovative technologies. Additionally, the integration of digital platforms for sales and distribution will streamline operations, making fertilizers more accessible to farmers, thus fostering growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogenous fertilizers Phosphatic fertilizers Potassic fertilizers Organic fertilizers Specialty fertilizers Slow-release fertilizers Others |

| By End-User | Crop producers Horticulturists Greenhouse operators Agricultural cooperatives Others |

| By Application | Soil application Foliar application Fertigation Others |

| By Distribution Channel | Direct sales Retail outlets Online platforms Distributors Others |

| By Packaging Type | Bulk packaging Bagged packaging Liquid packaging Others |

| By Price Range | Economy Mid-range Premium |

| By Brand Loyalty | Established brands Emerging brands Private labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retail Market | 150 | Retail Managers, Store Owners |

| Agricultural Cooperatives | 100 | Cooperative Leaders, Agronomy Advisors |

| Crop Producers | 200 | Farmers, Crop Managers |

| Fertilizer Manufacturers | 80 | Production Managers, Sales Directors |

| Government Agricultural Officials | 50 | Policy Makers, Agricultural Inspectors |

The Vietnam Fertilizer & Crop Nutrition Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by increasing food production demands and advancements in agricultural practices.