Region:Africa

Author(s):Geetanshi

Product Code:KRAA4512

Pages:93

Published On:September 2025

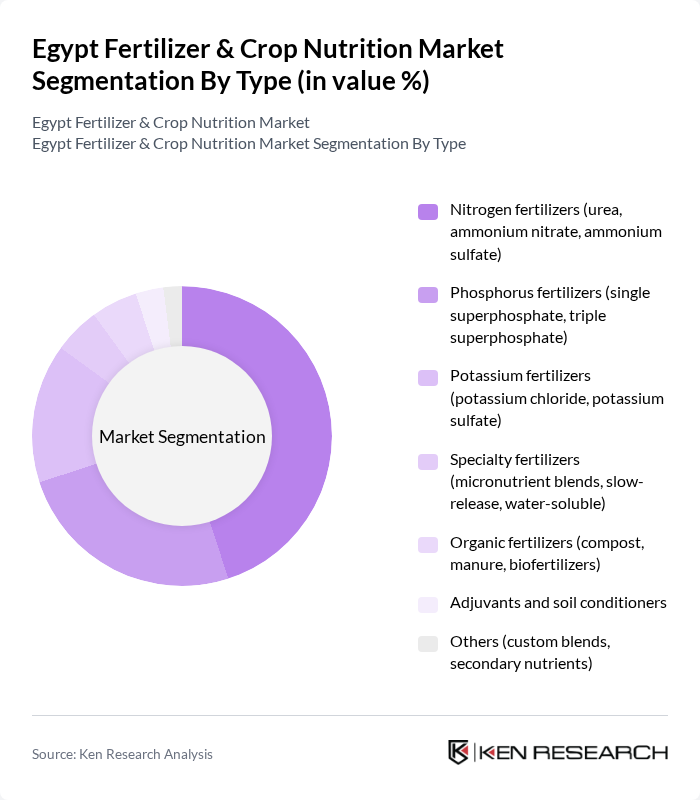

By Type:The market is segmented into various types of fertilizers, including nitrogen, phosphorus, potassium, specialty, organic, adjuvants, and others. Among these, nitrogen fertilizers, particularly urea and ammonium nitrate, dominate the market due to their essential role in enhancing crop yields. The increasing focus on high-yield crops and the need for efficient nutrient management have led to a surge in the adoption of nitrogen-based fertilizers. Recent trends show a growing interest in specialty and organic fertilizers, driven by sustainability initiatives and regulatory compliance .

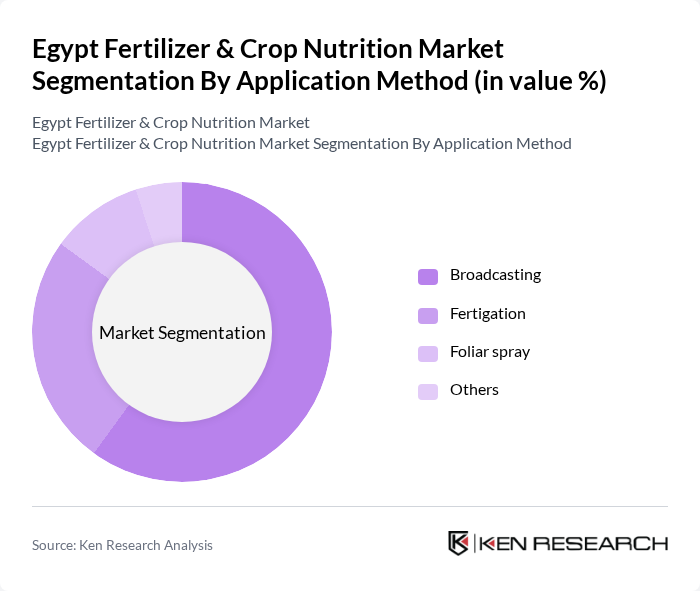

By Application Method:The application methods for fertilizers include broadcasting, fertigation, foliar spray, and others. Broadcasting remains the most widely used method due to its simplicity and effectiveness in large-scale farming. However, fertigation is gaining traction as it allows for precise nutrient delivery, which is crucial for maximizing crop yields and minimizing waste. The adoption of fertigation and foliar spray methods is increasing, particularly among commercial farms seeking higher efficiency and sustainability .

The Egypt Fertilizer & Crop Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Egyptian Chemical Industries (KIMA), Abu Qir Fertilizers and Chemical Industries Company (AFC), Misr Fertilizers Production Company (MOPCO), Alexandria Fertilizers Company (AlexFert), El Nasr Company for Intermediate Chemicals (NCIC), Egyptian Fertilizers Company (EFC), Delta Company for Fertilizers and Chemical Industries (Delta Fertilizers), Helwan Fertilizers Company, Suez Company for Fertilizers Production (SCFP), Evergrow for Specialty Fertilizers, El Nasr Mining Company (EMC), El Delta Company for Fertilizers, Al-Ahram for Fertilizers & Chemical Industries, Egyptian Agrochemicals Company, Green Nile Fertilizers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt Fertilizer & Crop Nutrition Market appears promising, driven by advancements in agricultural technology and a growing emphasis on sustainable practices. As precision agriculture gains traction, farmers are expected to adopt data-driven approaches to optimize fertilizer use, enhancing efficiency and reducing waste. Additionally, the increasing focus on soil health and integrated crop management will likely lead to a more balanced approach to fertilization, fostering long-term sustainability and productivity in the agricultural sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogen fertilizers (urea, ammonium nitrate, ammonium sulfate) Phosphorus fertilizers (single superphosphate, triple superphosphate) Potassium fertilizers (potassium chloride, potassium sulfate) Specialty fertilizers (micronutrient blends, slow-release, water-soluble) Organic fertilizers (compost, manure, biofertilizers) Adjuvants and soil conditioners Others (custom blends, secondary nutrients) |

| By Application Method | Broadcasting Fertigation Foliar spray Others |

| By Crop Type | Cereals (wheat, maize, rice) Fruits & vegetables (citrus, grapes, tomatoes, potatoes, etc.) Cash crops (cotton, sugarcane, etc.) Pulses & oilseeds Horticulture & floriculture Turf & ornamentals Others |

| By End-User | Large-scale farming enterprises Smallholder farmers Agricultural cooperatives Government agencies Others |

| By Distribution Channel | Direct sales (manufacturer to farm) Distributors & dealers Retail outlets/agrocenters Online sales Others |

| By Region | Nile Delta Upper Egypt Nile Valley Sinai Peninsula Western Desert (including Toshka, New Delta) Others |

| By Price Range | Low-cost fertilizers Mid-range fertilizers Premium fertilizers |

| By Packaging Type | Bulk packaging Bagged fertilizers Liquid fertilizers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retail Market | 100 | Retail Managers, Store Owners |

| Crop Nutrition Advisory Services | 70 | Agronomists, Crop Consultants |

| Large-Scale Agricultural Producers | 60 | Farm Owners, Agricultural Engineers |

| Government Agricultural Policy Makers | 40 | Policy Analysts, Agricultural Economists |

| Fertilizer Manufacturers | 50 | Product Managers, Sales Directors |

The Egypt Fertilizer & Crop Nutrition Market is valued at approximately USD 3.2 billion, driven by increasing food security demands, agricultural productivity, and government initiatives aimed at enhancing crop yields.