Region:Africa

Author(s):Rebecca

Product Code:KRAA4831

Pages:95

Published On:September 2025

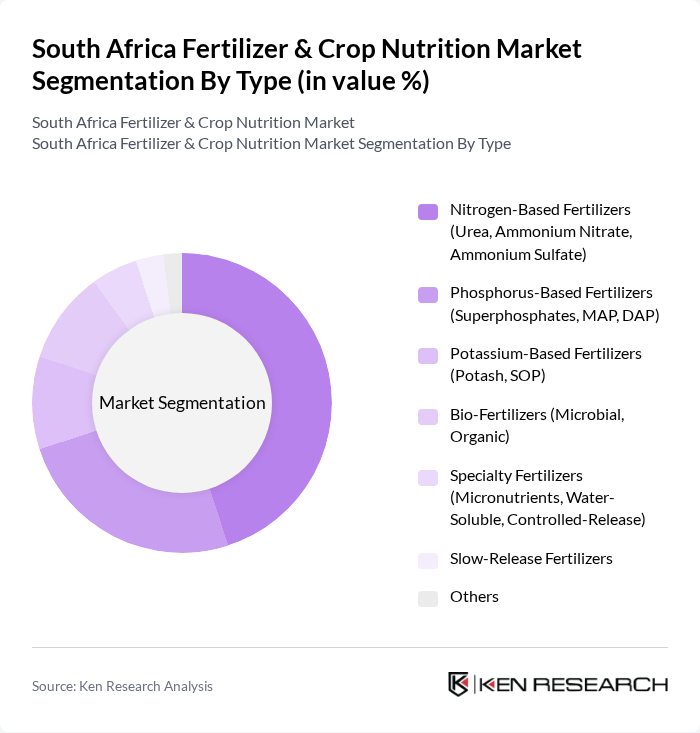

By Type:The market is segmented into various types of fertilizers, each catering to specific nutrient requirements of crops. Nitrogen-based fertilizers, including urea and ammonium nitrate, dominate the market due to their essential role in promoting plant growth and increasing crop yields. Phosphorus-based fertilizers, such as superphosphates, are also significant as they enhance root development and flowering. The increasing focus on organic farming has led to a rise in the adoption of bio-fertilizers, which are gaining traction among environmentally conscious farmers .

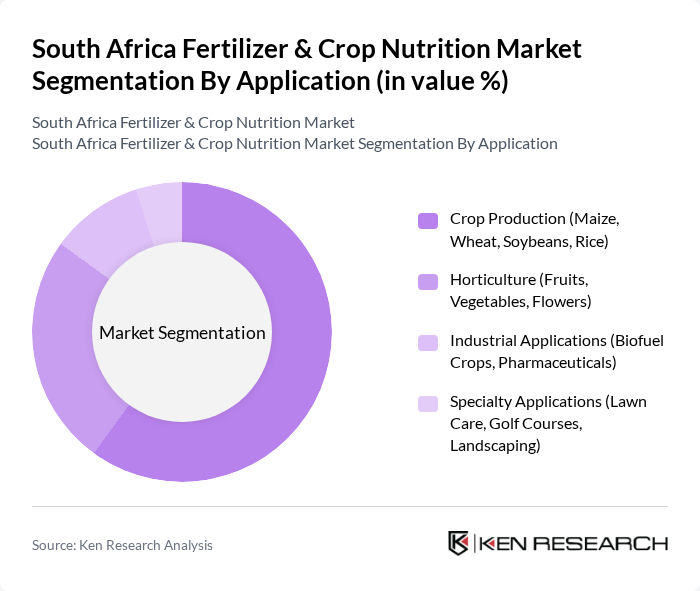

By Application:The application segment of the market includes various agricultural practices, with crop production being the largest segment. This includes staple crops such as maize, wheat, and soybeans, which are essential for food security in South Africa. Horticulture, which encompasses fruits, vegetables, and flowers, is also a significant application area, driven by both local consumption and export demands. The industrial applications segment is growing, particularly in biofuel production, as the country seeks to diversify its agricultural outputs .

The South Africa Fertilizer & Crop Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omnia Holdings Limited, Kynoch Fertilizer, Yara International ASA, AECI Plant Health (AECI Limited), Sasol Limited, Fertilizer Society of South Africa (FSSA), Profert (Pty) Ltd, Nutri Feeds (Pty) Ltd, Haifa South Africa (Haifa Group), UPL South Africa (UPL Limited), BASF South Africa (BASF SE), Syngenta South Africa (Syngenta AG), Corteva Agriscience South Africa, Bayer South Africa (Bayer AG), Suiso South Africa (Suiso Holdings) contribute to innovation, geographic expansion, and service delivery in this space.

The South African fertilizer and crop nutrition market is poised for transformation, driven by technological advancements and a shift towards sustainable practices. In the future, the integration of precision agriculture technologies is expected to enhance efficiency in fertilizer application, reducing waste and improving crop yields. Additionally, the growing emphasis on soil health and organic farming will likely create new market segments, fostering innovation in bio-based fertilizers and nutrient management solutions that align with environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogen-Based Fertilizers (Urea, Ammonium Nitrate, Ammonium Sulfate) Phosphorus-Based Fertilizers (Superphosphates, MAP, DAP) Potassium-Based Fertilizers (Potash, SOP) Bio-Fertilizers (Microbial, Organic) Specialty Fertilizers (Micronutrients, Water-Soluble, Controlled-Release) Slow-Release Fertilizers Others |

| By Application | Crop Production (Maize, Wheat, Soybeans, Rice) Horticulture (Fruits, Vegetables, Flowers) Industrial Applications (Biofuel Crops, Pharmaceuticals) Specialty Applications (Lawn Care, Golf Courses, Landscaping) |

| By End-User | Farmers Agricultural Cooperatives Government Agencies Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Others |

| By Region | Gauteng KwaZulu-Natal Western Cape Eastern Cape Limpopo Mpumalanga Others |

| By Packaging Type | Bulk Packaging Bagged Packaging Liquid Packaging Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Fertilization Practices | 120 | Farmers, Agronomists |

| Fruit and Vegetable Fertilizer Usage | 90 | Horticulturists, Agricultural Extension Officers |

| Fertilizer Distribution Channels | 60 | Distributors, Retail Managers |

| Impact of Sustainable Practices on Fertilizer Demand | 50 | Environmental Consultants, Policy Makers |

| Market Trends in Crop Nutrition | 70 | Market Analysts, Industry Experts |

The South Africa Fertilizer & Crop Nutrition Market is valued at approximately USD 2.6 billion, driven by factors such as food security demands, technological advancements in fertilizers, and the adoption of sustainable farming practices.