Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB3941

Pages:95

Published On:October 2025

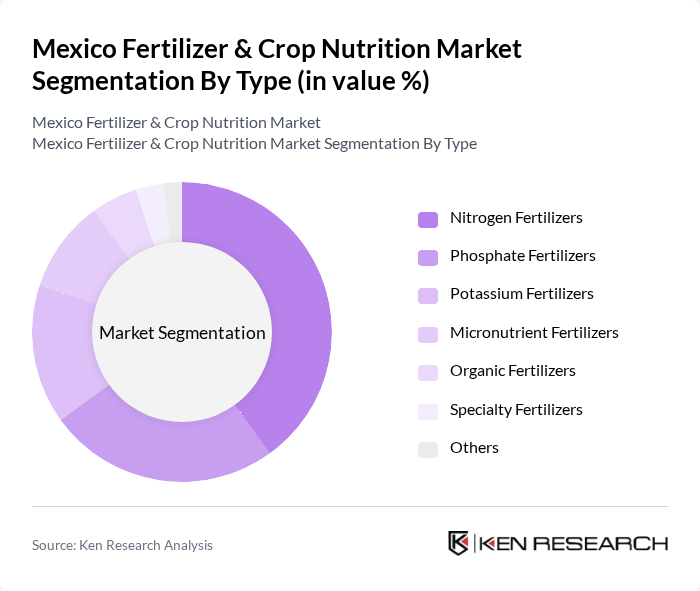

By Type:The market is segmented into various types of fertilizers, each catering to different agricultural needs. The primary types include nitrogen fertilizers, phosphate fertilizers, potassium fertilizers, micronutrient fertilizers, organic fertilizers, specialty fertilizers, and others. Each type serves a unique purpose in enhancing soil fertility and crop yield. Nitrogen fertilizers remain the dominant segment due to their essential role in crop growth, while specialty and organic fertilizers are gaining traction as sustainability and soil health become priorities for Mexican agriculture.

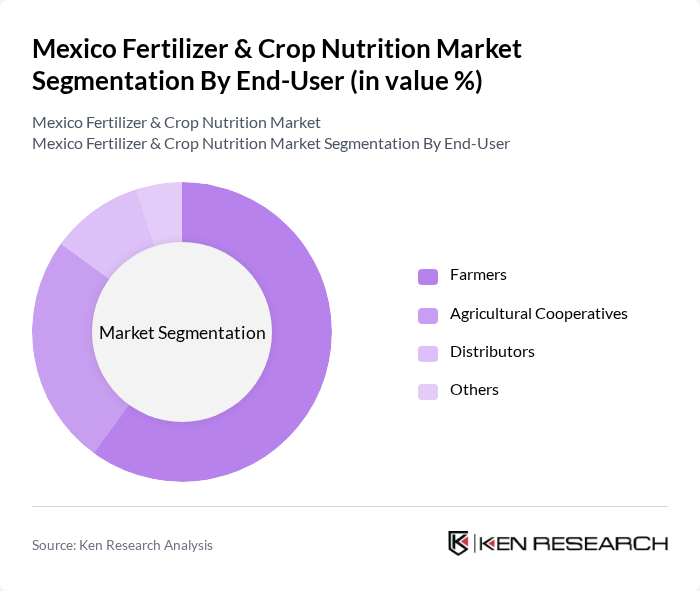

By End-User:The end-user segmentation includes farmers, agricultural cooperatives, distributors, and others. Each segment plays a crucial role in the distribution and application of fertilizers, with farmers being the primary consumers, followed by cooperatives that support local agricultural practices. Distributors and other stakeholders facilitate the supply chain and access to innovative products.

The Mexico Fertilizer & Crop Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutrien Ltd., Yara International ASA, CF Industries Holdings, Inc., The Mosaic Company, OCP Group, BASF SE, Syngenta AG, K+S AG, Haifa Group, ICL Group Ltd., Sociedad Química y Minera de Chile S.A., Uralchem Integrated Chemicals Company, Wilbur-Ellis Company, EuroChem Group AG, Fertinal S.A. de C.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico fertilizer and crop nutrition market appears promising, driven by increasing agricultural demands and technological advancements. The shift towards sustainable practices is expected to gain momentum, with more farmers adopting eco-friendly fertilizers. Additionally, the integration of digital farming solutions will enhance efficiency and productivity. As the market evolves, collaboration between government and private sectors will be crucial in addressing challenges and leveraging opportunities for growth in the agricultural sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogen Fertilizers Phosphate Fertilizers Potassium Fertilizers Micronutrient Fertilizers Organic Fertilizers Specialty Fertilizers Others |

| By End-User | Farmers Agricultural Cooperatives Distributors Others |

| By Application | Crop Production Horticulture Turf and Ornamental Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Others |

| By Crop Type | Cereals and Grains Fruits and Vegetables Oilseeds Others |

| By Region | Northern Mexico Central Mexico Southern Mexico Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Fertilization Practices | 100 | Farmers, Agronomists |

| Vegetable and Fruit Fertilizer Usage | 80 | Horticulturists, Agricultural Extension Officers |

| Fertilizer Distribution Channels | 60 | Distributors, Retailers |

| Organic Fertilizer Adoption | 50 | Organic Farmers, Sustainability Advocates |

| Crop Nutrition Innovations | 40 | Research Scientists, Product Development Managers |

The Mexico Fertilizer & Crop Nutrition Market is valued at approximately USD 2 billion, reflecting a significant growth driven by increasing food production demands, the adoption of precision agriculture, and heightened awareness of soil health among farmers.