Region:Asia

Author(s):Shubham

Product Code:KRAC4963

Pages:87

Published On:October 2025

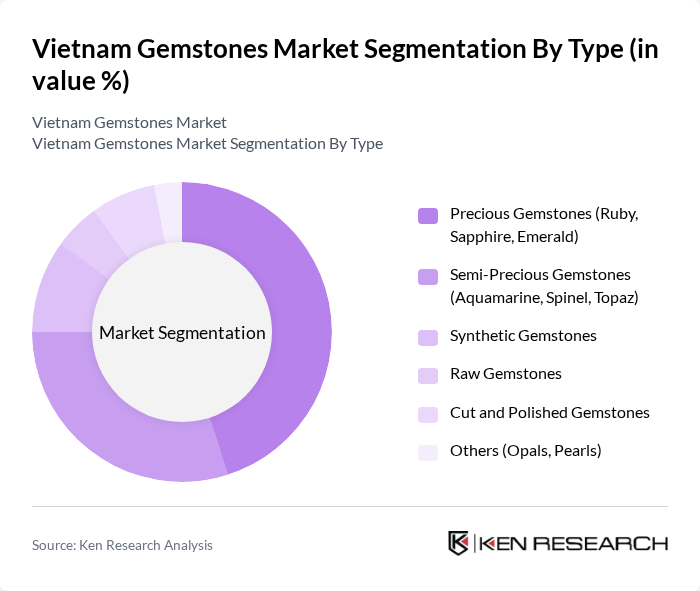

By Type:The market is segmented into various types of gemstones, including precious and semi-precious categories. Precious gemstones, such as rubies, sapphires, and emeralds, dominate the market due to their high value and demand in luxury jewelry. Semi-precious gemstones, including aquamarine, spinel, and topaz, also hold significant market share, appealing to a broader consumer base. Synthetic gemstones are gaining traction as a cost-effective alternative, while raw and cut gemstones cater to different segments of the market.

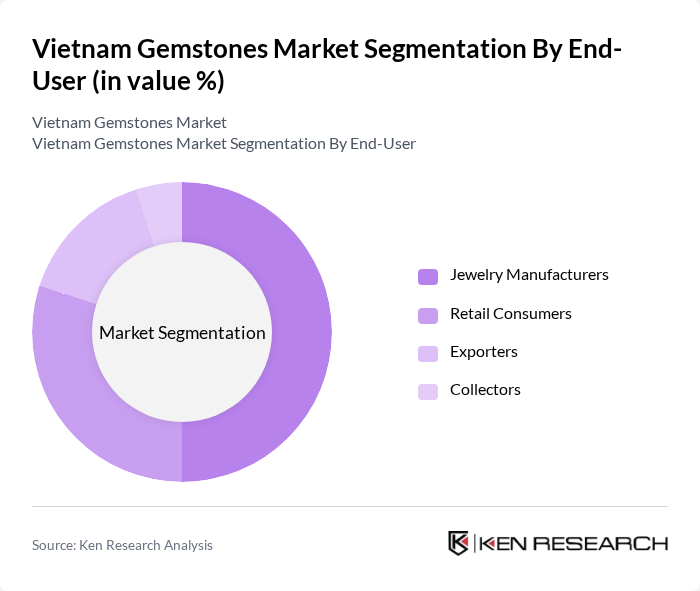

By End-User:The end-user segmentation includes jewelry manufacturers, retail consumers, exporters, and collectors. Jewelry manufacturers are the largest segment, driven by the increasing demand for customized and high-quality jewelry. Retail consumers are also significant, as they seek unique pieces for personal use or gifting. Exporters play a crucial role in the international trade of gemstones, while collectors contribute to the market by investing in rare and valuable stones.

The Vietnam Gemstones Market is characterized by a dynamic mix of regional and international players. Leading participants such as Phu Nhuan Jewelry Joint Stock Company, DOJI Gold & Gems Group, SJC Gold and Silver Company Limited, Bao Tin Minh Chau Jewelry Company, Viet Gems, Tan Cang Gemstone Company, Kim Cuong Jewelry Company, Huu Nghi Gemstone Company, Minh Tuan Jewelry Company, An Phuoc Gemstone Company, Ngoc Bich Jewelry Company, Viet Diamond Company, Hoang Gia Jewelry Company, Kim Hoang Jewelry Company, Viet Gemstone Trading Company contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam gemstones market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As ethical sourcing becomes increasingly important, the demand for responsibly mined gemstones is expected to rise. Additionally, the integration of digital marketing strategies will enhance brand visibility and consumer engagement. With a focus on sustainability and innovation, the market is likely to attract new investments, fostering growth and expanding opportunities for local artisans and businesses in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Precious Gemstones (Ruby, Sapphire, Emerald) Semi-Precious Gemstones (Aquamarine, Spinel, Topaz) Synthetic Gemstones Raw Gemstones Cut and Polished Gemstones Others (Opals, Pearls) |

| By End-User | Jewelry Manufacturers Retail Consumers Exporters Collectors |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Auctions Trade Shows |

| By Price Range | Low-End Gemstones Mid-Range Gemstones High-End Gemstones |

| By Application | Jewelry Making Decorative Items Investment Purposes |

| By Distribution Mode | Direct Sales Wholesale Distribution Online Marketplaces |

| By Certification Type | GIA Certified IGI Certified Other Certifications (e.g., AGS) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Gemstone Sales | 100 | Store Managers, Sales Representatives |

| Gemstone Manufacturing Insights | 80 | Production Managers, Quality Control Inspectors |

| Mining Operations Feedback | 60 | Mine Owners, Geologists |

| Consumer Preferences Survey | 120 | End Consumers, Jewelry Buyers |

| Export Market Analysis | 70 | Export Managers, Trade Analysts |

The Vietnam Gemstones Market is valued at approximately USD 1.8 billion, reflecting significant growth driven by increasing consumer demand for luxury goods and gemstones as investment assets. This market has seen a notable surge in both domestic and international interest.