Region:Asia

Author(s):Dev

Product Code:KRAC2057

Pages:83

Published On:October 2025

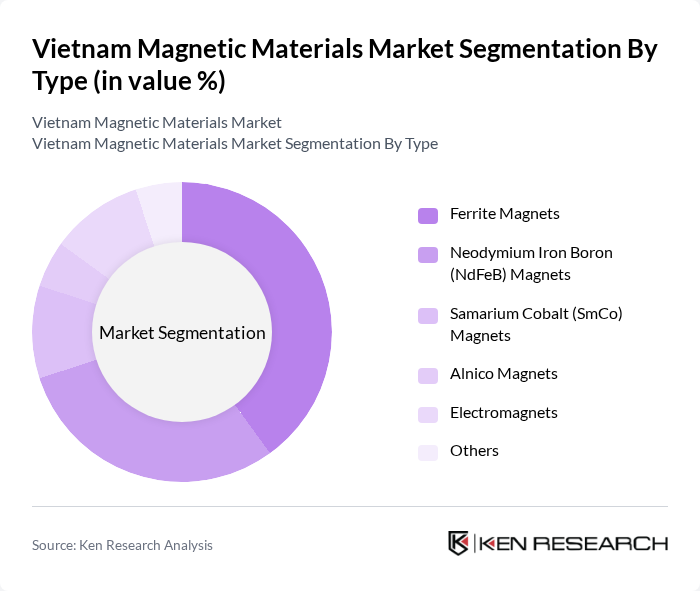

By Type:The market is segmented into various types of magnetic materials, including Ferrite Magnets, Neodymium Iron Boron (NdFeB) Magnets, Samarium Cobalt (SmCo) Magnets, Alnico Magnets, Electromagnets, and Others. Among these, Ferrite Magnets are the most widely used due to their cost-effectiveness and versatility in applications ranging from consumer electronics to automotive components. NdFeB Magnets are also gaining traction due to their superior magnetic properties, making them ideal for high-performance applications .

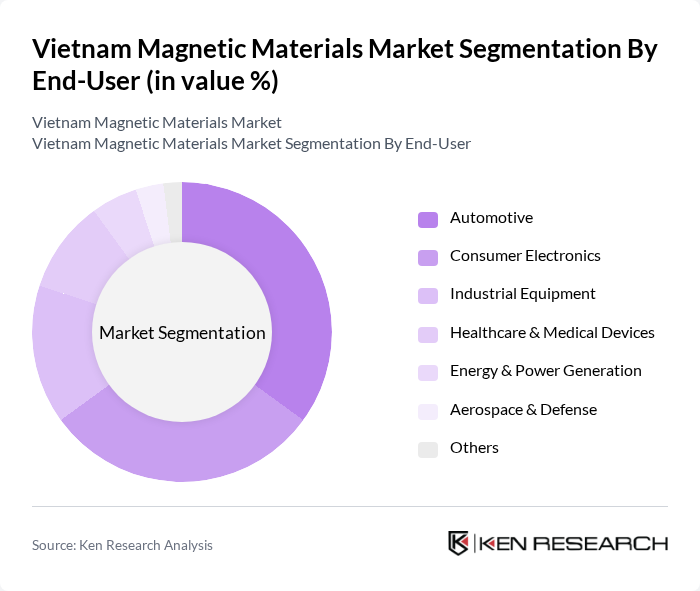

By End-User:The end-user segments include Automotive, Consumer Electronics, Industrial Equipment, Healthcare & Medical Devices, Energy & Power Generation, Aerospace & Defense, and Others. The automotive sector is the leading end-user, driven by the increasing adoption of electric vehicles, advanced driver-assistance systems, and the expansion of Vietnam’s EV infrastructure, all of which require high-performance magnetic materials. Consumer electronics also represent a significant portion of the market, with the demand for compact and efficient devices fueling growth .

The Vietnam Magnetic Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as VIMETAL Co., Ltd., Vietnam Magnet & Electronic Materials JSC (Vina Magnet), Hanoimex Group, Dai Dung Metallic Manufacture Construction & Trade Corporation, Dong Nai Magnet Joint Stock Company, Ho Chi Minh City Magnet Joint Stock Company, Nam Chao Magnet Co., Ltd., An Phat Holdings, Binh Minh Magnetics Co., Ltd., Saigon Magnetics Corporation, Vietnam National Chemical Group (Vinachem), VinFast, Viettel High Tech Industries Corporation, FPT Technology Research Institute, Hoa Sen Group contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam magnetic materials market is poised for significant growth, driven by the increasing demand for electric vehicles and renewable energy projects. As the government continues to support local manufacturing and technological advancements, the industry is expected to adapt to emerging trends such as sustainability and miniaturization. Furthermore, the focus on research and development will likely enhance product offerings, positioning Vietnam as a competitive player in the Southeast Asian market for magnetic materials.

| Segment | Sub-Segments |

|---|---|

| By Type | Ferrite Magnets Neodymium Iron Boron (NdFeB) Magnets Samarium Cobalt (SmCo) Magnets Alnico Magnets Electromagnets Others |

| By End-User | Automotive Consumer Electronics Industrial Equipment Healthcare & Medical Devices Energy & Power Generation Aerospace & Defense Others |

| By Application | Electric Motors Magnetic Sensors Magnetic Resonance Imaging (MRI) Data Storage Devices (HDD, CD, DVD) Wind Turbines Hybrid/Electric Vehicles HVAC Systems Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| By Price Range | Low Price Mid Price High Price |

| By Technology | Conventional Manufacturing Advanced Manufacturing Techniques Recycling Technologies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Manufacturing Sector | 120 | Production Managers, R&D Engineers |

| Automotive Industry Applications | 100 | Supply Chain Managers, Quality Control Officers |

| Renewable Energy Sector | 80 | Project Managers, Technical Directors |

| Industrial Equipment Manufacturers | 60 | Operations Managers, Product Development Leads |

| Research Institutions and Universities | 40 | Academic Researchers, Industry Analysts |

The Vietnam Magnetic Materials Market is valued at approximately USD 210 million, reflecting a robust growth trajectory driven by increasing demand across various sectors, including automotive, consumer electronics, and renewable energy.