Region:Asia

Author(s):Shubham

Product Code:KRAD3670

Pages:93

Published On:November 2025

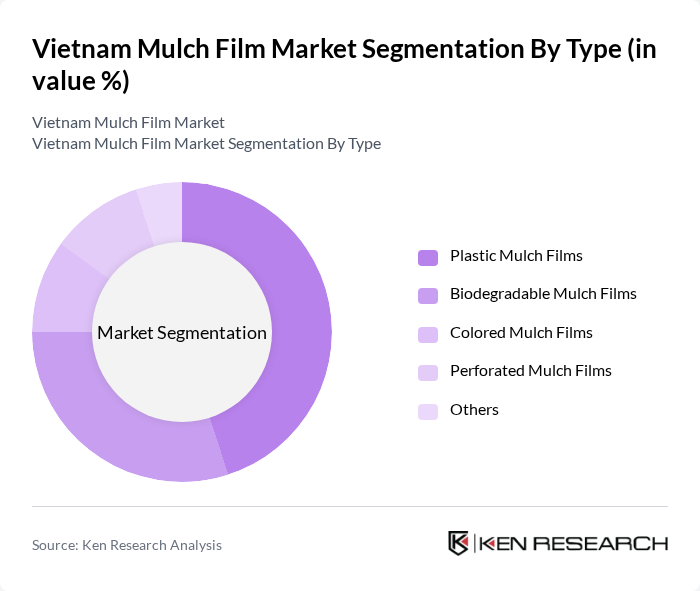

By Type:The market can be segmented into various types of mulch films, including Plastic Mulch Films, Biodegradable Mulch Films, Colored Mulch Films, Perforated Mulch Films, and Others. Each type serves different agricultural needs and preferences, influencing their market presence.

The Plastic Mulch Films segment dominates the market due to their widespread use in various crops, particularly vegetables. Farmers prefer plastic films for their durability and effectiveness in weed control, moisture retention, and soil temperature regulation. The increasing focus on maximizing crop yields and minimizing labor costs has further solidified the position of plastic mulch films in the agricultural sector. However, the Biodegradable Mulch Films segment is gaining traction as environmental concerns rise, leading to a gradual shift in consumer preferences.

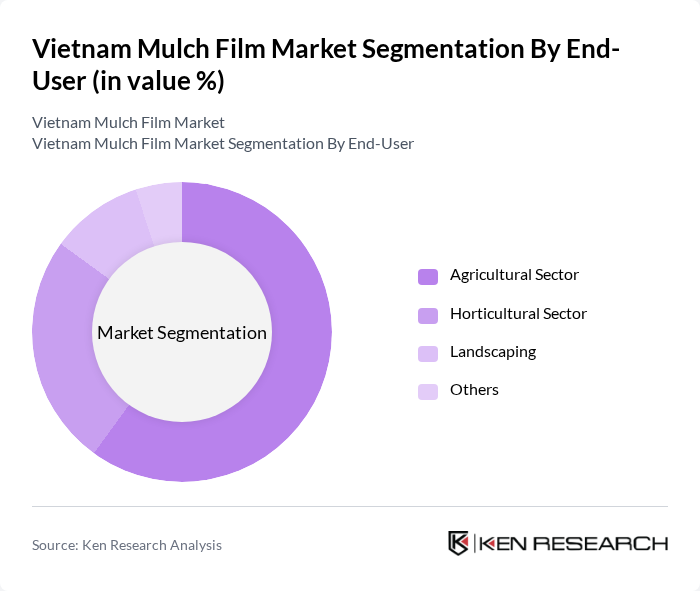

By End-User:The market is segmented based on end-users, including the Agricultural Sector, Horticultural Sector, Landscaping, and Others. Each segment reflects different applications and requirements for mulch films.

The Agricultural Sector is the leading end-user of mulch films, accounting for a significant portion of the market. This dominance is attributed to the high volume of crop production and the necessity for effective weed and moisture management in large-scale farming operations. The Horticultural Sector follows, driven by the need for specialized growing conditions for flowers and ornamental plants. The increasing trend of urban gardening and landscaping also contributes to the growth of mulch films in these sectors.

The Vietnam Mulch Film Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietnam Plastic Industry Corporation, An Phat Holdings, Tan Phat Plastic, Binh Minh Plastic, Long Thanh Plastic, Viet Nam Mulch Film Co., Hoang Ha Plastic, Minh Tam Plastic, Dai Dong Tien Plastic, Phuoc Thanh Plastic, Viet Plastic, Huu Nghi Plastic, Thanh Cong Plastic, Viet Nam Agricultural Products Co., Green Mulch Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam mulch film market is poised for significant growth, driven by increasing agricultural productivity and a shift towards sustainable practices. As the government continues to invest in agricultural innovation, the adoption of advanced mulch film technologies is expected to rise. Additionally, the growing consumer demand for organic produce will further incentivize farmers to adopt eco-friendly solutions. Overall, the market is likely to experience a transformative phase, aligning with global sustainability trends and enhancing food security in Vietnam.

| Segment | Sub-Segments |

|---|---|

| By Type | Plastic Mulch Films Biodegradable Mulch Films Colored Mulch Films Perforated Mulch Films Others |

| By End-User | Agricultural Sector Horticultural Sector Landscaping Others |

| By Crop Type | Vegetables Fruits Flowers Others |

| By Thickness | Thin Films Medium Films Thick Films Others |

| By Application Method | Manual Application Machine Application Others |

| By Distribution Channel | Direct Sales Online Retail Agricultural Supply Stores Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Farmers | 100 | Farm Owners, Crop Managers |

| Vegetable Producers | 80 | Horticulturists, Agricultural Technicians |

| Distributors of Agricultural Supplies | 60 | Sales Managers, Supply Chain Coordinators |

| Research Institutions | 50 | Agricultural Researchers, Policy Analysts |

| Retailers of Mulch Films | 70 | Store Managers, Product Buyers |

The Vietnam mulch film market is valued at approximately USD 175 million, reflecting a significant growth trend driven by modern agricultural practices aimed at enhancing efficiency and sustainability in crop production.