Region:Asia

Author(s):Geetanshi

Product Code:KRAB2715

Pages:98

Published On:October 2025

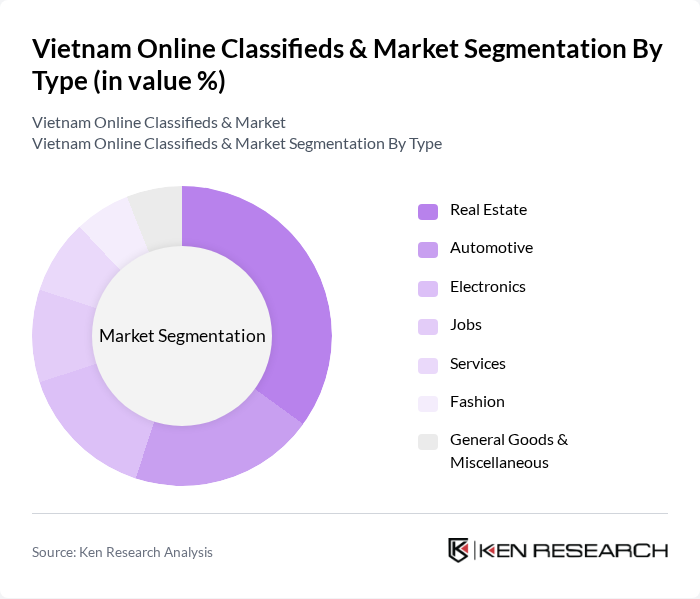

By Type:The market is segmented into various types, including Real Estate, Automotive, Electronics, Jobs, Services, Fashion, and General Goods & Miscellaneous. Among these, the Real Estate segment is particularly dominant due to the booming property market in urban areas, driven by increasing urbanization and investment in infrastructure. The demand for housing and commercial properties has led to a surge in online listings, making it a key player in the classifieds market. Automotive and Electronics segments also benefit from rapid digital adoption, while Jobs and Services segments are growing in line with urban workforce mobility and the expansion of the gig economy.

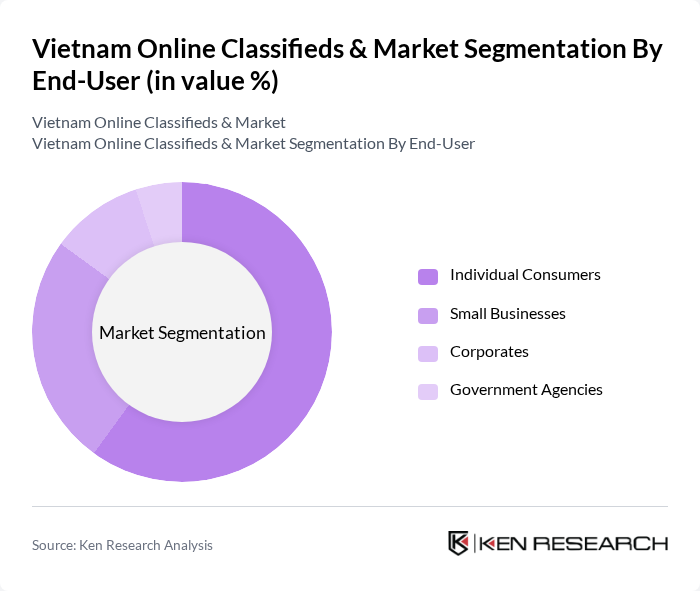

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporates, and Government Agencies. Individual Consumers dominate the market, driven by the increasing trend of online shopping and the convenience of accessing a wide range of products and services from home. The growing number of tech-savvy consumers, particularly among the younger population, has significantly contributed to the rise of online classifieds. Small businesses and corporates leverage digital classifieds for broader reach and cost efficiency, while government agencies use these platforms for public listings and procurement.

The Vietnam Online Classifieds & Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chotot, Muaban.net, Sendo.vn, Tiki.vn, Lazada.vn, Shopee.vn, Vatgia.com, 5giay.vn, Rongbay.com, Timnhanh.com, Muabannhadat.vn, Nhadat24h.net, MuaBanNhanh.com contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's online classifieds market appears promising, driven by technological advancements and changing consumer behaviors. As internet penetration continues to rise, platforms are likely to leverage data analytics and AI to enhance user experiences. Additionally, the increasing integration of social media for listings will further engage users. With a growing emphasis on mobile commerce, businesses that adapt to these trends will likely capture a larger share of the market, fostering innovation and competition.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Automotive Electronics Jobs Services Fashion General Goods & Miscellaneous |

| By End-User | Individual Consumers Small Businesses Corporates Government Agencies |

| By Sales Channel | Online Platforms Mobile Applications Social Commerce (e.g., Facebook, TikTok Shop) Offline Listings |

| By Pricing Model | Free Listings Paid Listings Subscription-Based |

| By Geographic Coverage | Urban Areas Rural Areas Regional Markets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Users of Online Classifieds | 100 | Frequent Buyers, Casual Users |

| Small Business Owners | 80 | Entrepreneurs, Retailers |

| Real Estate Listings | 60 | Real Estate Agents, Property Managers |

| Automotive Listings | 60 | Car Dealers, Private Sellers |

| Consumer Electronics Listings | 60 | Tech Enthusiasts, Gadget Sellers |

The Vietnam Online Classifieds & Market is valued at approximately USD 1.3 billion, driven by increased internet penetration, mobile device usage, and a growing preference for online shopping among consumers.