Region:Asia

Author(s):Geetanshi

Product Code:KRAB1508

Pages:83

Published On:January 2026

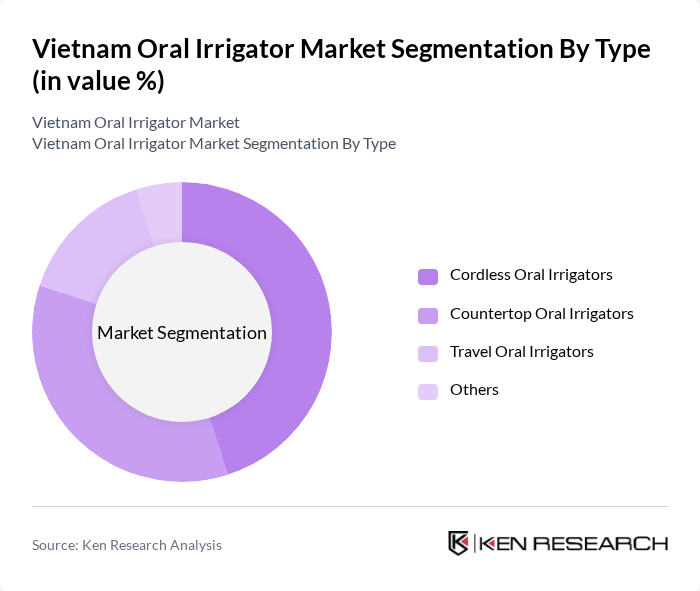

By Type:The market is segmented into Electric Oral Irrigators, Battery-operated Oral Irrigators, Manual Oral Irrigators, and Others. Electric Oral Irrigators are gaining traction due to their efficiency and ease of use, while Battery-operated models appeal to consumers seeking portability. Manual Oral Irrigators, though less popular, still hold a niche market among budget-conscious consumers. The "Others" category includes innovative designs and hybrid models that cater to specific consumer needs.

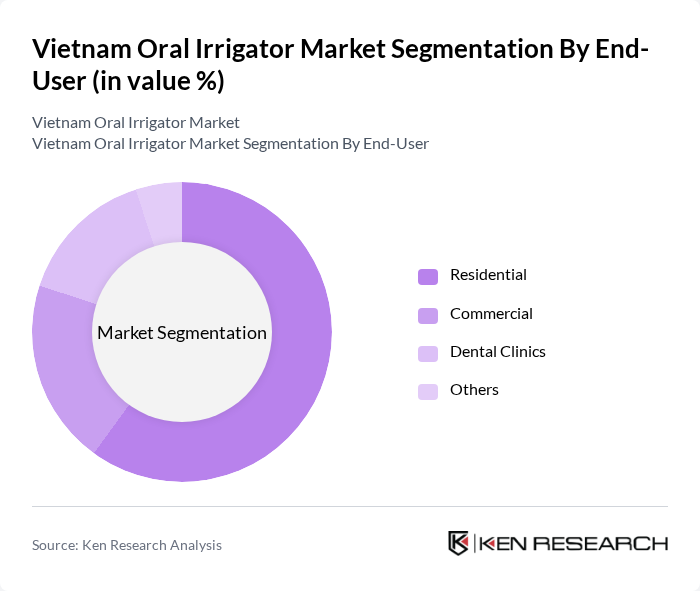

By End-User:The segmentation includes Residential, Commercial, Dental Clinics, and Others. The Residential segment dominates the market as more households invest in oral care products. Commercial establishments, including hotels and spas, are increasingly adopting oral irrigators to enhance guest experiences. Dental Clinics are also significant users, utilizing these devices for patient education and treatment. The "Others" category encompasses various niche applications.

The Vietnam Oral Irrigator Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Oral Healthcare, Waterpik, Inc., Panasonic Corporation, Oral-B (Procter & Gamble), Colgate-Palmolive Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam oral irrigator market appears promising, driven by increasing health consciousness and technological innovations. As consumers become more aware of the importance of oral hygiene, the demand for advanced dental care products is expected to rise. Additionally, the integration of smart technology into oral care devices will likely enhance user engagement and satisfaction. Companies that focus on educating consumers and leveraging e-commerce platforms will be well-positioned to capitalize on these trends and expand their market presence.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Oral Irrigators Battery-operated Oral Irrigators Manual Oral Irrigators Others |

| By End-User | Residential Commercial Dental Clinics Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Price Range | Budget Oral Irrigators Mid-range Oral Irrigators Premium Oral Irrigators Others |

| By Brand | Local Brands International Brands Private Labels Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Income Level (Low, Middle, High) Others |

| By Usage Frequency | Daily Users Weekly Users Occasional Users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Professionals | 100 | Dentists, Dental Hygienists |

| Retailers of Oral Care Products | 80 | Store Managers, Product Buyers |

| Consumers of Oral Irrigators | 150 | Health-conscious Individuals, Families |

| Distributors of Dental Products | 70 | Sales Representatives, Distribution Managers |

| Market Analysts | 50 | Industry Analysts, Market Researchers |

The Vietnam Oral Irrigator Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increased awareness of oral hygiene and rising disposable incomes among consumers.