Region:Asia

Author(s):Geetanshi

Product Code:KRVN5224

Pages:107

Published On:December 2025

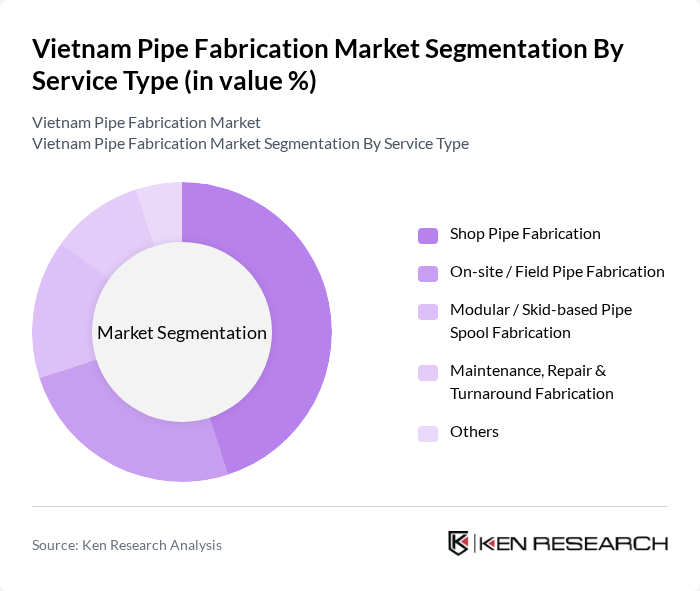

By Service Type:The service type segmentation includes various methods of pipe fabrication, each catering to different project requirements. The subsegments are Shop Pipe Fabrication, On-site / Field Pipe Fabrication, Modular / Skid-based Pipe Spool Fabrication, Maintenance, Repair & Turnaround Fabrication, and Others. Shop Pipe Fabrication is currently the leading subsegment due to its efficiency and cost-effectiveness in producing large quantities of pipes in a controlled environment.

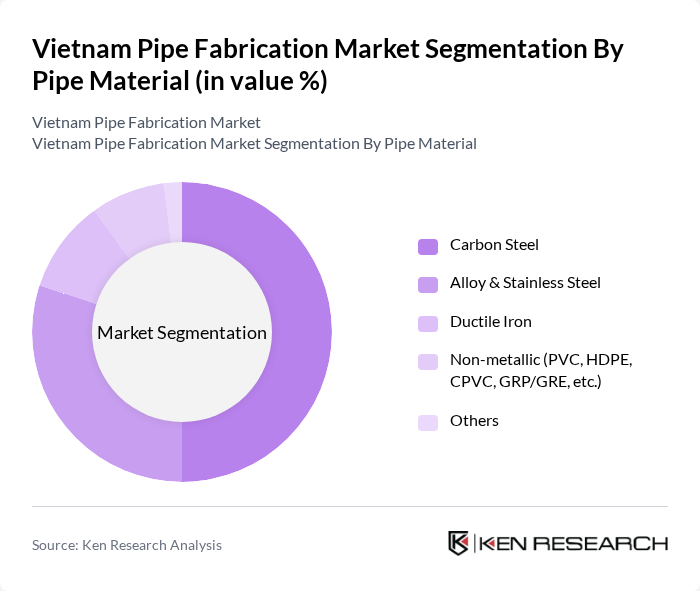

By Pipe Material:The pipe material segmentation encompasses various types of materials used in pipe fabrication, including Carbon Steel, Alloy & Stainless Steel, Ductile Iron, Non-metallic (PVC, HDPE, CPVC, GRP/GRE, etc.), and Others. Carbon Steel is the dominant material due to its strength, durability, and cost-effectiveness, making it the preferred choice for a wide range of applications in the oil and gas, construction, and manufacturing sectors.

The Vietnam Pipe Fabrication Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietnam Pipe Fabrication Company (VPFCO), Hoa Sen Group, Nam Kim Steel Joint Stock Company (NKG), Ton Dong A Corporation, Hoa Phat Group JSC, Binh Minh Plastics JSC, Tien Phong Plastic JSC, SMC Trading Investment Joint Stock Company, Tan A Dai Thanh Group, An Phat Holdings JSC, Dong A Steel Pipe Co., Ltd., Dat Hoa Plastics JSC, Long Thanh Plastic Co., Ltd., and other local fabricators contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam pipe fabrication market is poised for significant growth, driven by increasing investments in infrastructure and energy sectors. As the government prioritizes sustainable development, the adoption of advanced technologies and materials will become crucial. Companies are likely to focus on automation and digitalization to enhance efficiency and reduce costs. Additionally, the growing emphasis on quality and safety standards will shape the competitive landscape, encouraging innovation and collaboration among industry players to meet evolving market demands.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Shop Pipe Fabrication On-site / Field Pipe Fabrication Modular / Skid-based Pipe Spool Fabrication Maintenance, Repair & Turnaround Fabrication Others |

| By Pipe Material | Carbon Steel Alloy & Stainless Steel Ductile Iron Non?metallic (PVC, HDPE, CPVC, GRP/GRE, etc.) Others |

| By End-User Industry | Oil & Gas (Upstream, Midstream, Downstream) Power Generation & Energy (Conventional & Renewable) Petrochemicals & Chemicals Water Supply, Wastewater & Desalination Industrial Manufacturing & Process Industries Construction & Infrastructure (Buildings, Ports, Airports, etc.) Others |

| By Application | Process Piping Utility & Service Piping (Steam, Air, Cooling Water, etc.) Pipeline & Transmission Piping HVAC & Fire Protection Piping Plumbing & Drainage Others |

| By Diameter | Small Diameter (? 6”) Medium Diameter (> 6” – 24”) Large Diameter (> 24”) Others |

| By Fabrication Technology | Manual & Semi?automatic Welding Automated & Robotic Welding Cutting & Beveling (CNC, Plasma, Laser, etc.) Bending & Forming Non?Destructive Testing (NDT) & Inspection Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Pipe Usage | 120 | Project Managers, Site Engineers |

| Oil & Gas Pipeline Fabrication | 90 | Procurement Managers, Operations Directors |

| Water Supply Infrastructure | 80 | Municipal Engineers, Water Resource Managers |

| Industrial Pipe Applications | 70 | Facility Managers, Production Supervisors |

| Research & Development in Pipe Technology | 60 | R&D Managers, Product Development Engineers |

The Vietnam Pipe Fabrication Market is valued at approximately USD 1.3 billion, driven by growth in construction, infrastructure, and oil and gas sectors, alongside increasing demand for efficient fluid and gas transportation across various industries.