Region:Middle East

Author(s):Geetanshi

Product Code:KRVN5222

Pages:116

Published On:December 2025

By Service Type:The service type segmentation includes various methods of pipe fabrication, each catering to specific project requirements. The dominant sub-segment is Shop Pipe Fabrication, which is preferred for its efficiency and quality control. Onsite/Field Pipe Fabrication is also significant, especially for large-scale projects where installation flexibility is crucial. The demand for Engineering, Design, and 3D Modeling (BIM) services is increasing as companies seek to optimize project planning and execution.

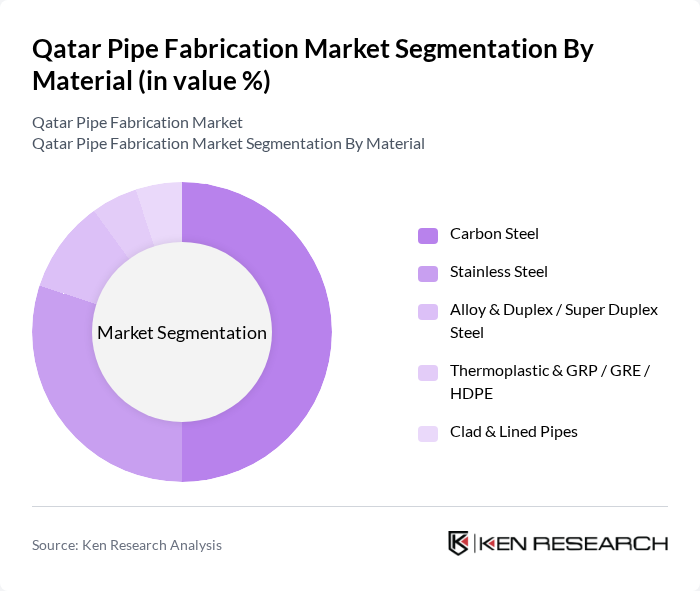

By Material:The material segmentation encompasses various types of materials used in pipe fabrication. Carbon Steel is the leading material due to its strength and cost-effectiveness, making it suitable for a wide range of applications. Stainless Steel follows closely, favored for its corrosion resistance in challenging environments. The use of Alloy & Duplex/Super Duplex Steel is growing, particularly in the oil and gas sector, where high strength and resistance to pitting corrosion are essential. Thermoplastic materials including GRP, GRE, and HDPE are utilized for their lightweight properties and chemical resistance in water and wastewater applications, while Clad & Lined Pipes provide enhanced corrosion protection for severe service conditions.

The Qatar Pipe Fabrication Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Engineering & Construction Company (Qcon), Doha Petroleum Construction Co. Ltd. (DOPET), Gulf Piping Company W.L.L., and Qatar Petroleum contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar pipe fabrication market is poised for significant transformation, driven by ongoing infrastructure projects and technological advancements. As the government continues to invest in large-scale developments, the demand for high-quality pipe solutions will rise. Additionally, the integration of digital technologies and automation will enhance operational efficiency. Companies that adapt to these trends and invest in workforce development will likely capture a larger market share, positioning themselves favorably in the competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Shop Pipe Fabrication Onsite / Field Pipe Fabrication Pre-fabricated Spools and Modular Assemblies Maintenance, Repair and Retrofit Fabrication Engineering, Design and 3D Modeling (BIM) |

| By Material | Carbon Steel Stainless Steel Alloy & Duplex / Super Duplex Steel Thermoplastic & GRP / GRE / HDPE Clad & Lined Pipes |

| By Diameter | Up to DN 50 mm DN 51–150 mm DN 151–300 mm DN 301–600 mm Above DN 600 mm |

| By Fabrication Process | Welding (SMAW, GTAW, GMAW, SAW) Cutting, Beveling and Forming Bending and Induction Bending Coating, Lining and Insulation Testing and Inspection (NDT, Hydrotest, FAT) |

| By Project Type | Oil & Gas (Onshore Pipelines, Offshore, Process Piping) Petrochemical & Chemical Plants Power & Desalination (Conventional, CCGT, IWPP) District Cooling, HVAC & Utilities Networks Infrastructure & Building Services (Mixed-Use, Stadiums, Commercial) |

| By Contract / Delivery Model | EPC / EPCM Contracts Lump Sum Turnkey (LSTK) Unit-Rate / Term Maintenance Contracts Subcontracting to Main Contractors Framework / Long-Term Agreements |

| By Region | Doha & Industrial Areas (Mesaieed, Ras Laffan) Al Rayyan Al Wakrah Al Khor & Northern Municipalities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Pipeline Projects | 100 | Project Managers, Procurement Officers |

| Water Supply Infrastructure | 80 | Municipal Engineers, Water Resource Managers |

| Construction Sector Fabrication | 70 | Construction Managers, Site Supervisors |

| Manufacturing of Pipe Components | 60 | Production Managers, Quality Control Engineers |

| Regulatory Compliance in Fabrication | 50 | Compliance Officers, Safety Managers |

The Qatar Pipe Fabrication Market is valued at approximately USD 1.1 billion, driven by the growth in the oil and gas sector, infrastructure investments, and the demand for energy-efficient solutions.