Region:Asia

Author(s):Geetanshi

Product Code:KRVN5225

Pages:112

Published On:December 2025

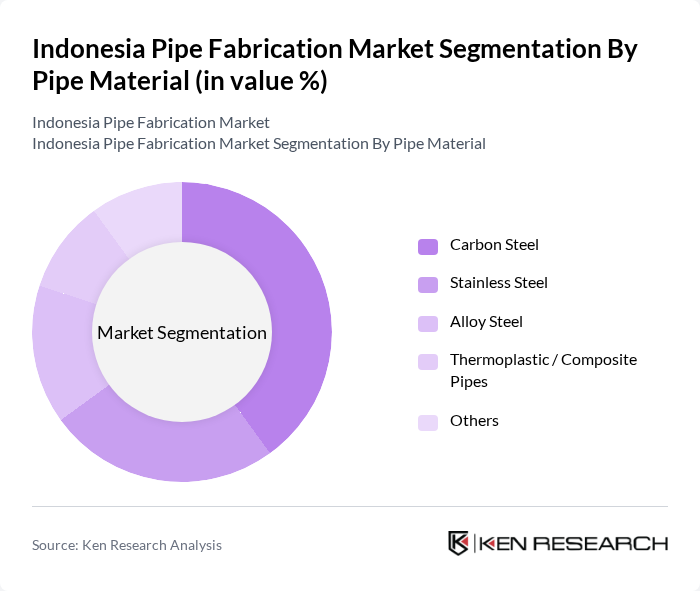

By Pipe Material:The pipe fabrication market is segmented based on the type of materials used in the production of pipes. The primary materials include carbon steel, stainless steel, alloy steel, thermoplastic/composite pipes, and others. Each material type has distinct properties that cater to various industrial applications, influencing their market demand.

The carbon steel segment dominates the market due to its high strength, durability, and cost-effectiveness, making it the preferred choice for various applications in the oil and gas, construction, and manufacturing sectors. Stainless steel follows closely, favored for its corrosion resistance and aesthetic appeal in specialized applications. The demand for alloy steel is also significant, particularly in high-stress environments, while thermoplastic and composite pipes are gaining traction in niche markets due to their lightweight and flexible properties.

By Fabrication Service Type:The market is also segmented based on the types of fabrication services offered, which include cutting & bevelling, bending & forming, welding & joining, coating, lining & insulation, spooling, modular skids & assembly, and others. Each service type plays a crucial role in the overall pipe fabrication process, catering to specific industry needs.

Among the fabrication service types, cutting & bevelling leads the market due to its essential role in preparing pipes for assembly and installation. Bending & forming services are also in high demand, particularly in industries requiring customized pipe shapes. Welding & joining services are critical for ensuring the integrity and strength of pipe connections, while coating and insulation services are increasingly important for enhancing the longevity and performance of pipes in various environments.

The Indonesia Pipe Fabrication Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Pupuk Kalimantan Timur (Pupuk Kaltim), PT Wijaya Karya (Persero) Tbk, PT Rekayasa Industri, PT Citra Tubindo Tbk, PT Bina Karya (Persero), PT Indah Kiat Pulp & Paper Tbk, PT Krakatau Steel (Persero) Tbk, PT Sumberdaya Sewatama, PT Adhi Karya (Persero) Tbk, PT Waskita Karya (Persero) Tbk, PT Jasa Marga (Persero) Tbk, PT Semen Indonesia (Persero) Tbk, PT Pembangunan Perumahan (Persero) Tbk, PT Hutama Karya (Persero), PT Citra Marga Nusaphala Persada Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia pipe fabrication market appears promising, driven by ongoing investments in infrastructure and energy sectors. As the government continues to prioritize local manufacturing and technological advancements, the industry is expected to adapt and innovate. Additionally, the increasing focus on sustainability and renewable energy projects will likely create new avenues for growth. Companies that embrace automation and digitalization will be better positioned to capitalize on these trends, ensuring long-term competitiveness in the market.

| Segment | Sub-Segments |

|---|---|

| By Pipe Material | Carbon Steel Stainless Steel Alloy Steel Thermoplastic / Composite Pipes Others |

| By Fabrication Service Type | Cutting & Bevelling Bending & Forming Welding & Joining Coating, Lining & Insulation Spooling, Modular Skids & Assembly Others |

| By End-Use Industry | Oil & Gas (Upstream, Midstream, Downstream) Power Generation (Thermal, Gas, Renewables) Petrochemicals & Chemicals Water & Wastewater Building & Infrastructure Construction Marine, Mining & Other Industrial |

| By Project Type | EPC / Turnkey Projects Maintenance, Repair & Overhaul (MRO) Brownfield Expansion Greenfield Projects |

| By Fabrication Location | Onshore Yards / Workshops Offshore / On-site Fabrication Modular / Prefabrication Facilities |

| By Customer Type | EPC Contractors Owners / Operators (IOCs, NOCs, Utilities) Industrial Contractors Developers & Government Agencies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Fabrication | 120 | Project Managers, Procurement Officers |

| Construction Industry Pipe Supply | 90 | Site Engineers, Construction Managers |

| Water Management Projects | 80 | Environmental Engineers, Project Coordinators |

| Manufacturing Sector Pipe Needs | 70 | Operations Managers, Supply Chain Analysts |

| Research & Development in Fabrication | 60 | R&D Managers, Technical Directors |

The Indonesia Pipe Fabrication Market is valued at approximately USD 1.6 billion, driven by increasing demand in infrastructure development, particularly in the oil and gas, power generation, and construction sectors.