Region:Middle East

Author(s):Geetanshi

Product Code:KRVN5223

Pages:106

Published On:December 2025

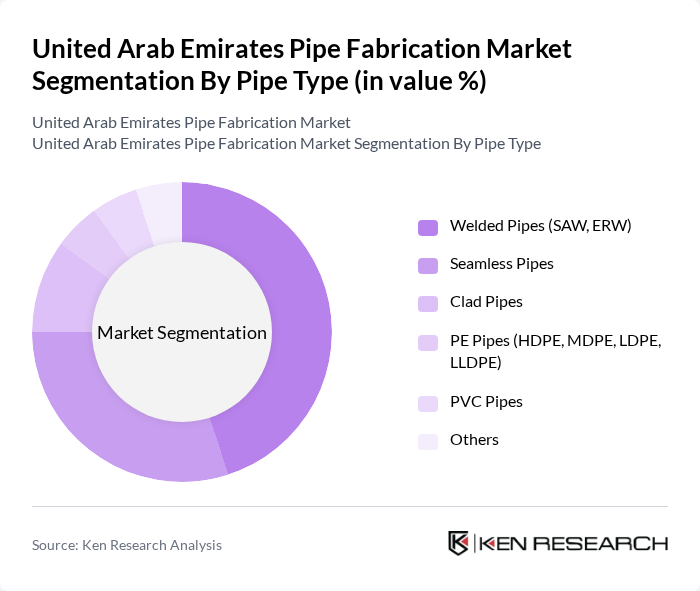

By Pipe Type:The pipe fabrication market is segmented into various types, including welded pipes (SAW, ERW), seamless pipes, clad pipes, PE pipes (HDPE, MDPE, LDPE, LLDPE), PVC pipes, and others. Welded pipes, particularly those produced through Submerged Arc Welding (SAW) and Electric Resistance Welding (ERW), hold a substantial share in regional oil & gas, water, and construction pipelines due to their cost-effectiveness and suitability for large-diameter and high-pressure transmission applications. Seamless pipes are also gaining traction, especially in the oil and gas sector and high-temperature or corrosive service, where high strength, reliability, and integrity under pressure are paramount. Demand for PE and PVC pipes is additionally supported by water supply, sewerage, and building services applications in the UAE, reflecting the growing use of plastic pipes alongside steel products.

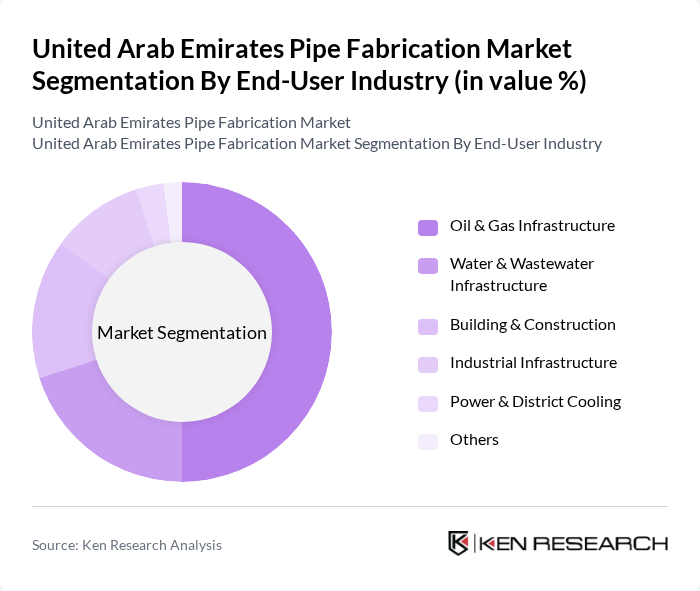

By End-User Industry:The end-user industries for pipe fabrication include oil & gas infrastructure, water & wastewater infrastructure, building & construction, industrial infrastructure, power & district cooling, and others. The oil & gas sector is the leading consumer of fabricated pipes, driven by the UAE's significant crude oil output and continued upstream and midstream investments in pipelines, processing plants, and export facilities. The water and wastewater segment is also expanding in line with national programs for municipal water networks, desalination integration, and sewerage, which require extensive steel and plastic piping. The construction sector plays a vital role as well, with numerous large-scale residential, commercial, industrial, and tourism projects in Abu Dhabi, Dubai, and other emirates requiring extensive piping solutions for plumbing, fire protection, HVAC, and district cooling systems.

The United Arab Emirates Pipe Fabrication Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Petroleum Construction Company (NPCC), UAE FABTECH, Lamprell, Emirates Steel Arkan, Abu Dhabi Metal Pipes & Profiles Industries Complex, Arabian Pipes Company, Gulf International Pipe Industry, Jindal SAW Ltd., Tenaris, Vallourec, Borusan Mannesmann, McDermott International, TechnipFMC, Saipem, Petrofac contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE pipe fabrication market appears promising, driven by ongoing investments in infrastructure and energy sectors. As the government continues to prioritize local manufacturing and technological advancements, the market is likely to witness increased efficiency and sustainability. Additionally, the integration of digital technologies will enhance operational capabilities, allowing companies to adapt to changing market demands. Overall, the sector is poised for growth, supported by favorable economic conditions and strategic initiatives.

| Segment | Sub-Segments |

|---|---|

| By Pipe Type | Welded Pipes (SAW, ERW) Seamless Pipes Clad Pipes PE Pipes (HDPE, MDPE, LDPE, LLDPE) PVC Pipes Others |

| By End-User Industry | Oil & Gas Infrastructure Water & Wastewater Infrastructure Building & Construction Industrial Infrastructure Power & District Cooling Others |

| By Application | Flow Lines Gathering Lines Transmission Lines Distribution Lines Water Supply & Irrigation Sewerage & Drainage HVAC & District Cooling Others |

| By Fabrication Method | Submerged Arc Welding (SAW) Electric Resistance Welding (ERW) Seamless Drawing Spiral Welding Others |

| By Material Grade | Carbon Steel (incl. API 5L Line Pipe) Stainless Steel Duplex & Super-Duplex Grades Corrosion-Resistant Alloys Low-Carbon & Green Steel Others |

| By Project Type | Greenfield Projects Brownfield Expansion Maintenance, Repair & Overhaul (MRO) Turnaround & Shutdown Projects Others |

| By Project Size | Mega & Large-Scale EPC Projects Medium-Scale Projects Small-Scale / Fabrication Job Orders |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Pipe Fabrication | 100 | Project Managers, Procurement Officers |

| Construction Sector Pipe Supply | 80 | Site Engineers, Supply Chain Managers |

| Utility Infrastructure Projects | 70 | Operations Managers, Technical Directors |

| Manufacturing of Specialty Pipes | 60 | Product Development Managers, Quality Assurance Leads |

| Market Trends in Pipe Fabrication | 90 | Industry Analysts, Business Development Executives |

The United Arab Emirates Pipe Fabrication Market is valued at approximately USD 1.7 billion, reflecting its significant role in the Middle East's pipes and fittings sector, driven by the construction and oil & gas industries.