Region:Asia

Author(s):Rebecca

Product Code:KRAD6236

Pages:97

Published On:December 2025

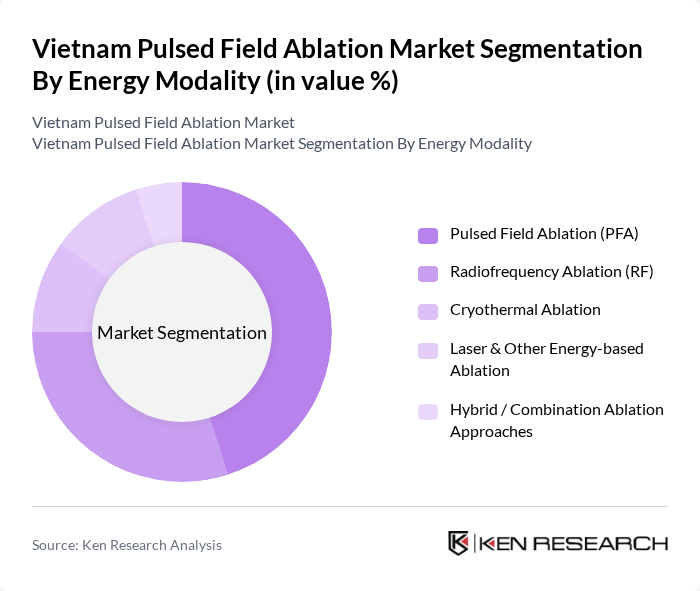

By Energy Modality:The energy modality segment includes various techniques used in pulsed field ablation, such as Pulsed Field Ablation (PFA), Radiofrequency Ablation (RF), Cryothermal Ablation, Laser & Other Energy-based Ablation, and Hybrid / Combination Ablation Approaches. Among these, Pulsed Field Ablation (PFA) is gaining significant traction due to its effectiveness and safety profile, making it the preferred choice for many healthcare providers.

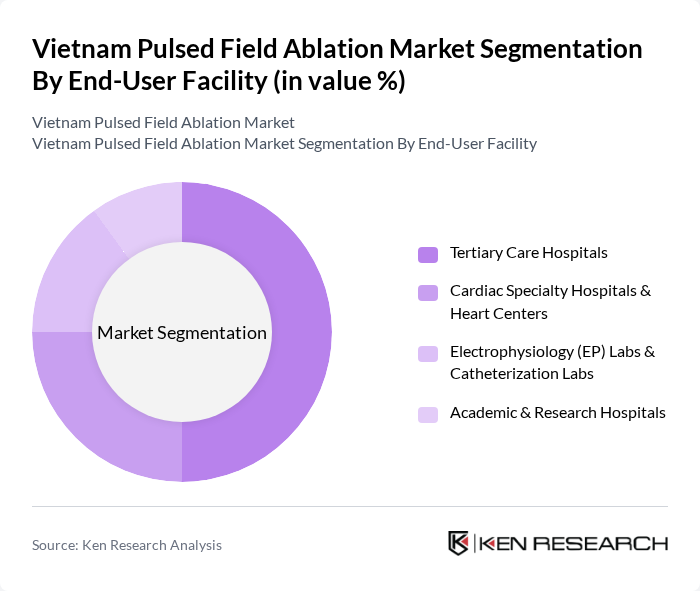

By End-User Facility:The end-user facility segment encompasses various healthcare settings where pulsed field ablation procedures are performed, including Tertiary Care Hospitals, Cardiac Specialty Hospitals & Heart Centers, Electrophysiology (EP) Labs & Catheterization Labs, and Academic & Research Hospitals. Tertiary Care Hospitals are leading this segment due to their comprehensive cardiac care services and advanced technological capabilities.

The Vietnam Pulsed Field Ablation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Scientific Corporation (FARAPULSE Pulsed Field Ablation System), Johnson & Johnson MedTech – Biosense Webster (Varipulse Platform), Medtronic plc (Pulsed Field Ablation Portfolio), Abbott Laboratories (Volt Pulsed Field Ablation System), Biotronik SE & Co. KG, Acutus Medical, Inc., Affera, Inc. (a Medtronic company), Adagio Medical, Inc., CardioFocus, Inc., AtriCure, Inc., Terumo Corporation, MicroPort Scientific Corporation, Shenzhen Lifotronic Technology Co., Ltd., Cathvision ApS, Imricor Medical Systems, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pulsed field ablation market in Vietnam appears promising, driven by ongoing advancements in medical technology and increasing healthcare investments. As the government continues to prioritize healthcare infrastructure, the accessibility of innovative treatments is expected to improve. Additionally, the growing trend towards outpatient procedures will likely enhance the adoption of pulsed field ablation, making it a preferred choice for both patients and healthcare providers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Energy Modality | Pulsed Field Ablation (PFA) Radiofrequency Ablation (RF) Cryothermal Ablation Laser & Other Energy-based Ablation Hybrid / Combination Ablation Approaches |

| By End-User Facility | Tertiary Care Hospitals Cardiac Specialty Hospitals & Heart Centers Electrophysiology (EP) Labs & Catheterization Labs Academic & Research Hospitals |

| By Clinical Indication | Atrial Fibrillation (AF) Atrial Flutter & Supraventricular Tachycardia (SVT) Ventricular Tachycardia (VT) Other Cardiac Arrhythmias |

| By Product Type | PFA Ablation Catheters PFA Generators / Console Systems Mapping & Navigation Systems (including PFA-enabled) Accessories & Disposables |

| By Distribution Channel | Direct Sales to Hospitals & EP Labs Local Medical Device Distributors Group Purchasing & Tender-based Procurement Online & E-procurement Platforms |

| By Region | Northern Vietnam (including Hanoi) Southern Vietnam (including Ho Chi Minh City) Central Vietnam Mekong River Delta & Other Provinces |

| By Policy & Financing Environment | Public Hospital Capex & Central Procurement Programs Social Health Insurance Reimbursement Coverage Public-Private Partnership (PPP) & ODA-funded Projects Private Investment & Self-pay Segment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiology Departments in Major Hospitals | 120 | Cardiologists, Electrophysiologists |

| Medical Device Distributors | 90 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 60 | Health Ministry Officials, Regulatory Experts |

| Patient Advocacy Groups | 45 | Patient Representatives, Health Advocates |

| Clinical Research Institutions | 70 | Research Scientists, Clinical Trial Coordinators |

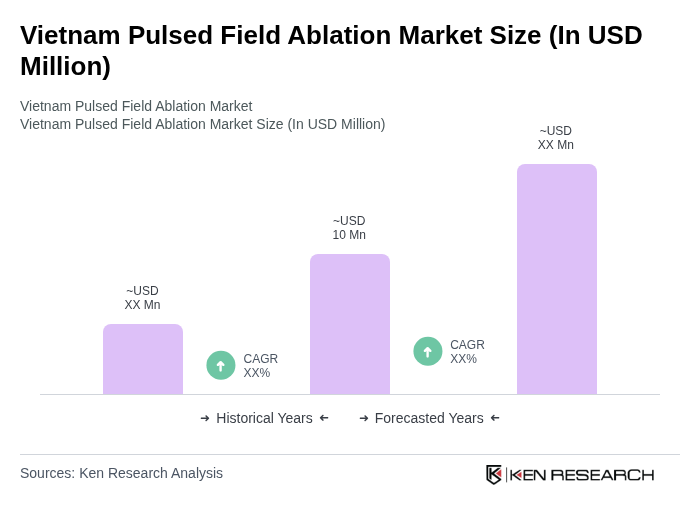

The Vietnam Pulsed Field Ablation Market is valued at approximately USD 10 million, driven by the rising prevalence of cardiac arrhythmias, advancements in medical technology, and increased healthcare expenditure.