Region:Asia

Author(s):Geetanshi

Product Code:KRAA5048

Pages:94

Published On:September 2025

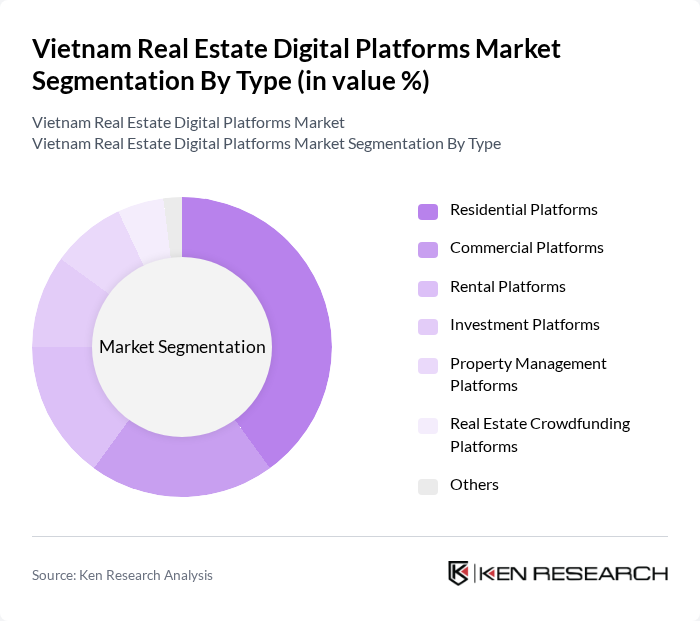

By Type:The market is segmented into various types, including Residential Platforms, Commercial Platforms, Rental Platforms, Investment Platforms, Property Management Platforms, Real Estate Crowdfunding Platforms, and Others. Among these, Residential Platforms are currently leading the market due to the high demand for housing solutions driven by urban migration and a growing population. The convenience of online property searches and transactions has made these platforms increasingly popular among homebuyers.

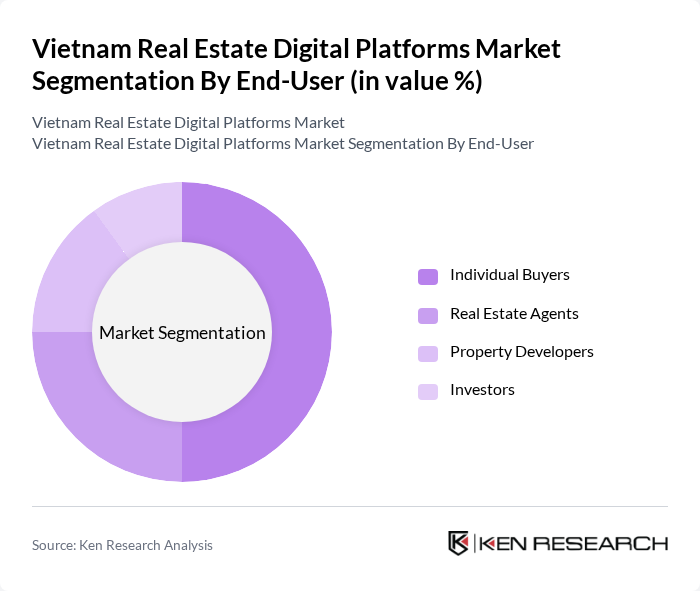

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Property Developers, and Investors. Individual Buyers dominate the market as they represent the largest group seeking residential properties. The increasing trend of first-time homebuyers and the growing interest in investment properties among individuals have significantly contributed to the expansion of digital platforms catering to this demographic.

The Vietnam Real Estate Digital Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Batdongsan.com.vn, Homedy.com, Muabannhadat.vn, Propzy.vn, Rever.vn, CenLand, Dat Xanh Group, Vinhomes, Novaland, FPT Corporation, Viettel Group, TNR Holdings Vietnam, An Gia Investment, Kinh Do Realty, Phu My Hung Development Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's real estate digital platforms is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As mobile applications gain traction, platforms will increasingly leverage AI and big data analytics to enhance user experiences and streamline transactions. Additionally, the integration of blockchain technology is expected to revolutionize property transactions, ensuring transparency and security. These trends will likely foster a more efficient and user-friendly real estate market, attracting further investment and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Platforms Commercial Platforms Rental Platforms Investment Platforms Property Management Platforms Real Estate Crowdfunding Platforms Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors |

| By Sales Channel | Online Sales Offline Sales Direct Sales Third-Party Platforms |

| By Application | Buying Selling Renting Property Management |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| By User Demographics | Age Group Income Level Geographic Location |

| By Policy Support | Government Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Platforms | 150 | Real Estate Agents, Home Buyers |

| Commercial Property Listings | 100 | Commercial Brokers, Property Managers |

| Real Estate Investment Platforms | 80 | Investors, Financial Advisors |

| Property Management Software Users | 70 | Property Managers, Landlords |

| Real Estate Technology Innovators | 60 | Tech Startups, Industry Experts |

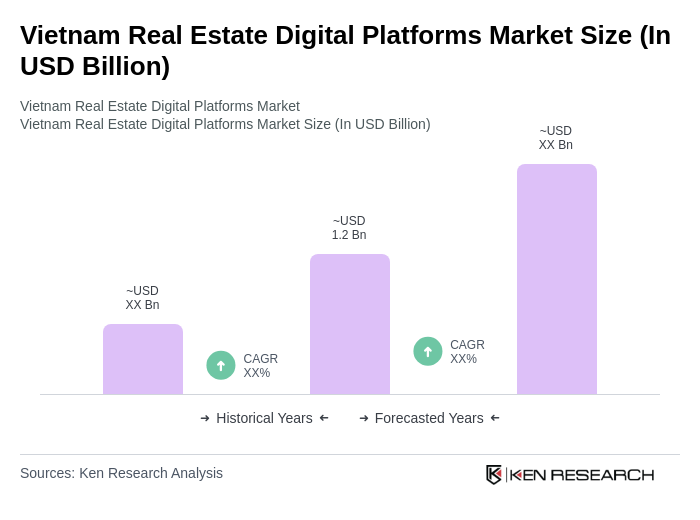

The Vietnam Real Estate Digital Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, digital technology adoption, and a rising middle class seeking efficient property solutions.